|

Getting your Trinity Audio player ready...

|

Since the Federal Reserve has raised its benchmark federal funds rate to 15-year highs to a range of 4.25% to 4.5%, many have theorized that an inevitable “fed pivot” will rally risk-on assets such as equities, real estate, and crypto. Differing economic conditions, relative leverage, historical trends, and inflation will demonstrate why that will not repeat this time.

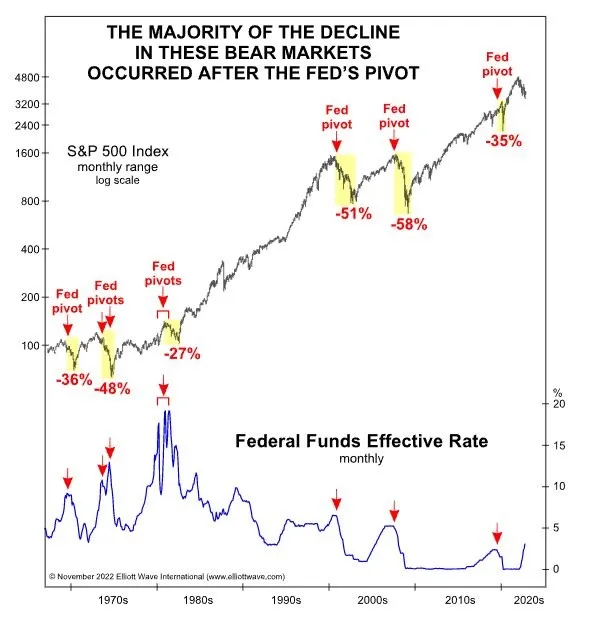

Analysts from the famous Robert Kiyosaki to the rabid r/wallstreetbets community discussed at length in 2022 that when, not if, the Federal Reserve must begin to cut the federal funds rate back to 0% (where they remained at 0% for the greater part of 14 years) that risk assets, especially stocks and digital currencies must necessarily rally in response. However, as one Wall Street Bets community member pointed out on their subreddit in late 2022, historically, this is not the case.

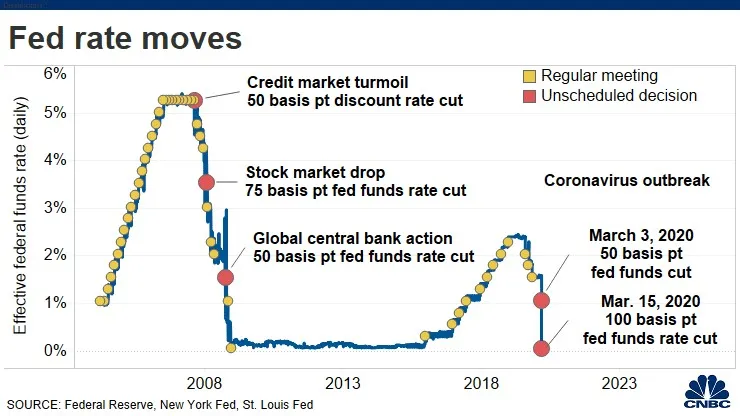

This chart indicates that the Fed reacts to markets, not drives them. The most recent example of this was at the start of the pandemic when the central bank frantically slashed rates twice in just two weeks in March 2020.

In response, the Dow Jones Industrial Average dropped a record of nearly 3,000 points in a single day on March 16, 2020, which completed a nearly 32% drop from February 12, 2020. The equities markets continued selling off despite emergency rate cuts by the Fed. Yes, stocks, property values, and digital currencies (especially BTC) did rally later in the year but note that these cuts were only 150 basis points, not 450 where the rates sit today. Also, the central bank had already begun cutting from 250 basis points (an 11-year high at the time) in July 2019.

The sustained rally in all risk assets through the end of 2021 was a combination of many factors, inflation expectations, stimulus checks, and the new pandemic work-from-home culture. In a post-pandemic world, where the economy is finally feeling the effects of supply chain devastation for the last three years and cheap money creation for over a decade. The Consumer Price Index (CPI) has continued to rise and still is (up 7.1% year over year as of December 2022). Demand for necessary goods and services has sustained while supply declined. These fundamental economic problems did not exist in the manner in the last 20 years as they do now. Furthermore, while interest rates are historically low, they are relatively high.

The implication is that investors have become as delusional as an addict going “cold turkey” as they were used to being able to borrow money at low cost for so long, and now that they cannot, they have unrealistic expectations about the future, such as perpetually hoping for that “fed pivot.”

https://twitter.com/wallstreetsilv/status/1587819516394102784

A pivot would imply a rate cut (as low as 25 basis points) or a pause on rate hikes. While the market may rally in the short term, the central bank’s statement and intent do nothing to solve the fundamental issues the common man faces daily. Relatedly, gold and silver are rising sharply in 2023 despite the relatively high interest rates, indicating fear in the markets.

Grocery prices will continue to rise, global conflicts will continue to exist, and digital currencies will continue to see significant headwinds in the form of criminal charges, fraud, consumer skepticism, and heavy-handed regulation as a result. Additionally, the rates would still be at or near 14-year highs, incentivizing parking capital in safe-haven assets for decent yields, such as bonds and savings accounts.

Why would I buy meme stocks or doggy coins when I can get 4% annualized returns, nearly risk-free in a Federal Deposit Insurance Corporation (FDIC)-insured bank?

Apparently,

Few.

Watch: The BSV Global Blockchain Convention panel, Law & Order: Regulatory Compliance for Blockchain & Digital Assets

07-05-2025

07-05-2025