|

Getting your Trinity Audio player ready...

|

Stop listening to every Joe who has something to say about the trading market.

The bullish: prediction or influence?

Every so often, we’ll see news of some notable personality being “bullish” about Bitcoin or any other cryptocurrency. Headline reads: “big corpo exec says this token will jump this high,”or “big corpo exec buys a gazillionX tokens,” the unspoken implication being that people should follow suit.

It seems philanthropic that notable industry names are all of a sudden willing to share their closely guarded trade secrets and forecasts to the public. But is it really?

You know what this is—it’s a pump, an influence game—and an effective one at that.

Their prediction becomes true the more they say it, and the more other people echo it—precisely because in trading, a prediction becoming a reality largely relies on altering market perception, on convincing the market. While market manipulation is illegal, its legal definition is limited and influence is fair game.

So we get stuck in a loop: did they predict the market, or did they influence the market to fit their prediction?

It can be argued then that the outcome was caused not by external factors but by the “prediction” itself. This means in many instances, a prediction is actually influence, even manipulation disguised as a forecast. Of course, this only works if you’re famous enough.

And you know when they tend to make such announcements: after they bought huge chunks of the coin—never before. This is precisely because it doesn’t make sense for anyone to hype it up before they buy in.

If a person thinks a certain asset will greatly jump in value, why wouldn’t he put money on it? And if he’s betting that it will, he wouldn’t be a credible source if he has no “skin in the game.” So the logical assumption is that this person has money in the asset at risk—all the more incentive for that person to make sure his “prediction” comes true.

The bearish (but secretly bullish and will buy the dip)

So what about those who proclaim the sky is falling and the crash of a particular crypto is next? Some are genuine economists doing a proper analysis of an asset, and some are sincerely just researching and making an analysis of their own. Others however, have a different motive—they want to buy more, but they want to buy at a discount.

The problem with hype buyers is that they are the easiest to scare. The flood of hype buyers can efficiently inflate a token’s trading value, this increase is often artificial. And with just a little nudge, they can bring the values crumbling back down—possibly even lower than when they got in.

The only thing a notable personality has to do is make a bad announcement, such as “it’s going to crash,” and the sheep drink the Kool-Aid. The panic selling causes the token’s value to drop, after which, the whales take advantage and buy off what the hype buyers dropped.

This is essentially the same thing as seeing someone holding an item at the store that you desperately want, going over to that person and saying the item is a horrible purchase, waiting for him to drop it and then taking it for yourself. Except in the context of cryptocurrencies, that item may as well be a rare vintage item that you can later sell for large profits.

If the person isn’t easy to sway, your tactic won’t work. But as we’ve seen in cryptocurrency trading, it most often works. This is why Jamie Dimon’s tirades of Bitcoin last year benefited his company JP Morgan and its clients greatly—they bought up bulks of BTC after Dimon’s tirades dragged the trade value down, effectively affording JP Morgan and its clients a huge discount. All they had to do was to wait for their discount-bought coins to shoot up again. It’s less common but still widely known that Dimon has been training his staff to handle crypto transactions for the past 18 months, he’s in so take his gloom and doom predictions with a big grain of salt.

For whales, trading is a game—along with the psychology of the market. This is how rich influential traders get even richer: they’re not just gaming the system, they’re gaming the players—they’re playing you.

Instead of gauging circumstances and making an assessment based on impending situations to predict outcomes, a “prediction,” whether baseless or not, is announced to influence outcomes. And therein lies the manipulation that hype buyers unwittingly drink up.

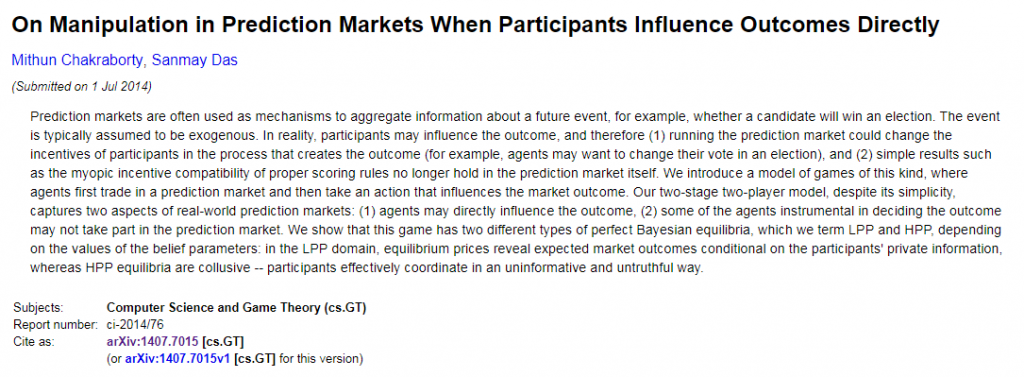

In a research paper by computer science and engineering researcher Mithun Chakraborty andhis adviser Sanmay Das, they explore ways around manipulation in prediction markets where participants influence the outcome. “The event is typically assumed to be exogenous. In reality, participants may influence the outcome,” they wrote. They’ve proposed a new game-theoretic model specifically aimed at solving this problem. But even if it can be solved, do people want to?

02-25-2026

02-25-2026