|

Getting your Trinity Audio player ready...

|

The UK High Court has found in favor of Ramona Ang (the wife of Dr. Craig Wright) in her case against Reliantco Investments Ltd., the Cyprus-based owner of trading platform UFX.

The facts of the case are sadly common: Ramona Ang was a customer of UFX and had found great success trading on it, turning an investment of US$200,000 into $700,000—at which point, Reliantco blocked Ang’s account, initially without providing clarity to Ang as to why her account was blocked.

Reliantco tried a number of arguments in order to justify its decision to ban Ang’s account and effectively seize hundreds of thousands of dollars’ worth of money from it. Reliantco’s core argument was that Ang’s account was in actuality being operated by Dr. Wright, in contravention of their terms of service. They also argued that Ang had deliberately submitted incorrect information as a part of the platforms’ KYC process. Finally, they argued that account was ultimately closed because Reliantco had discovered that Ang was married to Dr. Wright, the inventor of Bitcoin, and that the gains she had made using the account to that point were indicative of insider trading.

The Court rejected all three arguments, finding that Ang is entitled not only to the money in her UFX account, but the unrealized gains on the positions she had open at the time the account was closed, together with the money she would have gained from her intended investments had she been allowed to access her funds and realize the gains on her positions.

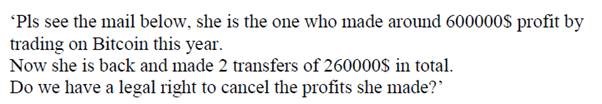

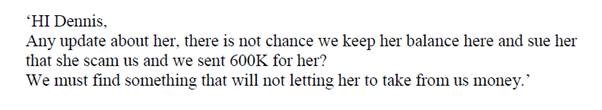

The ruling itself is an encouraging victory against bad faith digital asset exchanges. However, the evidence that the Court accepted in making its decision is a sobering read for anyone with money tied up in digital asset trading platforms. The trial produced emails sent internally between Reliantco agents and show the extraordinary lengths that a digital asset exchange is willing to go in order to avoid paying particularly successful customers. They show Reliantco employees scrambling to find a reason—any reason—to seize the money in Ang’s account and block her from using the platform and make no attempt to hide their motivations for doing so:

At times, the Reliantco communications reveal a hesitation to strip a prolific customer of their legitimate earnings, with one e-mail reading:

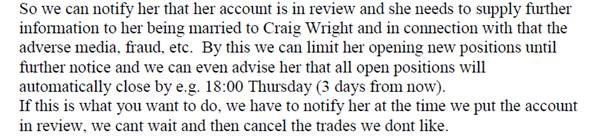

“We can’t wait and then cancel trades we don’t like” indeed, but this proved little more than a momentary lapse in greed on behalf of Reliantco, and the above email appears to be the last hint of any conscience on their part. In reply to the above, another apparently senior member of the Reliantco family said:

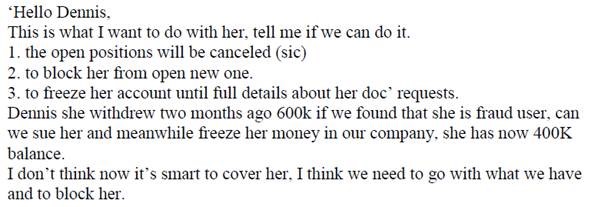

The tone in the above email is much more in line with Reliantco’s subsequent behavior and with the arguments it would go on to make in this trial. Ang’s pattern of success on the platform clearly troubled Reliantco as she appeared to be gearing up to take further Bitcoin-related positions. Mere days after the frenzy of internal emails described above, Reliantco emailed Ang notifying her that her account had been terminated “due to the Company’s internal Anti Money Laundering policy.” Even Reliantco’s own compliance department seemed a little perplexed that Ang had been terminated under this pretense:

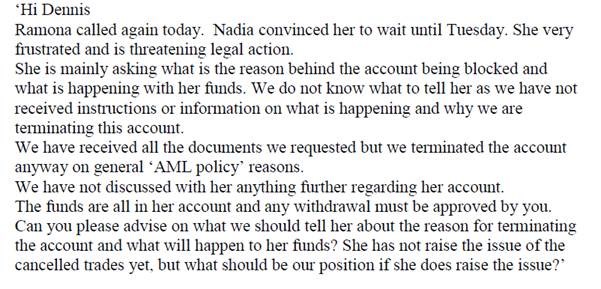

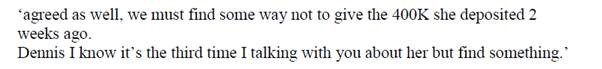

And if there was any doubt as to the actual concerns of Reliantco staff throughout this time, there are these shockingly illustrative internal emails which were sent after the account was terminated:

And:

In the context of these e-mails, it’s difficult to see Reliantco’s actions as anything other than a bad faith attempt to terminate a trading account which had become too successful for them to tolerate. Thankfully, Ang has been able to hold the exchange to account for what has turned out to be little more than outright theft, but it can be inferred that Reliantco—and outfits like them—are only willing to serve the customers they are able to take advantage of. Ang wasn’t one of those customers, but how many more lacked the patience, funds or knowledge to challenge their exchange in cases like this?

The Court will hear arguments on December 15 as to the amount of damages Ang will be entitled to. Ang had submitted that she had invested some US$200,000 via her UFX account, successfully turning that into $700,000 at the time the account was closed. As for the positions she had taken that she was unable to realize due to the termination, Ang said that the account would now be worth in excess of $3,000,000. Given the Court ruled that she is entitled to all of the money she had in the account, the profits she had made and the profits that she would have made both if her positions had been able to be realized and if she had been allowed to reinvest those profits as planned, Reliantco is likely to owe Ang damages in the millions.

02-20-2026

02-20-2026