|

Getting your Trinity Audio player ready...

|

This post is a guest contribution by George Siosi Samuels, managing director at Faiā. See how Faiā is committed to staying at the forefront of technological advancements here.

What a Japanese hedge fund collapse reveals about enterprise blockchain’s next move. On April 8, 2025, a Japanese hedge fund collapsed under the weight of a 60x leveraged position in 10-year U.S. Treasury bonds. The timing wasn’t coincidental.

Just days prior, Trump’s revived tariff announcements sent markets into a spiral. Bond yields surged. Liquidity evaporated. And then—like a signal too loud to ignore—a domino fell.

The result? A cascade sell-off in Treasuries, surging Japanese 30-year yields, and enough global pressure to force Trump into pausing his plans—at least for now. But beneath the geopolitical theatrics lies a quieter question: what does this moment signal for enterprise blockchain?

Let’s examine the fallout—through an east vs. west lens.

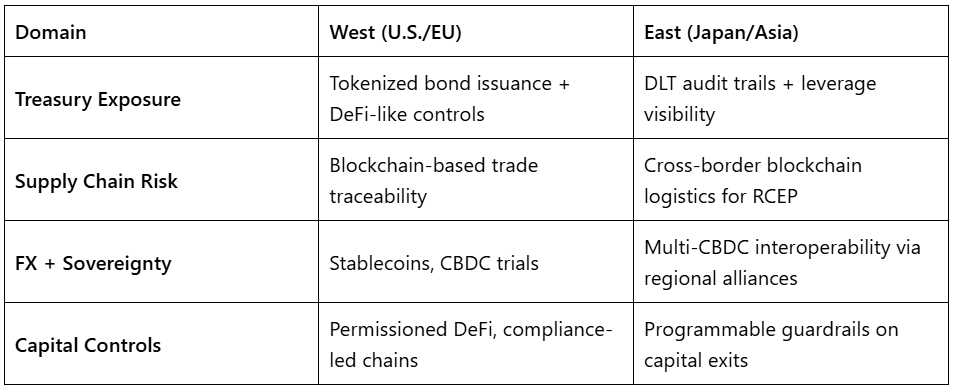

The West: From transparency theatre to on-chain accountability

In the U.S. and Europe, blockchain has long been marketed as the next evolution in trust. But in practice, it’s often been relegated to pilot programs, glossy white papers, or internal innovation teams far removed from real risk. This hedge fund’s collapse may change that. Why?

Because it wasn’t some meme-stock gamble or crypto blowup—it was a traditionally structured, institutionally respected fund betting on U.S. government debt—the safest of the safe. And it still cracked.

This sends a signal to Western enterprises:

If the global financial plumbing can buckle under legacy assumptions, then maybe “blockchain for auditability” isn’t a side quest. It’s survival infrastructure.

Expect a rise in:

- Tokenized treasuries with real-time on-chain proof of collateral

- Smart-contract-driven leverage thresholds for hedge funds and asset managers

- Auditable risk registries that allow governments and counterparties to monitor systemic exposure before it’s too late

Enterprise blockchain here stops being theoretical. It becomes tactical.

The East: Circuit-breakers and sovereign stack recalibrationJapan’s role in this story is more than geographical—it’s philosophical. In a culture known for precision, resilience, and long-term stewardship, the idea that a local fund imploded from exposure to foreign debt will land hard, especially in a region where U.S. monetary policy still casts a long shadow.

This may accelerate two moves in Asia:

1. Rethinking risk transparency through public-private DLT collaborations – Japan and South Korea were already exploring blockchain-based finance tools—but now, expect movement toward real-time leverage indexing, cross-border asset tracing, and circuit-breaker layers powered by distributed consensus.

2. Regional financial sovereignty via blockchain rails – The shock of U.S.-led volatility will likely boost projects like:

- mBridge (multi-CBDC settlement)

- RCEP-backed digital trade corridors

- Intra-Asian DeFi infrastructure with enterprise compliance baked in

Asia won’t decouple from the west—but it will want more say in how systems operate. Blockchain gives them the levers.

A moment of pattern recognition

This isn’t just about one hedge fund or one policy move.

It’s about what this moment reveals:

- The world’s most secure assets are no longer “safe”

- Rate shocks in one country ripple into another’s retirement funds

- Old pipes are leaking—and everyone’s still using them

Enterprise blockchain doesn’t solve everything, but it offers a new type of resilience:

- Programmable trust

- Distributed oversight

- Real-time calibration

East vs. West: How they’re likely to move

Closing thought

Blockchain isn’t here to save the system. It’s here to show us where it’s broken—and build what comes next. For enterprise leaders still on the fence, this moment isn’t just a warning. It’s a window. And it’s closing fast.

Watch | Mining Disrupt 2025 Highlights: Profitable trends every miner should know

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-07-2026

03-07-2026