|

Getting your Trinity Audio player ready...

|

This is a guest contribution by Vemund Skygazer of Yours.org. If you would like to submit a contribution please contact Bill Beatty for submission details. Thank you.

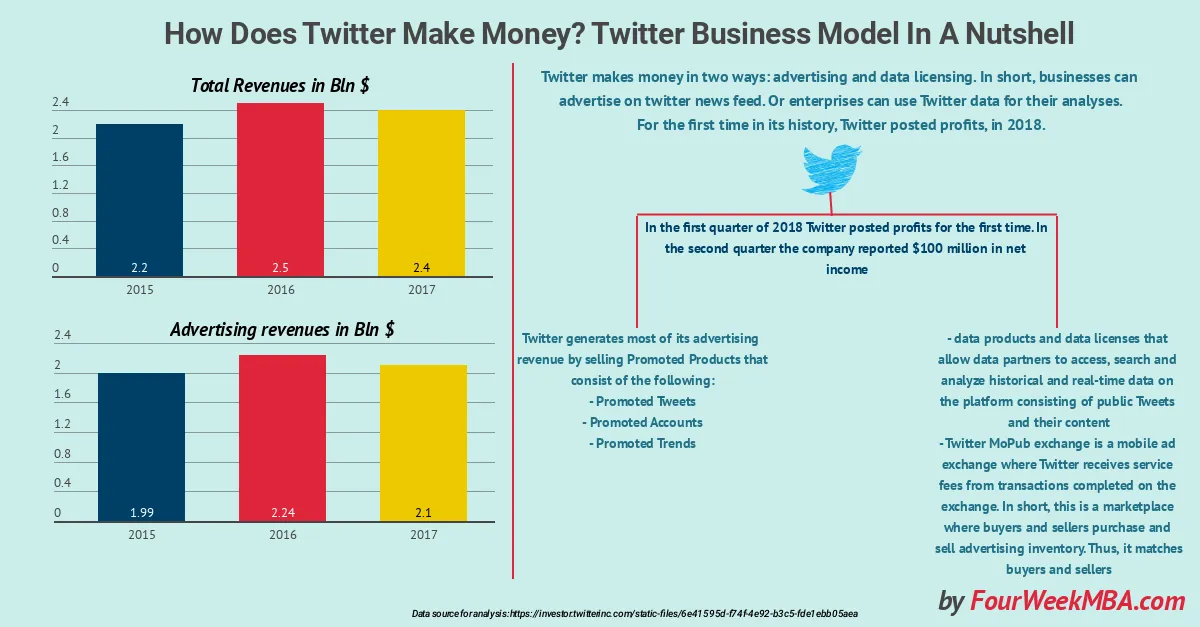

For a long time, Bitcoin and other cryptocurrencies has received widespread attention in mainstream and alternative media based on the price it has reached on exchanges. This could arguably be related due to the nature of modern media business model, which relies heavily on reporting on “shock value” and subjects which result in a reaction from the consumer, since these institutions rely on clicks or views, in order to achieve more clicks and viewers for their advertisers. This is a problem, since it incentivizes media to report, not thoroughly researched and fact-based, but rather to be the first one to report on the most controversial or click/view-generating news. Hence, the consumers who read the news, and are not necessarily privy to this fact, takes the news at face value, and having faith in that the reporting is somewhat accurate, and even though various polls have shown a decrease in the trust of the media, this research by Gallup actually shows a recovery in trust of media in the US in 2017 and 2018. Similarly, in social media, the same principles apply. Twitter and Facebook have a business model which incentivizes them to build their application in such a way that their users are engaged with the application, which in turn gives Twitter/Facebook more valuable metadata about their users’ behavior, which they then can sell to other companies. In other words, it is in Twitter and Facebook’s interest, to promote news in your feed that, rather than accurately inform you about the truth of what’s going on in the world, promote news and stories which keep you engaged on their platform. What this ultimately means is that the people or agencies who are good at getting people’s attention, not necessarily educating people, are the ones who gain followers, attention and promotion.

So how is this relevant to Bitcoin, and what has been termed “The cryptocurrency space”?

If we look at the conversations that are being had in relation to Bitcoin in the high-profile media agencies reporting on cryptocurrency, as well as on social media, we can (albeit based on anecdotal evidence) state that the majority of the conversation revolves around price in relation to conventional fiat, exchanges and personalities who are tweeting quasi-philosophical statements about how Bitcoin will revolutionize the economy as we know it. I encourage you to do a google search on “Bitcoin” and hit the “News” category. It becomes apparent that the price is absolutely the most reported on subject when it comes to this at nearly any given time. Going back to the attention-based business model that media has, we can evaluate whether reporting on price is a subject which educates people in a constructive way, or if it is a subject which is mostly effective in grabbing readers’ attention and thus generating ad-revenue as well as user behavior information for SoMe platforms.

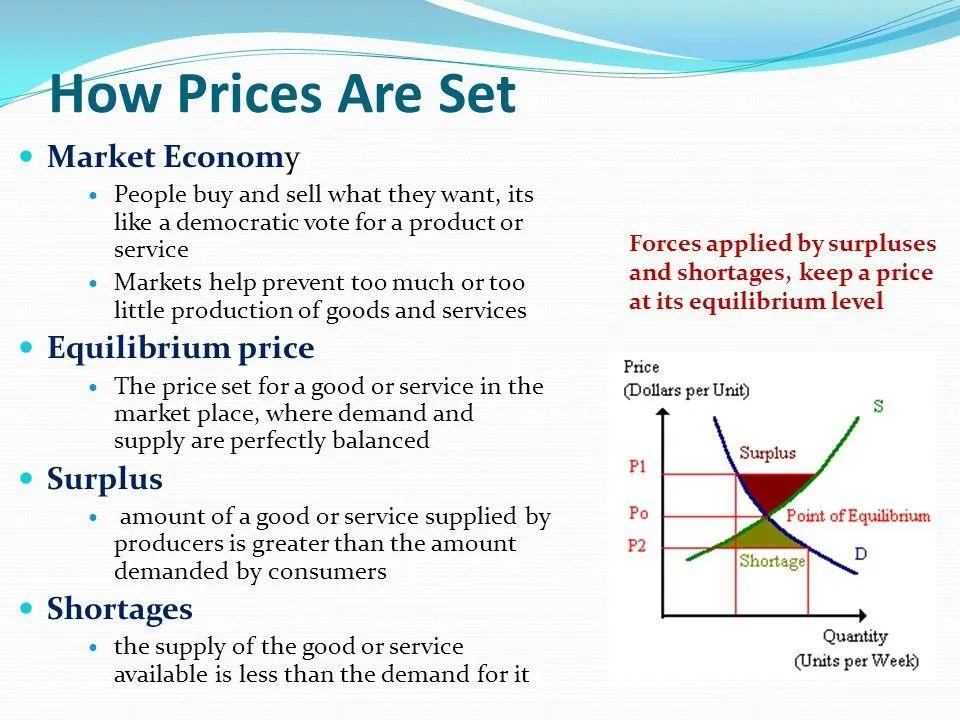

To determine which category this kind of reporting falls into, let us shortly discuss what the price of an asset tells us. The main difference between the price of an asset such as Bitcoin and the price of an actual product, is that the price of a product is a carefully constructed equation between the cost for the manufacturer + profits, and the market decides whether the price set, reflects the value it provides for the buyer of the product. The manufacturer’s profit is at the mercy of the market at all times. This is what decides whether a producer lives or dies as a business in the market. While oversimplified: if a producer cannot make sell their product which exceeds the cost of the production, they cannot sustain their business long-term.

Adam Smith put it this way: “The market price of every particular commodity is regulated by the proportion between the quantity which is actually brought to market, and the demand of those who are willing to pay the natural price of the commodity, or the whole value of the rent, labour, and profit, which must be paid in order to bring it thither.”

In the case of Bitcoin, there is no product and production cost in the same way as conventional product manufacturing. Instead, Bitcoin is an economic tool, and could be argued to hold the properties of commodity money: which can be used in a plethora of ways, and its design allows for things such as cost-efficient settlement, traceability, data storage and much more. But the price of a tool should be, at least in part, a reflection of its utility. In other words, Bitcoin without utility, is akin to a hammer in a world without nails and planks. However, because of the technical and economical complexities of Bitcoin, many people neglect to thoroughly investigate its utility, and instead of logical conclusions about what the price should be, default to whatever media outlets and social media influencers state about the qualities of Bitcoin. Because of this, the price could be argued not to be an accurate reflection of its utility, but instead highly psychologically influenced, and therefore possibly wildly inaccurate. This could be classified as an economic example of the “Madness of Crowds” of which there are many similar scenarios throughout history namely in the early 1900s and again in the 1990s dotcom-bubble. Going back to the example of the hammer, if people had no idea about what a hammer could do, but instead bought into the idea that were perpetrated by other people who stated “This tool can potentially make you fly and let you traverse the world in ways never seen before!”, it becomes obvious that this would cause the price of the tool to be misrepresented with relation to its utility.

Fearing Bitcoin

The inventor of Bitcoin clearly had an idea about which problems Bitcoin set out to solve. Among other things, it allows for a stronger financial sovereignty for the individual, it helps businesses because of fast, cost efficient international transfers and settlements, and it allows information on the internet to be accurately priced, potentially changing the ad-revenue based business model discussed earlier, on a fundamental level. It is rational to assume that it is in the interest of consumers and businesses to utilize these new features which improve their financial efficiency and sovereignty, a more efficient economy and higher quality information on the internet. The nature of a public, immutable ledger also means that transacting with Bitcoin will always leave an evidence trail, which could aid law-enforcement in combating both hard crimes, as well as prevent financial fraud in government and the private sector.

Perhaps unsurprisingly, the problems that Bitcoin have set out to solve are at present the precise mechanisms that have prevented it from reaching its true potential.

1. Bitcoin potentially disrupts the ad-revenue based business model of modern media, and social media platforms.

Because of modern media business models, information about Bitcoin’s utility has been drowned in the sea of price discussions, social media trolling and irrelevant drama that do not constructively inform, but keep users engaged. On Twitter, there is no cost to spam useless information, and so it has been used to sway the conversation to focus on price and interpersonal drama instead of utility. An internet where users pay for every bit of data they want to access, instead of willingly giving away their user behavior data for free, to companies who sell that information for profits, challenges the most popular platforms such as Facebook and Twitter.

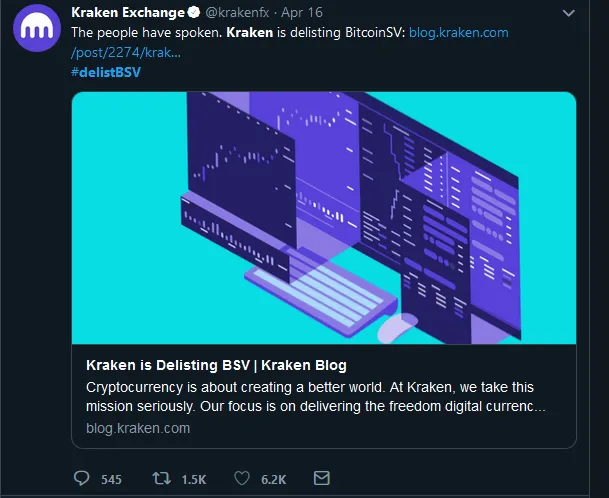

2. Bitcoin disrupts the roles of third-party intermediaries such as settlement banks and exchanges.

Certain exchanges in particular have grown immensely rich and influential due to becoming the de-facto gatekeeper for any one user to get on-boarded to Bitcoin. It is in many exchanges’ interest to ride on psychological hype and FOMO, in order to maintain a high amount of transaction volume, of which the exchange takes a percentage at every layer. If the true potential of Bitcoin is realized, the technology allows for on-boarding, essentially without the exchanges’ role as we know it today. It also needs to be emphasized that these entities are using the mechanics addressed in point 1 to enforce their standing through psychological manipulation, using controlled media outlets and social media. Binance is a good example of an exchange which is heavily invested in Social Media PR.

3. Bitcoin allows for traceability, making it harder for criminal and corrupt entities to get away with fraud, scams and other illegal operations.

Contrary to popular belief, Bitcoin is not anonymous, but private. This is beneficial to honest actors who want to accurately report their taxes more easily, and see where their tax money is being spent by the government. Anonymity is in the interest of criminal actors, corrupt governments and scammers, who want to have a way to escape the consequences of exploiting others. These actors have therefore convinced many that Bitcoin is flawed, since it does not allow for anonymity and tried to steer the conversation away from its true utility, to another warped version of Bitcoin which supports corruption and illegal operations.

At the end of this analysis, it is helpful to reflect on the possibility of all these 3 mechanics working together as an interconnected ecosystem, which is being utilized today where there are actual criminal actors, proven scammers who issue non-usable ICOs, with the help of corrupt and unregulated exchanges, operating outside of the law who together with hired traders and social media personalities are constructing an artificial narrative using social media to ramp up social consensus, using paid social media accounts for trolling, defamation and price manipulation. Through these mechanics, they can allow for wash-trading, money laundering for criminal organizations and pump-and-dump schemes. They fear Bitcoin, because Bitcoin makes it harder to be a dishonest actor, at all layers of our society. If information on the internet is priced, it is harder to get away with lies and fake approval (likes). If exchanges have a less important role in the future economy, pump-and-dump schemes will be less prevalent. And lastly, if all transactions take place on the immutable public ledger that is the Bitcoin network, it becomes harder to get away with criminal behavior. Bitcoin promotes fractal honesty, because it makes it economically less viable to act dishonestly, just as it does with mining, and thus dishonest actors will fear such a system in the same way the rat fears the watchful cat.

Bitcoin as envisioned by Satoshi Nakamoto

“The existing Visa credit card network processes about 15 million Internet purchases per day worldwide. Bitcoin can already scale much larger than that with existing hardware for a fraction of the cost. It never really hits a scale ceiling.” – Satoshi Nakamoto (April 2009)

Those who emphasize the importance of price, before even addressing the utility-aspect, are therefore misleading people and doing them a disservice, essentially keeping them trapped in the old system that Bitcoin is built to disrupt. And it is obvious that there is an economic incentive which leads them to these priorities.

The utility of Bitcoin increases as more and more businesses and market actors take this tool into use. If we can state that value is defined as utility or “Ability to solve important problems”, the value of Bitcoin is the equivalent of its utility. With a crippled version of Bitcoin, such as BTC, one has to critically evaluate whether the price is a reflection of its value. Likewise, with ABC’s version which encourages anonymity be built into a continuously changing protocol, we have to take into consideration how this will be treated from a legal perspective when enabled, and how this will affect its appeal to consumers and businesses alike.

Bitcoin SV is the original Bitcoin, in that it follows the original whitepaper which is designed to massively scale, and be compliant with law throughout the world. It solves an array of important problems that the world is facing today, and it is time to be vigilant towards the information that we are being shown regarding this subject, because when we look what incentives certain businesses and individuals have, it becomes apparent that there are actors who are currently benefitting from the exact problems Bitcoin are designed to solve, and they are doing everything they can to prevent the worldwide application of the original Bitcoin protocol.

This article originally appeared on Yours.org and republished with permission.

07-09-2025

07-09-2025