|

Getting your Trinity Audio player ready...

|

Crypto payment network TravelByBit will be dropping Bitcoin Core (BTC) and Bitcoin Cash (BCH) as a payment option in a network that has 400 Australian merchants, news outlet Micky reported.

TravelByBit founder Caleb Yeoh says, “We will be dropping both [BTC] and [BCH] from the POS (Point of Sale).”

This serves another devastating blow towards negative adoption for BTC. The use of BTC in commerce has been on the decline for many years as the objective of the BTC developers has been to deter BTC being used for payments and instead promoting it as a “store of value.” They have accomplished this objective by altering the protocol to introduce vulnerabilities like replace by fee (RBF) and restricting the block size limit to 1 megabyte, thus creating an artificial fee bidding market amongst consumers that allows exploits like this to be feasible.

“The truth is both [BTC] and [BCH] and many other blockchains are not suitable for retail point of sale transactions. There are trade-offs between user experience vs security,” Yeoh said.

Bitcoin has always been a safe and secure method for use in commerce since its inception, and has continued to improve its security and fragility over time. It continues to fulfil its promise as a peer to peer payments electronic cash system.

Bitcoin SV (BSV) is in the process of restoring the protocol as close to the original form described in the Whitepaper and increased the block size limit (currently 2000 Megabytes). This allows enough space in the blocks for transactions that ensure fees always remain low. RBF does not exist in the protocol and merchants can continue to accept BSV as a payment option with the use of zero confirmations (0-conf), which means that any transaction that has been broadcasted onto the network (into the mempool without being included into a block yet) can be safely accepted without the need of waiting at least 10 minutes before it is included into a block. The first transaction that has been broadcasted onto the network would be timestamped as the valid transaction and any subsequent attempt to double spend would be rejected.

In 2016, RBF was introduced into the BTC protocol due to scarcity of block space as the BTC developers limited the block size limit to 1MB despite rising demand for its use in commerce. RBF allows a user to double spend their own transaction with a higher fee to raise the chances of moving it into the next block. The problem is that this completely broke the security of safely using 0-conf, as a consumer could make a purchase with a merchant, walk out of the store and rebroadcast the transaction with a higher fee onto the network and reroute the destination address towards their own personal address. This results in the subsequent transaction overruling the initial transaction made inside the store, and the consumer would get their bitcoin back (minus the fee), whilst the merchant would be at loss.

The revolutionary concept of Bitcoin was that it solved the problem of allowing two parties to exchange money with each other without the need of an intermediary to facilitate or prevent a double spend.

In the very first paragraph of the Bitcoin whitepaper it clearly states the following: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.”

Technical expertise is not required to understand that this is the innovation of what Bitcoin brought to the world. Anything that goes against this is no longer using this invention and can no longer be labelled as Bitcoin.

TravelByBit still offers BSV as a payment option and have not commented at this stage if BSV will be impacted as an offering to consumers and merchants.

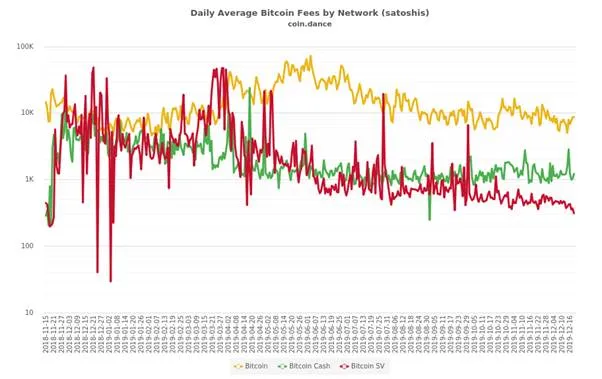

BSV fees have continue to decrease over time and consistently remained lower in comparison to BTC and BCH, whilst offering safe instant 0-conf transactions that has been popular for users and merchants.

Merchants and payment networks do not need to worry about accepting BSV as a payment option as Bitcoin in its original core design has a proven history of remaining a reliable, secure and low fee payment method. This still remains a far better option than the use of credit cards as there is always a risk of chargebacks and fraud, whilst other methods like Lightning Network have proven to have vulnerabilities that causes users loss of funds.

TravelByBit has kept support for Lightning Network transactions which occur outside of blockchain technology. They may want to re-evaluate their position on throwing support behind an unproven technology with known vulnerabilities. It is hard to deny the proven success of Bitcoin as a payment system when it is kept in its original design without scaling limits. It is important for any business in the industry offering these services to continue to remain objective and impartial, or risk losing the first mover advantage gained whilst the industry is still in its infancy.

07-15-2025

07-15-2025