|

Getting your Trinity Audio player ready...

|

More than $1.4 billion has been laundered in the first half of 2020 via digital currency exchanges, a new report from the blockchain analytics firm PeckShield has revealed.

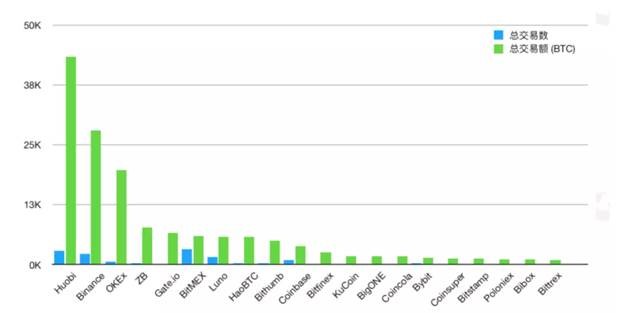

“In the past 6 months, a total of 13,927 high-risk transactions have flowed into digital asset exchanges,” the report reads. “The assets, totaling 147,000 BTC, are equivalent to more than $1.4 billion at current prices. We ranked the exchanges with the largest amount of stolen money. The top ten exchanges were: Huobi, Binance, OKEx, ZB, Gate.io, BitMEX, Luno, HaoBTC, Bithumb, and Coinbase.”

PeckShield considers a “high-risk transaction” any transaction that originates from a wallet address that is known to be associated with the darknet or a digital currency hack. It also ranked the digital currency exchanges that the high-risk transactions were liquidated through. Interestingly, the analytics firm found that well-known digital currency exchanges with KYC and AML procedures in place—such as Huobi, Binance, and even Coinbase—were the digital currency exchanges that the most money was laundered through.

Over 2 billion stolen

PeckShield’s research also revealed that in the first six months of 2020, there has been “101 hacker attacks, with a total of $2.591 billion in stolen money, of which at least $14.82 million has flowed into the exchanges.”

Beyond that, analytics firm discovered that $1.62 billion flowed into blacklisted addresses and $1.59 billion was sent to digital currency mixers.

Is digital currency crime on the rise?

Peckshield’s research supports a recent report from Crystal Blockchain that indicates the use of digital currency mixers is on the rise. The PeckShield report was also released just a few days before Twitter was compromised by a hacker to promote a digital currency scam that reached tens of millions of Twitter users. By the looks of it, digital currency-related cyber-crime is on the rise and the cyber-criminals are laundering the money in plain sight.

03-01-2026

03-01-2026