|

Getting your Trinity Audio player ready...

|

The promises of stablecoins are clear: it’s a way to fuse the low-cost, speed, and transferability of digital assets with the certainty of traditional currency. At the upper bounds of what is possible, stablecoins may become the new standard of payment in the same way payment cards are replacing cash.

But living up to these promises means being able to scale. It’s relatively simple to make a stablecoin; it’s much less simple to make one that’s going to be just as usable at 100 transactions per day as it is at 100,000.

This was the focus of the late-morning keynote on the London Blockchain Conference’s Visionaries Stage: Stablecoins that scale: Five tests for real-world money.

The designated hitter was Dr. Bernhard Kronfellner from Boston Consulting Group (BCG). Surveying the crowd, he muses that perhaps stablecoins don’t need five tests at all, because there’s a more useful indicator already in the room with us.

“The crowd has changed from people wearing hoodies to people that are wearing suits. So this is actually – without the five tests – the first indicator that stablecoins and digital assets have already become in the interest of the big banks, the big brands, and it will be the world’s new money.”

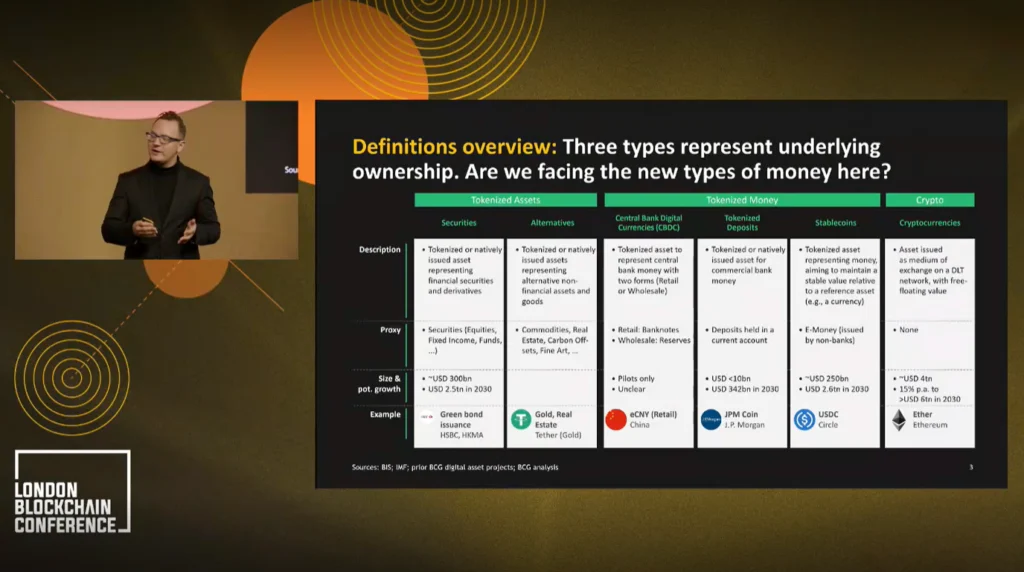

Nonetheless, Dr. Kronfellner sets out the five tests:

- Additional value

- Use cases

- Revenues

- Regulations

- CBDC-Co-existence

To start with ‘additional value,’ Dr. Kronfellner shows two images side by side: one warped, pot-hole-stricken road, and another smooth, 20-lane megahighway. Stablecoins, in essence, are the megahighway.

In a world of innovations, things like booking overseas accommodation have been disrupted by Airbnb (NASDAQ: ABNB) and have never been easier. But when you want to transfer money to the other side of the world, you could be looking at five banking days.

Stablecoins can do for money what Airbnb did for accommodation, in other words.

Dr. Kronfellner lists five benefits stablecoins help unlock:

- Lightning-fast transactions

- Reduced transaction costs

- Enhanced transparency

- Programmability and automation

- Global accessibility and financial inclusion

He also reminded the crowd that the real use cases these benefits might transform into are still being discovered.

“When a new technology like the Internet 20 years ago—with exchanging emails, first webpages, and so on—no one had a clue that 20 years later, with Instagram, we might see influencers that have followers and make a good living out of it.”

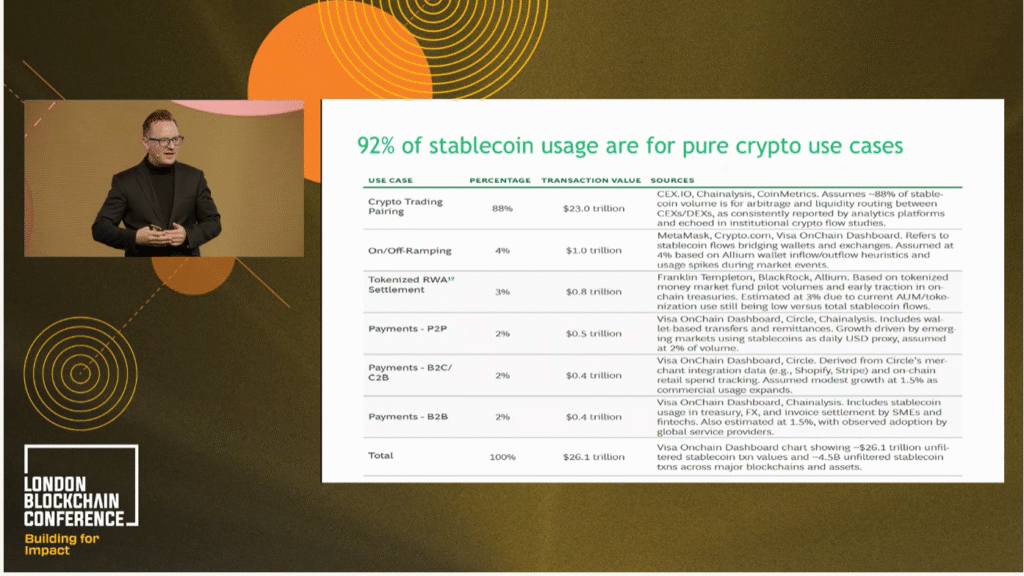

The message is this: the use cases that we see right now, such as crypto trading, are just the beginning. Five or ten years from now, perhaps artificial intelligence (AI) agents will help us exchange money, buy things, and invest.

Another question: Are companies across the value chain building viable business models? It’s not enough to merely have a use case for stablecoins; the use case has to make money.

Some certainly are, Dr. Kronfellner explained. Tether made $13 billion in profit last year from a mere 100 employees. Little wonder, then, that banks are expending effort to enter the space.

Exactly what form the banks’ entry into stablecoins might take is an open question. Dr. Kronfellner discusses the potential avenues banks are exploring—they could offer wallets or custody, issue their own stablecoin, create a consortium with others to issue a stablecoin, issue tokenized deposits (as JPMorgan (NASDAQ: JPM) has done), or they could simply do nothing, and wait and see which coins emerge as the winners.

“For some banks, this makes sense. They will see that the revenue will be reduced and decrease in cross-border transactions or other typical stablecoin use cases and some clients will go away. But not being a first-mover, for a tier 3 bank, might be good.”

Regardless, Dr. Kronfellner says that BCG sees stablecoins as a net opportunity for banks. The downsides are reducing; the upsides are growing.

What’s next? Dr. Kronfellner says he sees a run for APYs. Soon, people will keep stablecoins in their wallets as a store of value and start questioning how they can get yields on their portfolio as they do with cash. New platforms may emerge from traditional banks or payment service providers to offer people an APY on stablecoins.

AI agents are another area Dr. Kronfellner anticipates growing: AI agents will help us to use our stablecoins in our wallets to transfer money, or we can ask our AI agent to find out if there’s a cheap way to buy into the building with X amount of money. If the apartment building is already tokenized, the AI agent will return with a quote of how much fractional ownership would cost.

Dr. Kronfellner kept returning to the same point—from the banking perspective, the upsides for stablecoins are growing, while the downsides are starting to disappear.

Watch: Culture of BSV and the ‘Crypto’ Economy

02-23-2026

02-23-2026