|

Getting your Trinity Audio player ready...

|

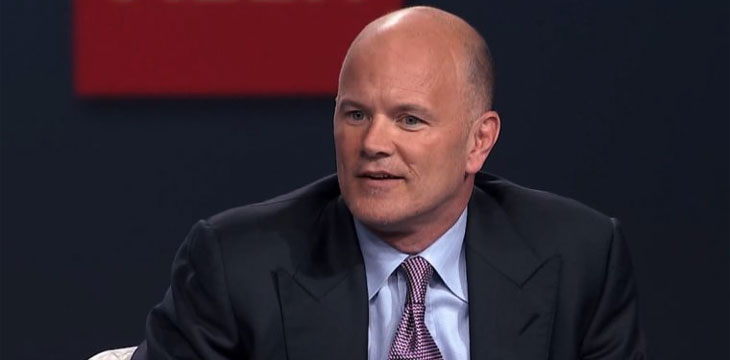

Following the introduction of cryptocurrency came the cryptocurrency exchange. There has been considerable growth in the industry, but some aren’t as adept as others in designing and implementing the myriad of options necessary to create a viable exchange. Enter AlphaPoint, a company that, among other things, offers an exchange software solution, as well as hosting capabilities. Galaxy Digital Capital Management founder Mike Novogratz likes the idea, and has already put $15 million into the startup.

Novogratz announced the investment last week, stating, “We are in the early stages of a fundamental transformation in financial markets due to the digitization of assets. […] We are excited to partner with AlphaPoint as we continue to help drive this revolutionary change in digital markets.”

AlphaPoint, which is already working with CME Group and The Royal Mint in the UK to create a crypto trading platform, is partnered with Microsoft, Intel, Hyperledger, the Enterprise Ethereum Alliance and more. Apart from the exchange option, the company also offers a distributed ledger platform to digitize financial instruments and to create trading venues.

With the investment, Galaxy’s managing director, Greg Wasserman, picks up a seat on the board of directors at AlphaPoint. However, the company, which was founded in 2013 in New York City, isn’t looking at only Novogratz for support. It has also received investments from Blockchain Capital, a venture capital firm that invests solely in blockchain technology.

Despite the current bleak crypto market, Novogratz has remained firm to his conviction that digital currencies will prevail. The market has taken a downturn recently, losing more than $110 billion in just one month. “Right now, the coins are kind of going sideways. But underneath, the people moving into the industry, it’s a straight line up. Job applications—straight line up. Private investing—straight line up,” he explained.

2018 has brought with it a slide in value of virtually all of the digital currencies. However, it is also brought forward a number of new trading options, more clarity and more awareness. Investment vehicles such as institutional investments are slow to catch on, but are still expected to be the catalyst to a very bright future.

02-22-2026

02-22-2026