|

Getting your Trinity Audio player ready...

|

Central bank digital currencies (CBDCs) are a divisive topic, but whether you love or hate them, they’re rapidly becoming a reality.

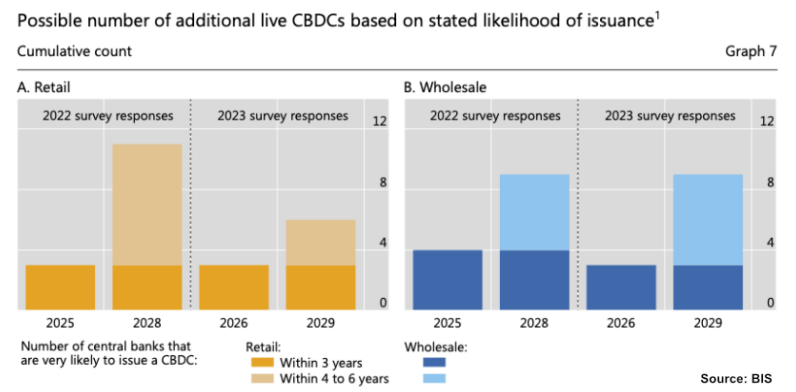

A new report by the Bank for International Settlements (BIS) shows that the number of central banks exploring CBDCs increased from 93% in 2022 to 94% in 2023. The same survey showed a sharp increase in CBDC pilot programs since last year.

While the number of retail CBDCs issued by 2029 is set to decrease, it’s full steam ahead regarding wholesale CBDCs. For the latter, the top priorities are interoperability with domestic payments, programmable payments, programmable money and interoperability with other CBDCs, according to the BIS report.

mBridge cross-border CBDC platform is progressing

While most central banks are now exploring CBDCs and testing how they might work, the BIS Innovation Hub has moved the mBridge cross-border payments platform into the Minimum Viable Product (MVP) stage.

A test transaction between China and the United Arab Emirates was completed in January, and the central banks of China, Hong Kong, Thailand, the UAE and Saudi Arabia are already on board.

mBridge uses a private-permissioned blockchain with each participating central bank running nodes and validating transactions. It allows for instant settlement between central banks in their respective CBDCs, whereas today, it can take several days and multiple intermediaries before settlement occurs.

Are CBDCs good or bad?

Like most technology, they’re a double-edged sword. They’re also multi-faceted, having financial, political and technological implications.

On the positive side, CBDCs will enable programmable money, meaning welfare payments can be programmed so they can only be spent and used for their intended purpose. They’ll also usher in greater financial transparency, making it easier for law enforcement to detect and clamp down on crime.

The negatives of CBDCs can’t be ignored, though. Liberty advocates worry about financial surveillance straight out of 1984, the ability for governments to freeze wallets and confiscate funds of dissidents and political rivals, and the general loss of privacy that comes with using paper money and coins.

Central banks have noted the public’s concerns about CBDCs and tried to reassure them. The German Bundesbank recently clarified that CBDCs would protect citizens’ privacy and would not replace other payment methods, such as credit cards and cash. However, CBDC critics are still skeptical.

An alternative ‘middle way’

CBDCs aren’t a problem in and of themselves; it’s the central bank-controlled ledgers they will run on that spook people. Central banks running the nodes will give them virtually unchecked power.

Since CBDCs seem inevitable, a proposed middle way is to issue them on scalable public blockchains like BSV. Being a proof-of-work (PoW) blockchain, no group of central banks could have complete control of the network. Other nodes run by private interests could ‘veto’ any moves viewed as illegal, and network rules balancing the needs of both CBDC issuers and users could be agreed on and enforced by all.

Since nodes on PoW blockchains require vast quantities of electricity, it’s impossible for them to remain anonymous. Everyone could verify who is running the nodes, and thus, they would be both subject to legal orders in their jurisdictions (e.g., they could freeze funds in cases of actual crime) while everyone could verify who they are, meaning entities like North Korea or the Central Intelligence Agency (CIA) could not take over the network using Sybil attacks.

Issuing CBDCs on a scalable utility blockchain like BSV is the middle way—all of the efficiency and transparency of peer-to-peer payments with instant settlement can be realized, while at the same time, concerns about government control and loss of privacy can be assuaged.

Then again, perhaps that’s not what the powers want. It’s up to the people to petition them and convince them that CBDCs are only acceptable if the ledgers they run on are distributed and out of the control of any single or tightly-knit group of entities. It’s all about trust, and BSV was designed to enable that.

Other advantages of CBDCS on a public ledger

Greater privacy and no central control are two of the benefits of public blockchains. Yet, there are other advantages that both CBDC critics and components could benefit from.

Chief among these is interoperability between CBDCs and apps. In a permissionless system, CBDCs could be used in all the applications built on the ledger they run on, provided the app creators design them to be compatible. Think CBDCs on a closed intranet network versus on the top internet.

Suddenly, CBDCs become useful for much more than just P2P payments between central banks and cash transactions between people in the real world. On a public, scalable blockchain, they could be used in games, social media platforms, communication apps, decentralized finance (DeFi) and other blockchain-based applications. From micropayments worth fractions of a cent to large settlements, CBDCs would suddenly have innumerable use cases.

For this to be possible, they must run on a scalable, permissionless, PoW ledger that anyone can build on. The first major CBDC to make that decision will likely gain adoption quickly and thus win the race to be the CBDC of the future.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: CBDCs are more than just digital money

03-09-2026

03-09-2026