|

Getting your Trinity Audio player ready...

|

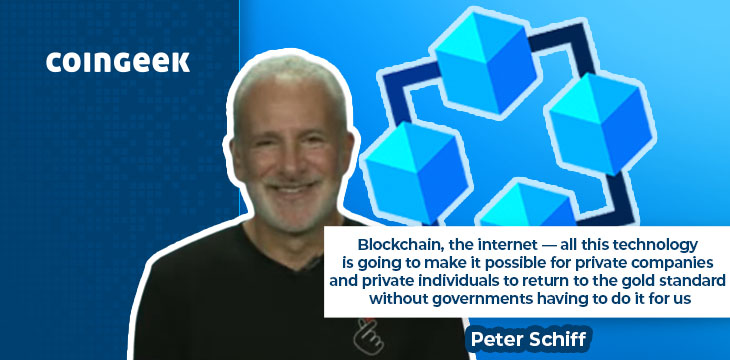

Peter Schiff is a well-known economist, money manager, and gold bug. This week, he joined the CoinGeek Weekly Livestream and talked to Kurt Wuckert Jr. about Bitcoin, the recent market carnage, and much more. Wuckert attempted to educate Schiff on the real Bitcoin. Did it work out?

Welcome, Peter Schiff

Wuckert begins by asking Schiff for a two-minute introduction. He clarifies that he’s not just a ‘gold guy,’ but he does believe it is money and that the founding fathers of the United States put the country on a gold standard for a reason. He thinks the world and the U.S. would be much better off had it not abandoned the gold standard in 1971.

Schiff doesn’t just believe in investing in gold. Instead, he believes in keeping powder dry in gold before deploying it to productive investments like real estate and stocks. At Euro Pacific Management, Schiff’s investment firm, one of the strategies is to buy gold and silver mining stocks, as well as the metals themselves.

Tokenized gold

Wuckert mentions that he has heard Schiff speak at length about Bitcoin and agrees with many of his critiques of it as digital gold. However, he asks for his thoughts on the potential of tokenizing gold on blockchain to transmit it across the planet.

Schiff says he knows dozens of people working on such projects right now. He emphasizes that gold itself is never tokenized (it’s a physical asset in a vault) but that evidence of ownership can be. He points out that such systems (paper claims on gold) have always been a more effective way to utilize gold as money. Blockchain technology can make this more efficient, transparent, and easy-to-use gold as money once again.

Gold vs. fiat currencies

As fiat currencies depreciate, Wuckert wants to know if Schiff’s position is that gold will increase in value or remain steady. He replies that when gold is $6,000 an ounce, that will be a significant jump from the $20 an ounce it was when the U.S. went off the gold standard. This is because the value of fiat is going down rather than gold is going up.

Based on the enormity of the deficits and the sheer scale of fiat currency creation in recent years, Schiff sees the dollar losing a lot of value in the near future. However, even if gold is $10,000 an ounce, it doesn’t mean gold has gained value, but rather that the dollar has lost it.

Bitcoin is not digital gold, and the necessity of the satoshi unit

Wuckert tells Schiff that Bitcoin split, leading to the scaling and hash wars, and outlines his position as a big blocker. He reminds him that BTC has been debased and that Bitcoin was always capable of issuing assets using Bitcoin script. For example, one could issue a Central Bank Digital Currency (CBDC) or a gold-backed token backed by satoshis and gold. The technology is there to do this right now, but businesses don’t want to do it yet.

Schiff says he doesn’t see why it needs to be built on a layer of satoshis. He also says that all of the money that has flowed into the sector so far was directed at creating tokens out of thin air, and this greater fool theory is why serious money hasn’t moved in yet. Add to this that BTC advocates have relentlessly attacked gold, and it’s little wonder that nobody has properly tokenized gold on the blockchain.

“Bitcoin is not digital gold,” Schiff says. Wuckert agrees and says this is a sophomore understanding of Bitcoin. He explains that using satoshis to underpin gold tokens would be done because miners would have to process the transaction, and they use Bitcoin as a unit of account. Schiff still can’t grasp the necessity of the satoshi unit and says Wuckert may need to show him something off-air to explain why it’s needed.

Wuckert explains the concept of BSV to Schiff, explaining the ability to do microtransactions and put millions of transactions inside big Bitcoin blocks. Schiff notes that Wuckert is at least attempting to make Bitcoin useful and says it could potentially be alternative money to government-decreed fiat.

Reintroducing gold and the free market

Wuckert notes that Bitcoin allows us to pay for a single instance of computing and dramatically reduces the cost of financial transactions. He asks Schiff to imagine doing a transaction on the blockchain that notifies everyone how much gold was transacted and other details right down to the serial number of the bar it came from.

Schiff likes the idea of tracking the ownership of tiny amounts of gold and thinks the only reason people currently use fiat is that it’s more convenient. He thinks people would naturally want to be paid in it if they knew they could pay for its goods and services.

Speaking more practically about how a tokenized gold system on the blockchain would work, Schiff believes that many companies would issue them, and then the free market would slowly decide what ones they trust.

Speaking about the compute power of the Bitcoin network that would allow all of this, Wuckert explains that satoshis buy the compute power, and Schiff gets it. He says he did not understand that satoshis were necessary for the transaction, but he allows that if the unit can be used for something practically useful, then it could have real value.

Small, casual transactions and electronic cash

Schiff states his position that we all have the right to private transactions. Wuckert explains that Bitcoin as an electronic cash system could allow for this sort of transaction, allowing us to conduct small, casual transactions without revealing lots of information about ourselves.

“This is what Satoshi Nakamoto was talking about,” Wuckert says, harkening back to the early days of Bitcoin. He explains that it was all about reducing friction.

Ending the interview, Wuckert offers to fly to Puerto Rico to demonstrate how a gold-backed token could be issued on BSV. Schiff listens, saying what Wuckert is saying “makes sense” and acknowledging that anything that would allow us to move tokens around cheaper and more efficiently could have real value.

Watch: The BSV Global Blockchain Convention panel, Blockchain Venture Investments: Driving Utility for a Better World

02-25-2026

02-25-2026