|

Getting your Trinity Audio player ready...

|

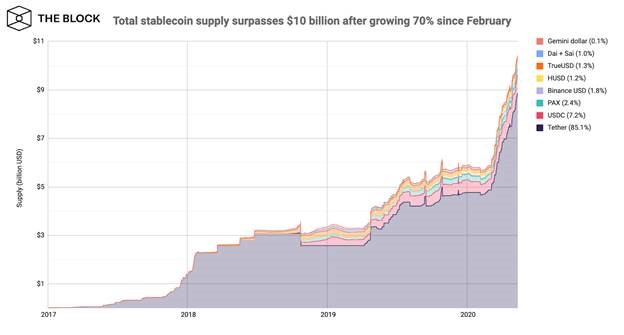

On May 12th, CoinMetrics.IO announced that the total free-float stablecoin supply passed $10 billion. The total stablecoin supply has grown by over 70% since the beginning of February, indicating consumers had an increased demand for a “stable” asset in periods of extreme volatility.

Whilst total issued stablecoins (including treasuries) passed $10b on Thursday last week, stablecoin Free Float Supply (excluding treasuries) only just passed $10b yesterday pic.twitter.com/MY6Ug7nq3d

— CoinMetrics.io (@coinmetrics) May 13, 2020

Who dominates the stablecoin market?

There are only a few major players in the stablecoin market, and even at that, Tether (USDT) controls over 85% of the market with over $8.8 billion worth of USDT in circulation.

USDC has the second-largest share of the stablecoin market, controlling roughly 7% of the market with $705,662,074 worth of USDC in circulation.

And PAX ranks third in stablecoin market dominance, controlling 2.4% of the market with $244,230,487 worth of PAX in circulation.

Why consumers want stablecoins

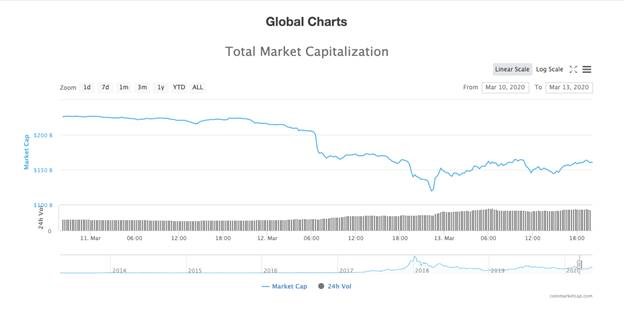

Stablecoins are typically consumer’s preferred digital assets in times of economic uncertainty and market volatility. The coronavirus was a black swan event that had an impact on markets ranging from equities to cryptocurrency. On March 12, a day that many observers and participants in the blockchain and digital currency industry called, “Black Thursday,” the total market capitalization of the digital asset industry declined by 39%, and some cryptocurrencies lost over 40% of their value.

In times of extreme volatility and uncertainty, consumers are more comfortable keeping their wealth in a stablecoin. Many exchanges host stablecoin-to-digital currency trading pairs, so storing wealth in a stablecoins makes it easier for consumers to re-enter digital currency markets when they believe the market has bottomed—compared to the consumer liquidating their crypto for fiat and then exchanging their fiat for digital currency when they are ready to re-enter.

Using stablecoins to re-enter the digital currency market is also cheaper. This is because it does not require traders to convert their digital currency to fiat and then back to digital currency, which means the trader does not have to pay the transaction fees as well as deposit and withdrawal fees that accompany that type of transaction.

The global equities and digital asset markets have begun to recover from the economic toll taken on them by the COVID-19 pandemic. The total digital asset market cap has increased by over 80% from the low it hit on March 12. However, as long as consumers have any sort of uncertainty towards the future of the digital asset market, or they have concerns about market volatility, you can expect the total supply of stablecoins to continually increase.

02-22-2026

02-22-2026