|

Getting your Trinity Audio player ready...

|

The White House has published a scathing condemnation of proof-of-work (PoW) blockchain mining operations, saying it intends to make them pay for their negative impact on the community. It proposes the Digital Asset Mining Energy (DAME) excise tax on such operations, which would phase in to equal 30% of their total energy costs.

The DAME Tax could raise US$3.5 billion in revenue within ten years, it said. It could also put some mining operations out of business completely due to recent struggles with digital asset market prices falling below the levels required to profit. Miners already pay substantial overhead costs, mainly on electricity and the need to continually upgrade hardware to stay competitive.

PoW mining’s increasingly poor public reputation creates risks for blockchain in general. There are calls for a total ban or blockchain protocols to process transactions using proof-of-stake (PoS) as an alternative. While allegedly less energy-intensive, PoS increases security risks and regulatory risks by making it more challenging to determine who “miners” actually are.

A more scalable, and thus more generally useful, PoW blockchain such as the original Bitcoin (BSV) could restore faith in PoW mining by demonstrating its wider benefits in processing and securing large amounts of data—uses other than simply generating big profits for Bitcoin hoarders.

The White House’s complaints

A statement released this week details the Biden administration’s gripes with PoW mining, echoing concerns currently popular in the mainstream media: that PoW digital asset mining is wasteful, polluting, and of little profit or benefit to anyone other than the operators themselves.

It said that a national policy is needed to deter miners from simply moving to other jurisdictions. If they’re considering moving outside the U.S., they should also consider that eight other countries are imposing their own restrictions or even outright bans, including Canada and China.

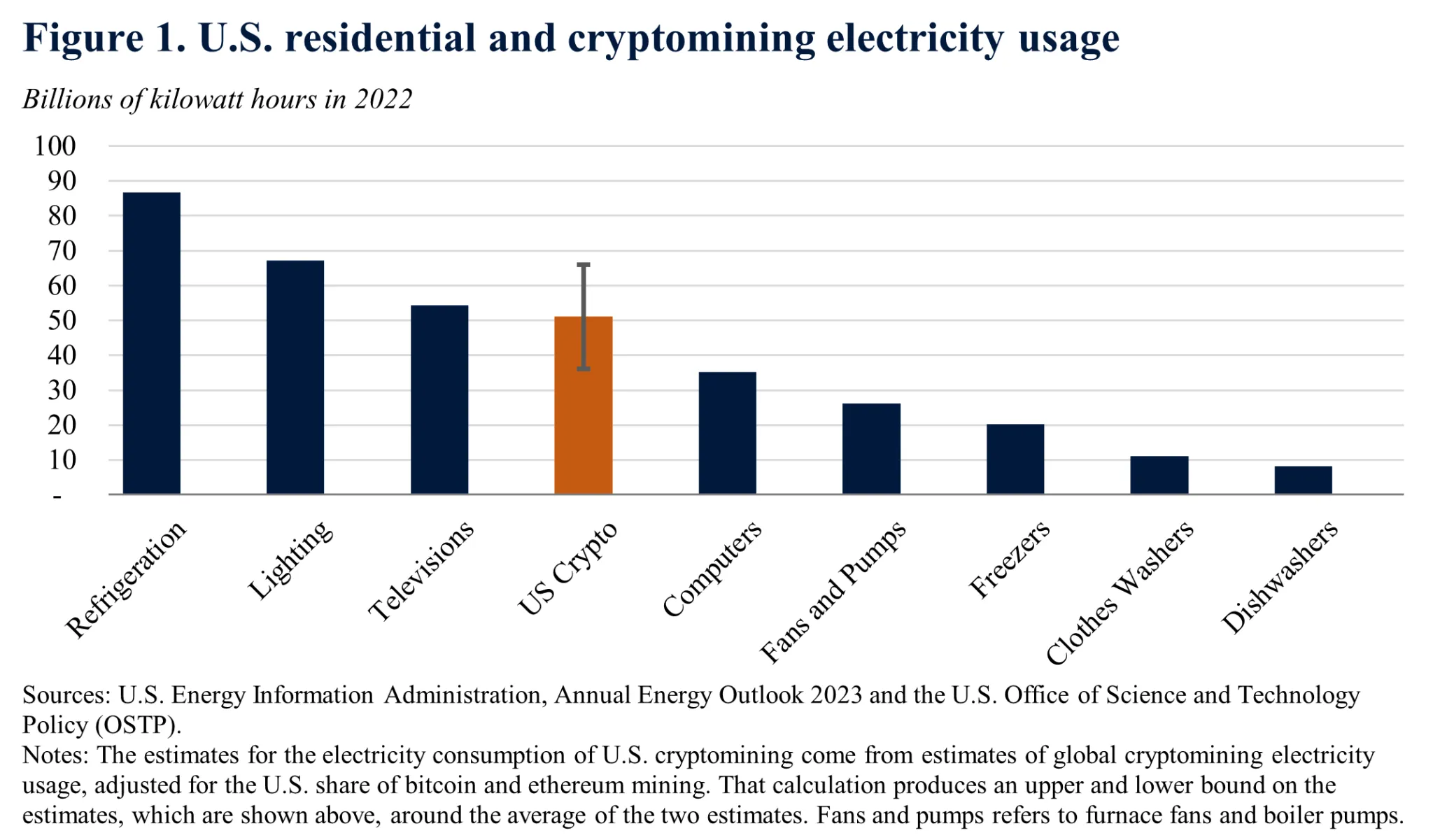

The White House made its disapproval of proof-of-work mining operations and practices clear in the statement titled “The DAME Tax: Making Cryptominers Pay for Costs They Impose on Others.” It directly targets the industry’s high energy consumption, ranking it fourth behind refrigeration, lighting, and televisions, and above computer use in general.

It also made it clear that this energy consumption has an adverse impact on communities outside the industry, saying it “has negative spillovers on the environment, quality of life, and electricity grids where these firms locate across the country,” adding that its pollution disproportionately affects “low-income neighborhoods and communities of color” and increases prices for everyone.

“Currently, cryptomining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate. The DAME tax encourages firms to start taking better account of the harms they impose on society.”

There are few social or economic benefits to local communities where mining operations are located despite promises of high-tech job opportunities, the statement continued. The industry is “geographically mobile,” meaning operators can easily pick up and move to another jurisdiction. Taxes they currently pay represent only a small boost to local revenues and are often offset by necessary upgrades to local energy infrastructure and price increases. Money and effort spent upgrading that infrastructure could end up wasted if operators move to another location.

Even when miners claim to use “clean” or renewable energy sources, this serves only to reduce the availability of those sources to other customers, it said. Furthermore, any broader social benefits stemming from the services these operations produce—digital assets and transaction infrastructure—”have yet to materialize.”

Is proof-of-work actually bad?

The answer to this question is: yes and no. Most of the White House’s complaints above are valid, or at least valid, based on how the cryptocurrency industry has conducted itself. However, there are countless other industries that consume disproportionately high amounts of energy while seeming to deliver little benefit to the general public, so why is blockchain being singled out?

This issue arose during the New York Senate Standing Committee on Banks hearing at the end of April. BSV Blockchain Association Global Public Policy Director Bryan Daugherty testified at the hearing, saying the reasons PoW benefits have not been realized include a misguided focus on speculative asset trading and the deliberately-limited capacity of networks calling themselves “Bitcoin,” such as BTC.

The entire BTC network can process only seven transactions per second due to its restrictive 1-4MB transaction block size, he said. This makes it of little use or benefit to the general public and has contributed to the myth of the “digital gold” speculative asset.

“If you remove that one-megabyte limit and have an unbounded block size every ten minutes, now you’re able to actually have scalable proof of work like BSV, that is less than 2kg of CO2 per transaction, even today. That’s because of the unbounded amount of transactions that can be included in a block,” Daugherty said.

Restricted BTC is indeed wasteful as a proof-of-work processing network. However, using Bitcoin’s original, scalable protocol as BSV does means PoW can deliver real benefits to everyone—not just price speculators. It would also enable miners to earn from transaction fees rather than simply chasing the per-block coin subsidy.

CoinGeek Conversations with Kurt Wuckert Jr: Think of Bitcoin mining as financial self-discipline

07-11-2025

07-11-2025