|

Getting your Trinity Audio player ready...

|

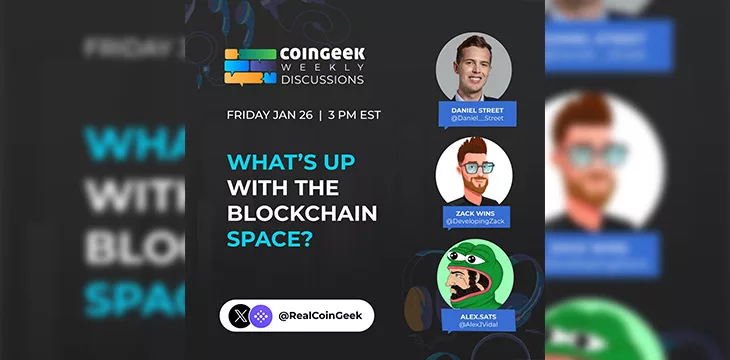

On last week’s episode of CoinGeek Discussions, Daniel Street, co-founder and CEO of LaMint, talked about how micropayments can change the creator economy, his firm’s plans for the future, and much more. Check it out via this link.

The biggest news in the blockchain space

The weekly conversation usually starts with sharing the biggest news of the week.

Host Zachary Weiner points to the impending sale of BTC seized from the Silk Road. Around $130 million worth of BTC will be sold, and he thinks it’s foolish for the United States government to sell them. He also says he’s seen a massive uptick in open-source development on BSV.

Street thinks Dr. Craig Wright’s settlement offer in COPA vs. Wright is the biggest news of the week. It’s almost an out for Dr. Wright and an opportunity for COPA, he says. Now, if other so-called Bitcoin based networks (BTC, BCH) crash and burn, they can’t blame Dr. Wright.

Who is Daniel Street, and what is his Bitcoin story?

Street is the co-founder and CEO of LaMint, formerly Relica. He believes in the power of micropayments to change the creator economy. Later in the discussion, he says OnlyFans is probably 18 months away from figuring out what Bitcoin is and implementing micropayments.

Street discovered Bitcoin around 12 years ago at around $30 and rode the price wave up. After experiencing a dramatic crash, he left the space for a couple of years. After his brother introduced him to Ethereum, he rekindled his interest in the space, and at the end of 2018, he watched many of Dr. Wright’s videos and went down the Bitcoin rabbit hole.

It was at this point that Street and his brother built Relica. Soon after, they met another co-founder who pointed them toward LaMint. He believes this second app solves a huge problem, allowing people to monetize content for under $5. He says it has been a long five years, but he knows they’re on the right path.

Elaborating on the shift from Relica to LaMint, Street tells us it took a couple of years to find the right fit. He encourages creators to leverage their existing audiences, offer some free content on LaMint, and capitalize with some pay-per-view content. The opportunities are endless for micropayments, he says.

Currently, the LaMint team is building a bulk messaging system that will allow creators to reach all their followers easily. There will also be revenue-share options to collaborate with other creators, e.g., on a 90/10 split. The referral system has three tiers, something that’s only possible, thanks to BSV’s capabilities.

Steet rightly says that, for Bitcoin to go mainstream, the user experience has to be seamless. HandCash top-ups will help with this.

What’s the strategy to get people to understand micropayments?

Weiner points out that getting the right people to understand the value of micropayments can be challenging. He asks if LaMint has a strategy for doing so.

Street says they will go after nano payments first. Most new creators must work for six to 12 months before they earn anything. These hungry creators are the initial target market. LaMint can allow them to build up their audience while earning right away. Whereas OnlyFans creators must convince their followers to pay $5 or more for content, creators on LaMint can charge much less.

Is there a chance this model just doesn’t work? Street doesn’t think so. He thinks platforms like OnlyFans are only 18 months away from discovering Bitcoin micropayments. For now, the priority is making the app as user-friendly as possible and ensuring the on/off ramps are seamless. Micropayments can’t be done at scale on any other platform.

What categories are people paying attention to? Podcasts, recipes, gaming, and a handful of others are popular. They also want to introduce live streaming. Tips are popular on other platforms, but the minimums are higher compared to what’s possible on Bitcoin micropayments.

What’s the most exciting use case for blockchain in the next 5-10 years?

Vidal asks the same questions he always asks guests. Street answers that it’s the opportunity for everyone worldwide to earn and participate in one network.

Street believes Bitcoin will take over as the primary payment system of the world in the next five to 10 years. Fiat is too limited, and the old Visa (NASDAQ: V) and Mastercard (NASDAQ: MA) systems are cost-prohibitive for micropayments.

To hear more about LaMint’s future plans, the rapidly growing player base of Champions TCG, creator-consumer relationships, and more, tune into the CoinGeek Discussions episode using this link.

Watch: With micropayments, nothing else needs to happen

02-25-2026

02-25-2026