|

Getting your Trinity Audio player ready...

|

This post originally appeared on the PeerGame website, and we republished with permission from Peergame.

To understand what the acquisition means to BSV, first, we need to understand two companies: Money Button and The Bayesian Group. Please know that this interpretation is purely based on our speculation, not a result of discussion with either Money Button or Bayesian.

What is Money Button really?

Money Button is a web payment platform that has been the cornerstone of the BSV app ecosystem. Without Money Button, there wouldn’t be Peergame or most other apps because we wouldn’t have imagined the possibility of our application in the first place.

It is no exaggeration that Money Button can be compared to the iPhone which created the entire ecosystem of apps plus many competitors.

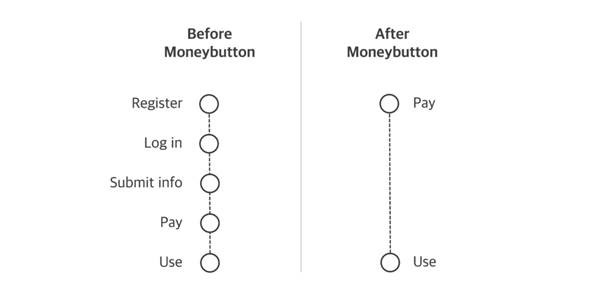

Money Button separated the payment system from apps. It means that apps do not need their own payment system which requires cumbersome processes for end-users. Remember how you paid anything on the internet. You have to go through a lengthy process of registration, sign in, submitting credit card info, etc.

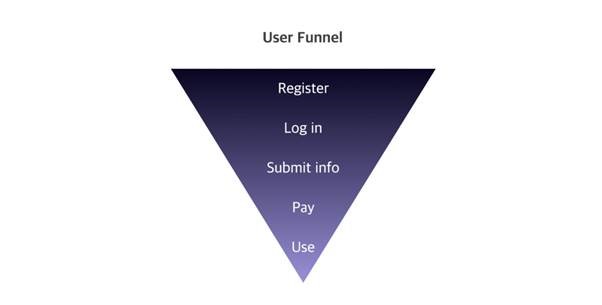

Such a process creates a “funnel”, a pool of visitors getting smaller as they go through the whole cycle until they can reach the conversion. For example, traditional online gaming sites lose 24% of visitors during the registration process, and only 1/3 of registered users make a deposit. To replace all that with a single swipe of a button was a breakthrough for the new commercial internet.

(On a side note, one of the reasons why Streamanity does well after Jack Liu’s acquisition is because he understood this mechanism. Streamanity abandoned its own wallet system and adopted RelayX and Money Button, which eliminated the funnel. The fact that anyone can pay-to-watch without signup opened up the broader market and created better user experience.)

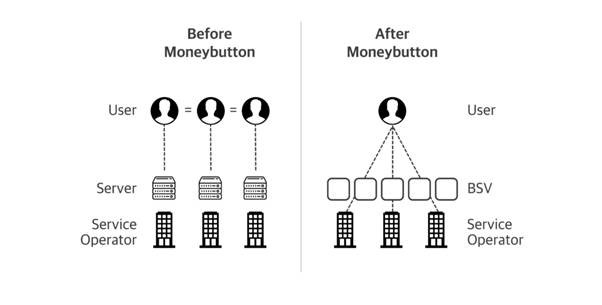

Another innovation Money Button made was that they separated online identity from apps. Before Money Button, every internet service needed to maintain its own database of users, which is submitted by the registration process. But now anyone can send a payment via Paymail, and the identity doesn’t need to be duplicated over services. Users can keep their sovereignty.

Okay great. But why did Ryan X. Charles sell such a promising, powerful platform to the Bayesian group, which is a fairly unknown company? Let’s first see what Bayesian is up to.

What does the Bayesian Group do:

Bayesian seems to do two things in the surface

- Market-related businesses, such as market-making, liquidity providing, auto OTC, etc.

- Token protocol called Fabriik

These two tracks of their business don’t seem to mix well. What does trading coins have to do with tokens on BSV? But if Money Button, the prominent payment platform, jumps into the bigger picture, it all starts to make sense.

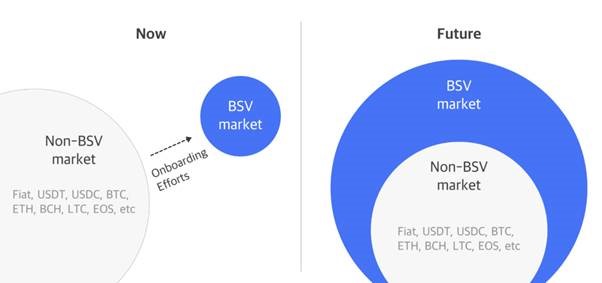

As Ryan explained in his post “Standardize SPV and Tokens for Five Billion Daily Active Users” right before the acquisition, he emphasizes heavily on tokens and a bigger market of five billion users. The message of his writing is actually about a methodology to onboard billions of users to BSV ecosystem “without” educating them about BSV.

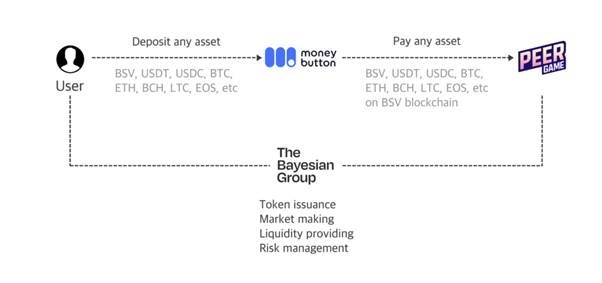

As all of the cryptocurrencies except BSV suffer from high fees and slow transactions, Money Button and Bayesian are going to tokenize other cryptocurrencies and fiat currencies using Fabriik’s BSV tokenization protocol and integrate them to Money Button platform. Then users will be able to pay their favorite coins just like they’re currently doing with BSV.

End-users do not care whether or not their coins are wrapped or issued on top of a token as long as it works and transacts faster and cheaper. End-users will simply switch their slow wallet like Metamask to the fast wallet like Money Button.

Because the native coins (BTC, ETH, etc) need to be managed securely and atomically with its BSV token version, we think that the Bayesian group will play the role of middle-man, managing the native assets, providing liquidity, and settling for the app providers accepting BTC, ETH tokens.

BSV apps do not need to compromise their system to expand to the broader market. We, Peergame, have long pondered the option of having our own deposit system to accept other coins. But we don’t need to anymore because BTC users will be able to send their BTC to Peergame with the same user experience we provide now, such as no registration, instant payout, on-chain provably fair system, sovereignty over their funds.

This possibility is already demonstrated by RelayX. RelayX issued USDC on BSV blockchain and users will be able to send USDC as they do with BSV using the RelayX platform. You can also even scan the Litecoin QR payment code, and the RelayX mobile wallet will automatically convert BSV to LTC and finalize the payment in a matter of seconds.

If you look closely, Jack Liu has been working on the same components that Money Button and Bayesian seem to prepare now. Jack owns FloatSV, which functions as a market maker like Bayesian, RunSV token protocol like Fabriik, and RelayX super wallet like Money Button. This kind of competition will accelerate the growth of the BSV ecosystem.

Unfathomably bright future

This approach will bring a new era of BSV app ecosystem. BSV app builders can be sure that the user market is big enough for them to continue to grow. So BSV builders, be fast and get ready before the influx of billion users brought by such amazing entrepreneurs like Jack Liu, Ryan Charles, and many others. Seize the opportunity!

03-10-2026

03-10-2026