|

Getting your Trinity Audio player ready...

|

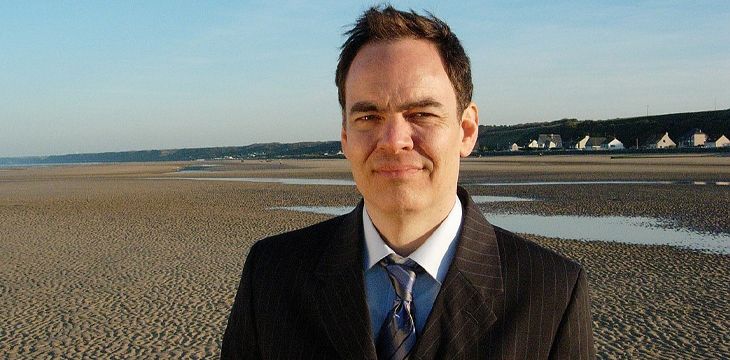

Television alt-finance pundit and BTC proponent Max Keiser has been busy attacking Bitcoin SV on his social media accounts and in interviews. It’s not rare for Keiser to produce outlandish statements on BTC prices, or slam public figures involved with non-BTC blockchains. But these can also be used as a barometer of which projects BTC and its army of public relations representatives see as the biggest threats.

Some more recent comments from the host of RT’s “Keiser Report” came after Calvin Ayre, founder of Ayre Group and CoinGeek, accused him of being paid to promote BTC:

https://twitter.com/maxkeiser/status/1284891791125368836

A few days prior, he posted a more generic anti-BSV meme, though BSV has not suffered any crises worthy of comparison to such a dramatic event:

https://twitter.com/maxkeiser/status/1284608819147022336

In fact, that Bitcoin (BSV) has not suffered any technical problems since restoring the original Bitcoin protocol in early 2020 which is the opposite of a burning boat. That meme more accurately describes BTC and other altcoins, which have experienced problems with scaling, volume, high fees, and lost funds. These are often self-inflicted—Bitcoin can scale on-chain, yet BTC now touts the complex and problematic Lightning Network to handle most of its transactions. Bitcoin flourishes, with more and more applications developers choosing to build on it every day—while BTC Core developers and Blockstream keep their network crippled.

The BSV development team has proved Bitcoin can scale on-chain, process thousands of transactions per second at low fees, and do a lot more. Bitcoin is capable of processing as much data as the internet itself. Those who say it couldn’t, and who wasted years with their pointless “scaling debate,” are truly the captains of a sinking ship.

Speaking in an interview on Patrick Bet-David’s “Valuetainment” channel last month (which has over 2.4 million subscribers) Keiser listed off the reasons he thinks Dr. Craig Wright and Bitcoin BSV have little value:

“It has been well documented in numerous sources that (Wright’s) claims are bogus,” Keiser said, and BSV is “an outright fraud.” He took particular issue with “the way he conducts himself,” and a series of lawsuits Wright brought against members of the BTC community that repeatedly made libelous comments to that extent, which “he has lost or is in the process of losing.”

“He is absolutely laughed at … “in a year or two from now, the name will be forgotten forever.”

We should note that most of the publicly available material on Dr. Wright’s history have come from the yet-to-be-tried Ira Kleiman lawsuit — in which Wright is the defendant, not the plaintiff. We should also note that none of the allegations that Keiser spouted off about Wright’s claims are accurate whatsoever. We do not consider blog posts from sock puppets as legitimate sources of information.

Apparently not realizing the irony, Keiser then followed his attack on Wright by giving his reasons why it was better for Satoshi Nakamoto’s true identity to remain unknown forever:

“If you have a known person attached to it, they become an attack vector. And people will attack that person. And so you don’t want that. You know, who invented gold?”

When Bet-David pointed out that gold is a naturally-occurring element and Bitcoin is a man-made technology, the conversation veered off on a tangent over whether God created man and thus Bitcoin too, and the evils of fiat money.

Where’s all this coming from?

Keiser, a former stand-up comedian and part-time stock trader, hosts “The Keiser report” on RT. He has been bullish on BTC on his RT show for many years, finding it a perfect fit for his anti-bank/government sentiments and contrarian views on finance and economics. These have often revolved around precious metals and alternative currencies. In the late 1990s he was CEO of the Hollywood Stock Exchange, which traded virtual securities based on the fortunes of movies and stars. In 2010, he also led a campaign against JPMorgan Chase by appealing to the public to buy silver, raising its price and closing JPM’s short positions.

These views, coupled with his large audience, made him a darling of the BTC community. Keiser is also co-founder at Heisenberg Capital, a BTC venture capital fund. He recently told Cointelegraph’s Allen Scott that he named the company after he “started noticing that Bitcoin was becoming self-aware,” and that humans as a species need “to prove we are worthy of Bitcoin.”

In 2020 he has predicted the BTC price will hit $50K, $100K and eventually $400K due to a collapse in the USD and economic/financial turmoil resulting from this year’s COVID-19 crisis. A dollar crash would surely increase the dollar value of BTC, along with the price of everything else. However BTC’s chances of replacing it as a reserve currency are slim given its 3-7 transaction-per-second limit and spending alternatives that involve funding (and maintaining) off-chain payment channels.

As a popular broadcaster and long-time entertainment industry figure, Keiser is no doubt aware of the attention-grabbing potential any prediction of a six-figure BTC has. He and others have been making such predictions for years. In reality these viral statements more often result in temporary, short-term bumps in the BTC price than long-term injections of cash. However even short-term bumps are adequate to make large profits for speculative traders, at the expense of naive rush-buyers.

Who’s actually listening?

The frequent animosity directed at Bitcoin BSV by BTC supporters –whether coordinated, paid, or grassroots—has become predictable both in subject matter and its lack of substance. They have included soundbite campaigns in the mainstream media and on social networks, as well as collusion between some exchanges to “delist BSV.”

As Bitcoiners have pointed out, if BSV is as valueless as its detractors claim, then simply ignoring it would suffice. The counter-argument that BSV is a target because it takes the name “Bitcoin” and (rightfully) claims to be the original Bitcoin is hollow, since many other assets have done that over the years, and disappeared amid crashing prices and developer apathy.

The attacks are indicative of a strategy to “play the man, not the ball.” Most efforts are simply character assassinations on Dr. Wright. There’s very little material out there giving technical reasons why BSV doesn’t work. There have been no signs on the BSV side that anything is technically amiss with its on-chain scaling vision, either. Developers continue to build new projects on the BSV blockchain and find new use-cases for its processing abilities, as well as utilize the old (and long forgotten) BTC promise of a micropayments economy.

BSV is the only network that can accurately (and perhaps even legally) be called Bitcoin. Its protocol is by far the closest to the original version released by Dr. Craig Wright as Satoshi Nakamoto in 2009, and it’s the only one that maintains Satoshi’s original vision.

Bitcoin, as BSV, creates a vast micropayments economy and can process all the world’s data on an open and auditable blockchain, secured by economic incentives. That which Max Keiser and his fellow bagholders proclaim in the mass media as “Bitcoin” is BTC, which devolved away from the original protocol and should be referred to as an altcoin.

Observers should regard shareable soundbites as just that. BTC pundits talk mainly about massive price rises and the personalities of their opponents. The BSV community is focused not on price, but on building long-term viability.

12-13-2025

12-13-2025