|

Getting your Trinity Audio player ready...

|

Timing?

In our three previous articles on the adoption of blockchain technology, we covered the business concerns of Energy Consumption, Governance and Politics, and Regulatory Compliance. In this article, we will continue our journey and explore another category: Timing. In future articles, we will discuss Technology to close out the series.

Things happen all the time around us. We are in a constant movement of events. Empires come and go, dictators rise and fall. History captures some events, some events are completely lost, or some are rewritten by the winners. A young industry is taking the richest layer of the social stairway in modern-day society: software. Software has become a necessity these days where everyone is bound to spend hours with information noise: from politics to important business documents. There are more and more servers on demand. The promise from a few years ago that the cloud will be very cheap and very secure turns out on its head: the cloud is everything but cheap and secure. The blockchain industry is in a similar position: assets worth billions of dollars have been hacked or stolen from digital currency exchanges, billions have been seized by governments around the world with hundreds of thousands of BTC. The interesting part—almost everyone nowadays has heard of the word Bitcoin at some level. And for those in the fintech business, there is another world—blockchain. The problem is that blockchain is one big promise that has not yet materialized. How do we know that? Very simple—just count the number of daily transactions across all blockchain, and you will get the idea: less than a few million.

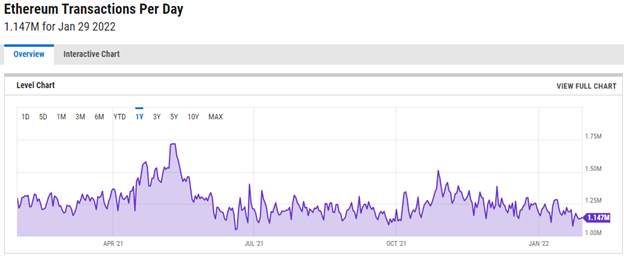

Take one of the most popular chains today—Ethereum, with their max record at 1.7 million transactions around May 2021.

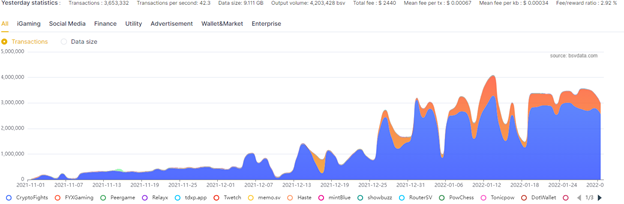

Here we have BSV blockchain, which portrays similar data showing millions of transactions per day, max amount per day of around 4 million.

At the same time, the credit card transactions in the United States per day are calculated to be around 109 million. And if we look at all transactions recorded in some digital form, we are looking at a staggering amount of hundreds of billion transactions of data. Just the money spent on the internet is estimated to be US$1 million per minute.

So, if blockchain is so good with superior technology, the question immediately comes to mind—why is the world not embracing it? Well, maybe the world is not ready, or maybe the world does not need it. These are serious questions we need to evaluate through the prism of one measurement: Timing.

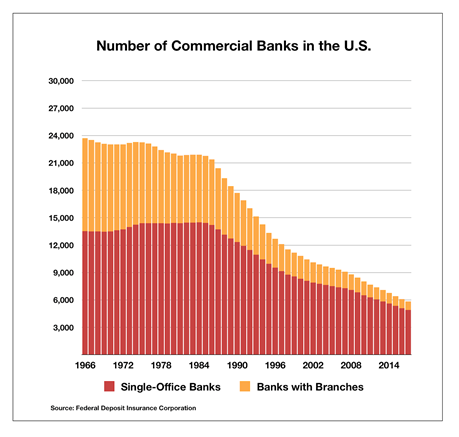

Does the world trust third parties to control their private and public information—apparently, yes. Most individuals are told to store their assets in vaults and banks. If we actually look at how the banking sector evolves over time.

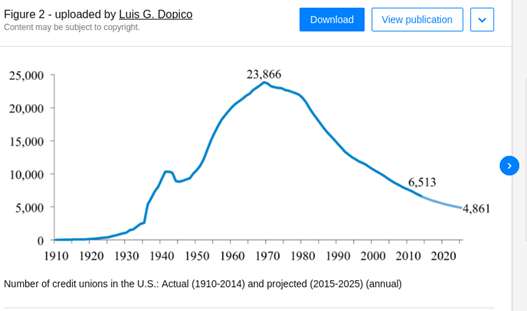

We noticed an interesting trend: the number of banks is getting smaller and smaller. A similar situation is happening with credit unions.

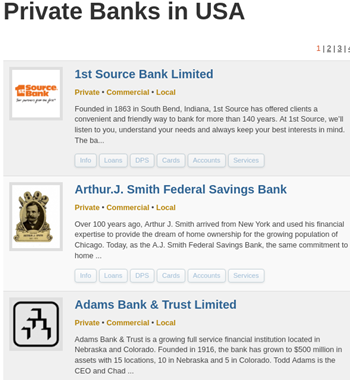

I think there will be a direct correlation between the derivation of lowering the number of licensed institutions to deal with treasury notes. And blockchain is a timing bomb ready for use. That event has to be facilitated by some man-made or natural disaster, but very soon, maybe no longer than 10-15 years from now, we are looking for the world to be run on the blockchain. Another prediction that could happen is the rise again of private banking.

Private banks are few and far between in the U.S., and they are not reporting to the Securities and Exchange Commission (SEC). Private banking with the combination of mobile technology could unleash the entrepreneurial power limited by the 1913 Congress restriction of private banking by officially creating the third federal reserve system the U.S. had implemented.

Another reason for the ticking time bomb on the blockchain is the system’s weaknesses for massive attacks to create double-spending.

Private banks are small, with limited technological power and have a very focused service landscape. That makes them a very attractive target for engaging in a win-win partnership with the right technology group to bring the right technology layer to life. More about the technology will be revealed in our 5th article on this series. A small hit will be mobile technology, NFT chains, NoCode platforms, integrated seamlessly with public blockchain with the ability to produce billions of low latency transactions that are mined at a very low fee.

Currently, the developers are so excited about playing with the technology that they literally brush off the risk of a blockchain being hacked. And when a blockchain is hacked, the other blockchain developers are getting a little dance of joy.

Apparently, we need to wait another decade to try again and see if the stars will align this time. There is a huge promise to utilize the chain for various activities.

In order for blockchain technology to be adapted at a massive scale, the following needs to happen:

– The mining companies, the blockchain providers and the development companies around them have to understand that the number of transactions is the most important ingredient that will make blockchain technology main-street. And we are talking hundreds of millions, if not billions of transactions on the PUBLIC chain daily with ZERO risk for double spending.

– Wall Street technologies have to cross the Rubicon and share their secrets with the blockchain development community. We are talking about low latency and a huge amount of data inserted, queried, and reported in nanoseconds.

– The mobile revolution with NoCode platform that can scale unlimited and create a self-writing software based on AI.

– Work within the legal jurisdiction but push the envelope 10x faster than the current crowd mentality, camouflage anything digital currency, and only expose fiat federal notes on the surface for the average consumers.

Summary

No technology can help an idea whose time has not yet come, and blockchain is no exception. But eventually, the void gets filled, and the crowd will adapt to it. Sometimes not in the original version but in a version that very few had predicted.

To cross the Rubicon, blockchain has to address the trust issue that was the core promise of the technology. When that gap is filled, the time will be just right to spread it across our daily lives.

Watch: CoinGeek New York panel, BSV vs. Other Blockchains: Differences that Matter for Developers & Businesses

Recommended for you

Circle (NASDAQ: CRCL) soared in 2025 thanks to U.S. ‘regulatory clarity,’ but can this momentum survive a ban on crypto

02-26-2026

02-26-2026