|

Getting your Trinity Audio player ready...

|

Questions about how Bitfinex is staying afloat with no publicly known bank backing them is inciting dangerous theories.

In light of the recent Tether heist—which saw a culprit (or culprits) make off with $31 million worth of its US dollar-backed tokens, USDT, talks about an inside job are not the only ones circulating. Theories of a possible collusion between Tether and Bitfinex to rig the cryptocurrency market are also surfacing.

Here’s what’s circulating in the corners of the web: no bank wants to partner up with Bitfinex, so they’re pumping the price of BTC in order to keep a steady flow of depositors and keep anyone from cashing out of the exchange. And while the pump part of this isn’t scary from a HODLer’s perspective—it’s the dump that is.

In a Medium post, user Bitfinex’ed—who is dedicated to “exposing fraud by largest Bitcoin exchange, Bitfinex/Tether”—outlined a possible pump-and-dump scheme perpetrated by Tether and its partner Bitfinex, in an attempt to buy some time until the exchange can find a bank that’s willing to accommodate their transactions.

This is problematic. Last year, Bitfinex had a falling out with Wells Fargo, the last bank that was willing to process their transactions. And shortly after, they suffered the largest Bitcoin robbery since Mt Gox—in August 2016, the exchange lost 120,000 BTC to what it says was a hack. It didn’t help that their decision to “distribute the losses equally” amongst user accounts was met with controversy. Neither did the fact that they gave no clear explanation as to how exactly the hack happened, when the funds were in a multi-signature wallet and required two of three signatures. Although they were able to “pay off” users by offering them equity, the lack of transparency and refusal to submit to audit compliance did not sit well with the public.

The multi-million dollar hacks of both companies—which are said to be owned by the same people—have users doubting the credibility of their statements. Tether itself has also been shady, marketing their tokens as “money for the internet,” yet repeatedly stating in the less conspicuous legal section of their website that Tethers are not money and that they are under no obligation to exchange users’ Tethers with actual money.

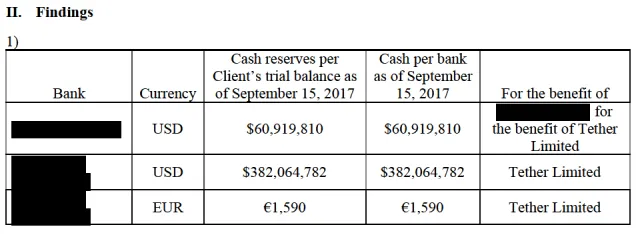

To date, it’s still unclear which bank processes Bitfinex’s transactions—if there is even one. Since the Wells Fargo fallout, they haven’t been transparent about who they’re banking with. Their casual admission of creating shell companies to bank for them probably didn’t do them any favours either. Or maybe they do have a bank, but can’t admit it to the public because the bank they’re banking with unwittingly dealt with them through one of their shell companies.

To circumvent the banking problem, user Bitfinex’ed says Bitfinex is likely employing Hawala banking.

“Bitfinex essentially match-makes you with someone wanting to withdraw from their exchange, and you send the money directly to the other party withdrawing.”

This doesn’t seem so bad at first glance. It’s either they facilitate trading as if they were just serving as a peer-to-peer online matching platform, or throw in the towel and close down—which they don’t seem to be keen on doing. But as Bitfinex’ed points out, this can end in tears.

“Well, there’s a problem. This requires a never ending stream of money coming into the exchange.

The minute the prices of Bitcoin turns bearish, and the prices continuously fall, eventually people will stop catching knives, money coming in comes to a trickle, and people are wanting to withdraw and nobody wants to deposit.

So, the only choice Bitfinex has, is to relentlessly manipulate the price of Bitcoin up for as long as possible so that people always want to deposit, until they are able to re-establish a legitimate banking partner.”

So then what happens when they finally establish a banking partner? They will no longer need to artificially inflate BTC prices. And there goes the dump.

The same would happen if they were to close down.

To be fair, if the BTC price were to crash, it wouldn’t exactly be a surprise. And it probably would take a lot more than one exchange pulling off some “cat-and-mouse tricks.” Whether this is true or not, BTC’s current value is, in fact, primarily backed by speculation. If we could set aside our inner blind fanatics and look at things objectively, perhaps we could really look out for when the bubble will burst. Any cryptocurrency’s price is never really the core value of a system. Such surges are the result of intrigue and likely, FOMO. But if we were to look ahead to five, ten, or more years from now, such value fluctuations would probably have died down, and the value stability will put an end to cryptocurrencies’ get-rich-quick investment appeal. Hopefully by then, we will all be utilizing cryptocurrencies for what they were really made for—transactions.

07-06-2025

07-06-2025