|

Getting your Trinity Audio player ready...

|

YouTube’s quarterly ad revenue fell nearly 2% year over year in Q3 of 2022. The reason given is that advertisers are spending less money because of economic conditions such as inflation, rising prices, the collapse of digital currencies, and higher interest rates. Personally, I have seen my monthly revenue decline over 50% in December and January 2023, despite the same engagement.

If content creators’ performance remains steady, yet they see arbitrary large cuts in revenue, this indicates a broken model.

The advertising model for content creators is broken.

The only reason this model exists is because of the lack of native payment technology on the Internet. For example, I generally earn $10 per video and average at least 1,000 views per video. Instead of earning $0.01 per view directly from my following, I get paid in a roundabout means on monthly recurrence from a trusted third party based on how many ads my subscribers saw. While there is absolutely a positive relationship between my ad revenue earnings and the number of views, total view time, and engagement, these metrics are secondary to the ads seen as a result.

The tired, natural argument made against the pay-per-view model is that no one will want to pay to watch YouTube videos. This is demonstrably false. Most agree that time equals money, and typically “free” users must watch ads before and during the video watched. If users are like me, then they pay $10 per month for the YouTube Premium service to bypass all ads on the platform, as well as unlock other features such as downloading, offline watching, and music. YouTube reported 50 million Premium users in 2021.

The unseen principle of economics applies to the pay-per-view model. If the price is lowered from $10 per month to $0.01 per view (or less), then we cannot assume that customers will not pay that price. Simple economics dictate that lower prices incentivize demand, and YouTube’s current high barrier to entry monthly subscription model proves demand exists to bypass ads in exchange for accepting payment directly.

To implement the pay-per-view model properly, the payment technology must support amounts as low as possible. Enter Bitcoin, 14-year-old payment technology that to date has primarily been used for rabid speculation, Ponzi scheming, and criminal activity. Bitcoin was created to bypass this inefficient advertising model and allow entrepreneurs to earn where they could not before.

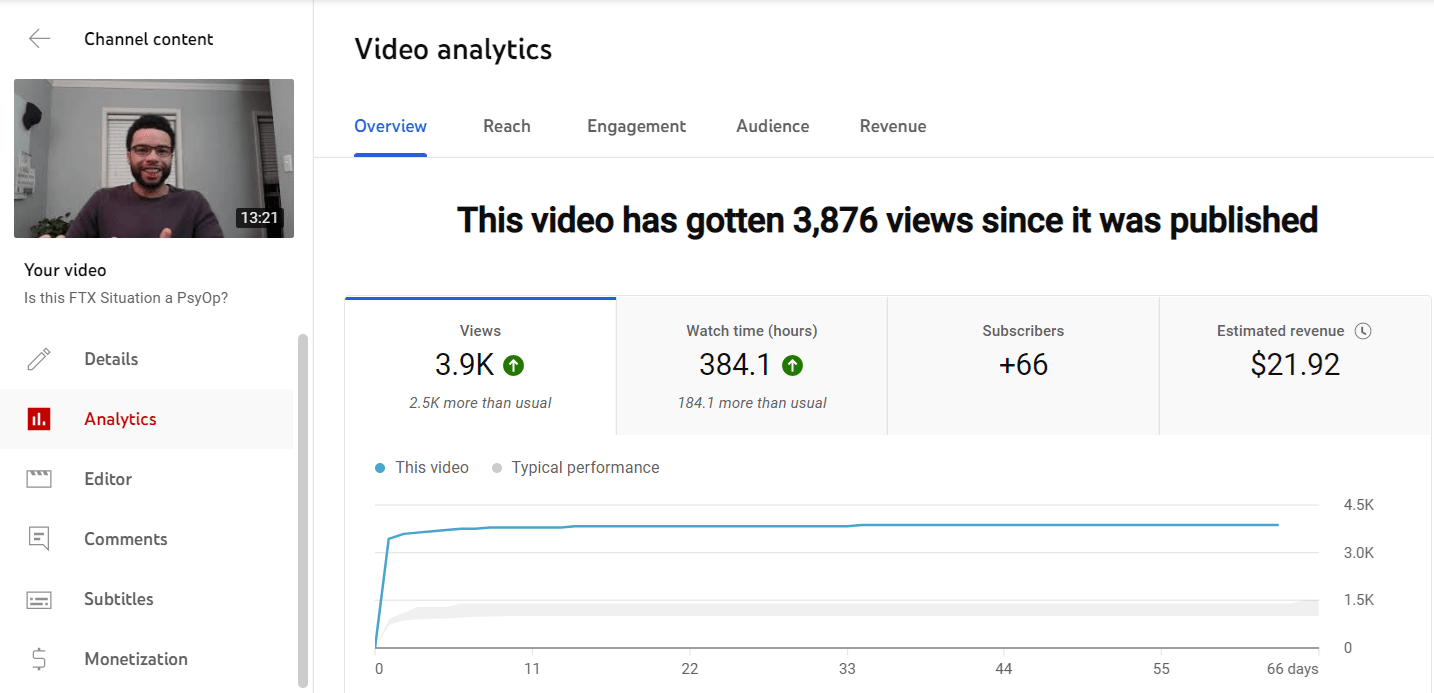

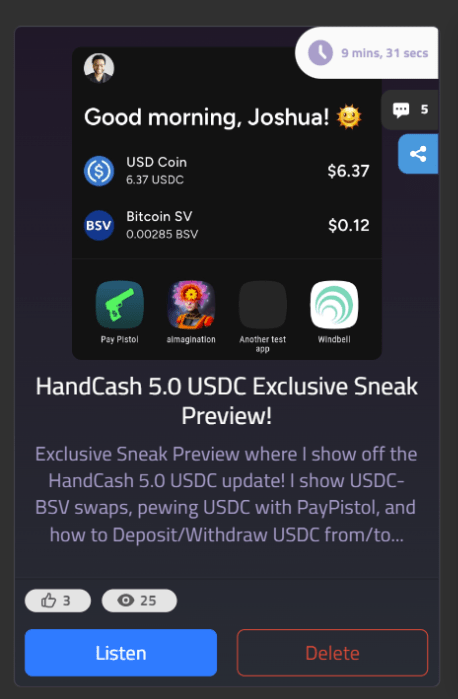

For the first time, I have proven this model can work with numbers that most could not argue with. I published an exclusive video on the pay-per-view video platform Real World Podcasts, where I can set my price per video. There are no ads on this platform. Within three hours, I earned over $22 on only 24 views for $0.98 each. In comparison, I have earned only $21.92 on 3,900 views on my top-performing video on YouTube ever, over 66 days. Furthermore, I have already received the cash for each payment, and it is immediately spendable compared to having to wait at least 30 days for the YouTube payment to arrive in my bank account.

The more money I can earn via this model, the more absurd the ad model seems in comparison. However, the drop-off in reach and audience must be considered as trade-offs when pivoting to the pay-per-view model. Admittedly, the technology and ease of use are not quite there yet, but as more creators like me start to move over and experiment, the more apparent the obvious value proposition of the Bitcoin technology becomes.

Watch: Live Streaming & Blockchain

02-23-2026

02-23-2026