|

Getting your Trinity Audio player ready...

|

The question of who is behind the demand for the digital currency industry’s largest stablecoin by market cap (USDT) has always been unanswered; until now.

This week, Protos Media released a report detailing exactly who is buying USDT. Pointing out that Tether has grown from a market cap of $1 billion in 2017 to over $70 billion at the time of writing, Protos’ report concluded a multi-month investigation and pinpointed where over 70% of all USDT goes and to whom. The highly detailed report tracked movements of USDT across eight blockchains including, Ethereum, Omni, Liquid, Tron, Simple Ledger Protocol, EOS, Solana, and Algorand.

What does the report reveal, and what does it mean for the digital currency industry? Let’s look closer.

Key takeaways from the Protos Media Tether report

The key findings of the Tether report can be summarized as follows:

- Tether issued $108.5 billion USDT and received $32.7 billion between 2014 and today.

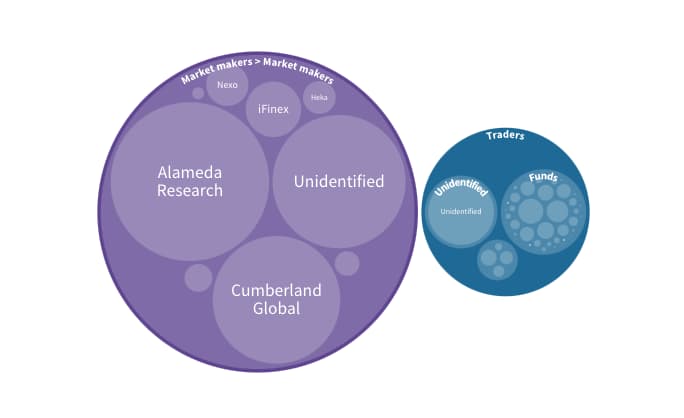

- The majority of this was sent to market makers and liquidity providers such as Cumberland Global and Alameda Research.

- 89.2% of funds went to market makers, 8.5% went to trading firms, and 2.3% went to individual traders.

Breaking down exactly who received USDT and in what quantities, Protos found that:

- Alameda Research, the brainchild of billionaire Sam Bankman-Fried, received almost $36.7 billion.

- $23.7 billion went to market-maker Cumberland Global. This firm provides liquidity to various exchanges.

- At least $4.5 billion went to iFinex, the parent company of both Tether and the digital asset exchange Bitfinex.

- $2.6 billion went to Nexo, a major player in the decentralized finance ecosystem.

- More than $1.5 billion went to Heka, a market maker operated by several academics mentioned in the recently released Paradise Papers.

- At least $1.1 billion went to Jump Crypto, the firm behind the popular DEX called Serum which is operated on Solana.

- Three Arrows Capital received a minimum of $674 million. This is a trading firm run by popular digital currency traders Su Zhu and Kyle Davies.

- About $908 million went to Delchain, a firm owned by Tether’s primary banking partner Deltec Bank and Trust.

- $881 million went to Blockchain Access, the firm behind Blockchain.com.

- Another $200 million went to RenRenBit, a Singapore-based firm that serviced Chinese exchanges.

- Shillong’s Web, a firm that appears to handle Tether for various trading desks but could not be located at its reported address by Protos Media reporters, received $595 million in Tether.

- Christopher Harborne, better known as the Brexit bankroller, received more than $70 million in USDT under his Thai name in 2019.

- $50 million was sent to Justin Sun, the infamous promoter of Tron, directly to his Binance account.

Warning: almost the entire digital currency industry depends on Tether

While the numbers divulged in Protos’ report make for fascinating reading, albeit not implying anything illegal, intelligent readers will come to a startling conclusion; almost the entire digital currency industry is backed by a stablecoin whose issuer has never proven it is fully backed, refuses to submit to an audit by a legitimate accounting firm, has been caught lying about massive losses for which it was subsequently banned from New York state, and that will not reveal what commercial paper it allegedly holds to back USDT.

Not only this, but vast amounts of Tether were issued directly to parties who benefit from the astronomical rise in certain digital currency prices. For example, Alameda Research participated in Solana’s $314 million token sales and has since received $36.7 billion in Tether as Solana has risen from an unknown token to a top five digital currency. At the very least, this should raise questions.

Digital currency traders should also wonder what would happen to digital currency prices if Tether does turn out to be one of the world’s biggest frauds? Certain commentators attempt to spin this potential revelation as positive for digital currency prices as traders would sell their USDT for other coins, but who would be willing to accept them on the other side of the trade? In reality, liquidity across all major exchanges would evaporate in minutes.

Of course, while Tether has been proven to lie before, it could turn out that there are perfectly legitimate reasons for its cloak and dagger approach and its hiding in the shadows. Until then, digital currency traders should be cautious about keeping any funds in Tether and should consider using alternative trading pairs. As the Protos’ Tether report shows, a few large players control the vast majority of the USDT in circulation, and not only would it be extremely difficult to out-trade them given their practically unlimited bankrolls, but if Tether does fail, some of the industry’s largest companies could be gone overnight.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—a from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple and

Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

02-24-2026

02-24-2026