|

Getting your Trinity Audio player ready...

|

Bitcoin SV can be understood as a tool for freedom and opportunities besides all technical explanations. No wonder it attracts people that preach freedom, people that are motivated and people that believe that humans have the ability to change their life to one with a better direction.

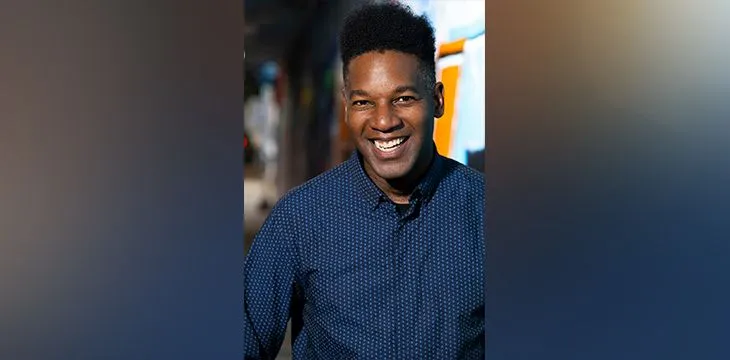

Entrepreneur, educator and coach T.K. Coleman is one of them. He is Director of Entrepreneurial Education @feeonline and co-founder of Praxis.

We caught up with Coleman to hear about how he got involved in Bitcoin SV and to get insights into a mind of someone who is not too technically involved with Bitcoin, but highly acknowledges and spreads its capabilities.

Hi, T.K.! You do a lot of awesome things—kindly introduce yourself!

Well, I’ll begin with my life mission: I want to help as many people as possible realize that they have the permission and the power to be the predominant creative force in their own lives.

I believe that so-called “ordinary” individuals are far more capable of thinking for themselves, taking charge of their own lives, and influencing the world for good more than many of us have been conditioned to believe. It’s easy to sit back and bemoan how terrible the world is, but I think it’s far more productive to do the hard work of trying to make the world a freer place one person at a time. A true leader will usher you towards your power, not away from it. A true leader isn’t just going to give you the truth about all the hardship and unfairness in the world. They’re also going to give you the truth about our rich history of overcoming incredible odds. That’s not positive thinking. That’s practical thinking.

In everything I do, I try to practice and promote this outlook on life. For the last several years that took the form of helping young people launch their careers through Praxis. The bulk of my work involved developing the curriculum, coaching, and community aspects of the program. When we first started, the notion that you could succeed without a college degree without having to be some kind of rare genius was much more controversial. Now you see more and more people talking about the importance of college alternatives and skills training because of what we’re seeing with the lockdown. It’s almost fashionable to say you don’t need a college degree nowadays. I’m proud to have been part of a movement that helped change the conversation on what’s possible in the realm of alternative higher education before it was the cool thing to do.

Currently, the bulk of my work centers around promoting financial literacy, economic self-sufficiency, and entrepreneurial thinking through the work I do with the Foundation for Economic Education. This involves lots of workshops with High School and College Students across the country. Additionally I host and produce several podcasts and livestreams through the “Revolution of One” project where my goal is to expose young people, especially people of color, to a diverse range of entrepreneurs who can provide them with insights and examples on how to be successful no matter where you’ve come from.

Feel free to tell us about your “Bitcoin journey.”

I originally heard about Bitcoin around the time I helped Isaac Morehouse start Praxis around 6 years ago. I was doing a few talks at some colleges and a lot of the students would ask me about this thing called Bitcoin during the Q&A. I had no idea what they were talking about, so I went home and bookmarked some YouTube videos that I never actually watched. I even remember being at conferences with people like Naomi Brockwell and Jeffrey Tucker and hearing them talk about it a lot. It seemed like this interesting thing related to freedom and a lot of the things I was already interested in, but I felt no urgency to study it. Isaac was really into it and he kept badgering me about it. He was even like “just follow these simple instructions to set up a wallet and I will literally give you some satoshis.” I just couldn’t get motivated though. I didn’t get it.

Well, when Bitcoin hit that all-time high in late 2017, you better believe that got my attention. Like many newcomers in the space, my combination of FOMO and regret sent me in search of “the next big thing” that would bring quick riches. When the BTC/BCH split happened, I was having a lot of conversations with the Numpties (Isaac, Steve, & Deryk) about this stuff and they convinced me on the philosophy behind big blocks.

So I saw BCH as a second chance at Bitcoin considering the dominant perception of BTC as king. Besides BCH, I was also infatuated with a bunch of alt-coins on Ethereum. When the BCH/BSV split happened, the dominant perception was that BCH was the preferable or most ideal option. BCH seemed like the obvious choice. It had way more support from exchanges, it was still very cheap, and SV had a whole bunch of negative talk surrounding it.

But when I looked into things, I found the ambitions of BSV to be far more interesting. The concept of the BSV network as the plumbing or infrastructure for an entirely new way of looking at information exchange seized my imagination like nothing else. And I was really intrigued by this idea that most of these alt-coins were born out of a misunderstanding that bitcoin was broken and couldn’t scale. The notion that you could do so much more on Bitcoin than Peer-to-Peer cash was very intriguing.

I remember watching this Jimmy Nguyen talk about data and it hit me: Bitcoin isn’t just a cash system that happens to be electronic. It’s an electronic system, a data system, a communication system that happens to feature cash as an integral part of the incentive structure. While everyone else was busy trying to get people to hold or accept bitcoins, the SV team was focusing on the possibilities of the network. Crypto was a “number go up” community, Bitcoin SV was a “network go up” community. And when I looked around to see what the people in BCH were saying about this, they mostly dismissed the SV vision as either silly or secondary.

At best, they would acknowledge enterprise-level data solutions as a possible use case, but they would downplay it as secondary to just getting people to use it as cash. At worst, they would mock the idea as futile. My reaction was basically, “I don’t know if BSV will win, but this is the only approach to winning that’s actually compelling enough to capture my curiosity and make me want to learn as much as I can.”

In one of the many YouTube videos you appear in concerning Bitcoin, you mentioned that you started to look deeper into Bitcoin around the time the BCH/BSV split happened:

This is interesting. Usually I talk to people who have been “in Bitcoin” for several years already, they have a long history to look at Bitcoin SV. You seem to have started your Bitcoin journey roughly around the time BSV actually came to life—this could be an advantage in the sense that you are not influenced by a lot of “Bitcoin trouble” from the past?

In some ways, yes. Because I haven’t been around since the beginning, I don’t feel frustrated or impatient towards the amount of time it’s taking for Bitcoin to achieve global adoption. I hear many people say things like “It’s been 10 years already and we still haven’t achieved this” or “I’m tired of all these forks” and I can only imagine how similarly I would feel had I observed Bitcoin going through a bunch of intense mudslinging debates over the years. So in some ways I think I came in at the perfect time. Ask me this question again in 10 years and let’s see how I feel.

Even though you are—compared to others—quite new to Bitcoin, you seem to have delved deep into it already. How easy or hard is it to understand Bitcoin SV once one has reliable information available?

One of the coolest things about Bitcoin SV is that all the people who are building stuff are very willing to answer questions, share information, and point you to resources for further study. I haven’t had a single negative experience when asking people in BSV about what something means or why something is a certain way.

Although learning takes time and effort, it’s a lot easier when you can get other people involved. You need people to argue with, brainstorm with, and so on. Whenever I have questions, I send messages to people in SV and I ask them. They always have interesting things to say. And even if you’re too shy for that, there’s a lot of good content you can check out on Streamanity.

I don’t think it’s that hard to find good information about BSV. The hard part is making up your mind to look past all the noise from people who feel threatened by BSV. My recommendation for anyone who wants to learn about BSV or anything else is to go find some people who are actually investing in the ecosystem and ask them to point you to some good resources that represent or explain their ideas. It’s always easy to find someone who says “that’s a stupid idea,” but you should spend some time listening to people who actually put those ideas into practice if you want to learn about the idea. Then you can decide to accept or reject it with an open mind. But at least make a good faith effort to look at the positive case first. And that’s what’s really difficult for most people. It’s difficult to be open-minded and charitable towards things that aren’t winning in the eyes of the mainstream.

You are also part of the so called “The Four Numpties” that discuss Bitcoin in a very entertaining yet highly informative show on Isaac Morehouse’s channel. Kindly tell us about the show.

The Four Numpties is really just a series of everyday conversations about Bitcoin-related things between four friends. We’ve been doing this in the background just for fun for at least the past couple of years. One day, Isaac suggested we record one of our conversations, share with others, and see how it goes. And we’ve been doing that for almost a year now. I love our conversations. We’re all pretty busy with our own creative projects, so it’s a great opportunity to spend time with guys I like philosophizing with. And it also helps me learn more about Bitcoin.

When you have to defend and talk about your ideas in front of an audience, it incentivizes you to get better at learning your stuff. We derived our name from a commenter who hates our videos. He makes some kind of disparaging remark every time we post a new episode. One week, he said something like, “Oh great, the 4 numpties again,” and I thought, “What a great name.” So we decided to use that. And it’s perfect for us because our whole thing is to never take ourselves too seriously.

We never want to become the kind of people who can’t laugh at ourselves or who want to run away and hide just because someone isn’t in love with us. The day we start taking ourselves that seriously is the day we need to hang it up and go do something else. The Numpties is about having fun first.

What did you learn discussing Bitcoin with Isaac Morehouse, Steve Patterson and Deryk Makgill?

From the guys, I’m constantly learning how to process and articulate my thoughts about Bitcoin when faced with tough questions that push me beyond my level of research. That’s really good for me. I’m also learning a lot of things about the historical side of things that they grasp a lot better than me.

From our audience, I learned that there are lots of people in Bitcoin who enjoy seeing an example of people discussing and disagreeing about things without becoming melodramatic and personal. I think lots of people are bored by all the mudslinging and pretentiousness they see in crypto. They just want something genuine and lighthearted even if it’s not perfect.

In the show you stated not to be a too technical person when it comes to Bitcoin. Same here, by the way. However, this does not at all seem to hinder your interest in Bitcoin SV and its recent developments. Kindly share your thoughts about how non technical people can still help Bitcoin SV to grow and even play a crucial role in the ecosystem.

Here’s what’s interesting and ironic to me about the whole technical side of things. Many of the biggest problems in bitcoin have been the direct result of people thinking about things like security, scalability, utility, and value solely in terms of technology rather than economics. Some people make all sorts of lofty-sounding arguments about the way things should be done and no one dares to challenge them because “Well…I don’t have a computer science degree, so who am I to challenge this guy over here speaking a bunch of technical jargon?” And I think a lot of people have been misled and taken advantage of because of this perception that Bitcoin is all about trusting developers to guide us toward infallible truth.

To me, this is the heart of Craig Wright’s criticism of “code is law.” That idea ignores the fact that Bitcoin is an economic system. All this focus on the blockchain data structure won’t mean anything if people don’t overcome their economic fallacies about Bitcoin the incentive structure. This is one of the things I love about Steve Patterson’s takes. He emphasizes the importance of philosophy in all this. Granted, a philosophy background won’t impress anyone nearly as much as a computer science background, but understanding how to construct arguments, how to make conceptual distinctions, how to identify assumptions, how to detect logical fallacies, how to think about epistemology…. these are aspects of sound reasoning that are just as vital as anything else.

So while I totally acknowledge and respect the technical side of bitcoin, I think it needs to be rescued from the perception that this is primarily for computer science buffs. There’s a ton of room for entrepreneurs, accountants, economists, educators, marketers, researchers, and people from many other disciplines to contribute to the ecosphere. If Bitcoin succeeds, it’s going to impact every aspect of our world just as the invention of the personal computer or the internet did. So if you’re someone that’s interested in Bitcoin, you have an early mover advantage when it comes to thinking critically and creatively about how it might impact your particular discipline.

Now here’s the funny part about my answer: my interest in Bitcoin has inspired me to start studying computer science. I don’t think that’s a prerequisite, but I really want to understand things from the vantage point of information theory and information technology. That’s where my curiosities are compelling me. For others, I would say the important thing is to look for little points of intersection between what intrigues you about Bitcoin and the things you’re already interested in. And don’t be intimidated by the challenges of learning something new. Take small steps and start from where you are. The Computer Science book I’m currently reading is designed for middle school students. We all have to start somewhere.

Since the BTC/BCH and BCH/BSV split, the “communities” involved in these digital assets were battling each other online and offline. Yet in the show you partake in, all of you discuss Bitcoin in a very reasonable and calm way without having to agree on every detail. Is this the future?

I think it will always be the case that human beings will disagree and debate about things that have significant political and economic implication. And Bitcoin is no exception. When you think about the magnitude of this vision and all the different ways it can alter the way we exchange value, it’s a miracle that anyone agrees about anything at all.

Ravi Zacharias once said we should seek to create discussions that generate more heat than light. That’s something I try to represent in my dialogue with others, but ultimately I think power is about learning how to move ideas forward even when people don’t agree. We can’t always win people over at the level of ideas, but that shouldn’t stop us from trying to change the incentives. To me, that’s what the entrepreneurial spirit is all about.

With all of your online presence, you encourage people to be free and take their destiny into their own hands. Let us try to apply that to the Bitcoin world—we see a lot of entrepreneurs in Bitcoin SV, even very small teams trying to achieve big things. Since you also work as a coach in various ways, how would you coach Bitcoin SV entrepreneurs?

Keep an experimental and playful attitude. Bitcoin isn’t a religion. It’s a massive and historically unprecedented scientific experiment being conducted in the real world. Every blockchain believer’s hypothesis will be tested and weighed in the court of results. Proof of work, not proof of faith will determine the outcome.

When you look at it this way, you begin to realize that you don’t need to have faith. You just need to be willing to try something new. Sometimes we can get stuck trying to figure out the best possible way to do things or we can wreck ourselves trying to come up with an answer for every possible question, but there’s nothing more empowering than giving yourself permission to start things.

Entrepreneurship isn’t a school test where you have to get all the questions right. It’s a process of discovery. Sometimes the best way to discover what works is by doing the work. Ten minutes trying to build your idea will be worth far more to you than ten hours arguing with people about your ideas.

Some people will demand that you spend hours debating them on social media about how reasonable your ideas are, but why not create a low-risk experiment where you can just test the ideas out in the real world? Instead of letting your possibilities be determined by some self-appointed social media committee, you can give yourself permission to try things and you can refine your theories along the way.

At least that’s the way I see it.

Do you mention Bitcoin SV in your motivational videos as a tool for people to “break free” in a way, be it economically or concerning their current jobs? Is it a topic you bring up a lot nowadays?

Funny timing. I actually plan on launching a podcast very soon that combines my interest in Bitcoin, Personal Development, and Motivation. Stay tuned for details on that.

Since BTC’s whole purpose seems to be “hodling until death,” which does not seem attractive for outsiders to get involved in, Bitcoin SV has a whole other vision of building use cases and actually being used as cash at the same time. What kind of people is Bitcoin SV attracting in your experience so far?

There are a lot of interesting debates happening right now around issues like social media censorship, suppressed search engine results, and the privacy, permanency, reliability, and security of data. We’ve experienced a concentrated dosage of life in 2020. A global pandemic, an economic lockdown unlike anything we’ve ever seen, an unprecedented amount of money printing by central banks, protests and riots….these events have shown just how much disagreement, confusion, and fear can be generated when people have no idea of who to trust.

I see more criticism and skepticism of mainstream media than I can recall in my lifetime. More and more people are starting to realize that the battle for freedom isn’t just centered on money, but it’s centered on the ownership and distribution of information. I think the type of individuals and businesses that are being drawn to Bitcoin SV are the ones who want to separate the signal from the noise. They want more transparency, accountability, ownership, and freedom in relation to the data we share about ourselves and the data that we’re constantly being bombarded with.

What are you personally looking for in Bitcoin?

Besides money? One thing I’ve said on the show before is that we’re all going to be rich if Bitcoin wins. That’s not a reference to hodling. That’s a reference to all the new possibilities for creativity and commerce that Bitcoin can facilitate. Our world economy is like the Major Leagues before black people were allowed to play. Some of the most creative, talented, and hardworking people in the world are significantly limited from creating wealth for themselves and others because of flaws and inefficiencies in our financial system. We call them “The Unbanked.” They have the talent, but they’re not players in the game.

Bitcoin can fix this. When you think about the Major Leagues before Jackie Robinson, there were still a lot of really good white players, but the whole game suffered because the best were not competing with the best. The Major leagues became a more competitive, creative, profitable, and entertaining league for everyone when more people were permitted to play. That’s what an expanded system of cooperation and coordination does. As someone who is passionate about individual freedom and economic self-sufficiency, I’m rooting for a world where Bitcoin opens the floodgates for more innovation than we’ve ever seen. And I want to see more people able to create wealth without a bunch of artificial and needless restrictions holding them back. Can we get there? Time will tell.

Thank you for your time and efforts!

Thanks for having me. If I haven’t overstayed my welcome, I’ll end with a final story.

There’s a movie starring Denzel Washington called “Hurricane.” It’s about a former boxing champion Rubin Carter who’s wrongly imprisoned for a crime, but the story centers around a young illiterate teenager named Lesra Martin. Lesra serendipitously gets ahold of a copy of Carter’s book, “The Sixteenth Round,” and is thoroughly captivated by the story. Through an almost unbelievable, but true, sequence of events, the boy’s unceasing curiosity leads to a lengthy legal battle that results in the exoneration of Carter. Lesra eventually became a lawyer.

When Lesra meets Carter to tell him about how the book changed his life, Carter says this line to him that I’ll never forget: “We don’t always choose the books we read… sometimes they choose us.” I believe that our curiosities offer us the greatest opportunities for self discovery and personal transformation if we actually devote ourselves to them. When we find ourselves fascinated by some idea, that idea can be an inner compass of sorts that gives new meaning and direction to our lives.

So if you find yourself fascinated by Bitcoin, don’t place any limitations on what you can possibly learn and create! Dive in. You never know where things might lead.

08-17-2025

08-17-2025