|

Getting your Trinity Audio player ready...

|

A prominent BTC developer, Luke Dashjr, was recently hacked, and his PGP key was compromised. Subsequently, over $3 million worth of BTC was stolen from his wallets.

What happened to Luke Dashjr and his BTC?

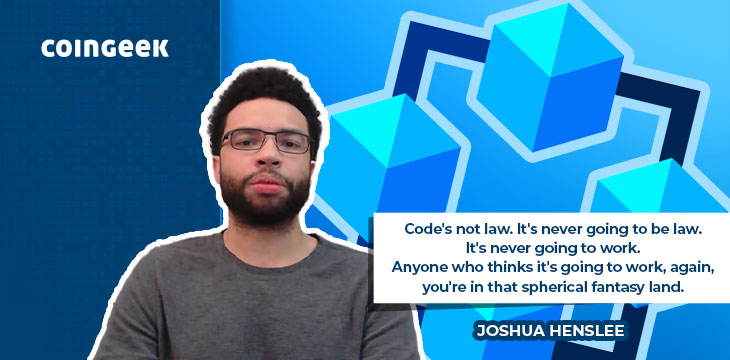

Henslee begins by pointing out that he and other BSVers have been saying for a long time that a world in which you can simply have your coins stolen with no recourse to justice is not a desirable world to live in. A world in which the best hacker becomes the richest person is crazy, he says.

“It looks bad,” Henslee says. If this can happen to one of the supposed best Bitcoin developers in the world, what chance does the common man have? Henslee wonders how this ends; does this developer just lose his coins? Is that how this system works? If so, the system will not work and will not see global adoption.

What’s the logical conclusion to all of this? It’s courts moving coins after ownership has been legally proven, Henslee says. “I don’t care what anybody says. The original software supported it, and the reality is this is going to happen,” he says.

This scenario lays waste to the ‘code is law’ scenario. The fact that Luke Dashjr tagged the Federal Bureau of Investigation (FBI) in a tweet pleading for help has already exposed the hypocrisy behind this narrative. Henslee is sympathetic and hopes he gets his money back despite not liking BTC Core developers on a personal level.

What the heck @FBI @ic3 why can't I reach anyone???

— Luke Dashjr (@LukeDashjr) January 1, 2023

Coin recovery and the collapse of the ‘crypto’ narrative

Henslee understands the fear surrounding the notion that governments can send letters to node operators telling them to change software and reassign coins. He calls this a “valid fear.” He speculates that this occurrence will collapse the entire crypto industry narrative.

One of the main arguments against recovering coins is that the costs of coordinating with all the nodes would be too high. However, Henslee points out that when the dollar amount is high enough, it starts to make more economic sense.

They will tell you that hash power can move around which is vaguely and marginally true.

— Kurt Wuckert Jr (@kurtwuckertjr) December 28, 2022

Home hashers can switch.

But most global hash power is industrial size and under contract with their pool of choice. More still are parent or sub entities of Foundry & Antpool themselves. pic.twitter.com/iCAxy7latE

If digital currencies are to be used as money, as Satoshi Nakamoto intended, then coin recovery will need to be possible on some level. Henslee points out that the lie of ‘decentralization’ prevents this, but in reality, that’s a myth, and only a few mining nodes control the BTC network. Given how much these large miners have invested, Henslee predicts they will follow court orders, forcing medium-sized miners to follow suit.

Key takeaways from this video

- BTC Core developer Luke Dashjr recently lost approximately $3 million worth of BTC after being hacked.

- This looks terrible, showing those who would potentially use digital currencies like BTC at a scale that there’s no way to recover their funds if they are stolen.

- However, Henslee notes that there is a way—to coordinate with nodes but admitting this doesn’t fit the BTC narrative.

He believes that the cracks in the ‘not your keys, not your coins’ narrative are already showing, and an event will eventually occur that lays waste to this harmful myth, showing that coins can be recovered.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

03-01-2026

03-01-2026