|

Getting your Trinity Audio player ready...

|

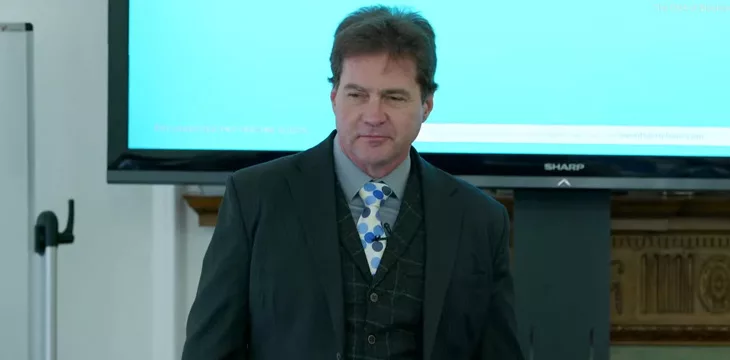

Smart contracts are not a new idea! As Dr. Craig S. Wright points out in the latest installment of the Bitcoin Masterclasses workshops, automating business processes through digitization has been around for decades now. But how well has it been done? Not very. Can it be done better using a scalable blockchain? Absolutely.

You can view the first session and the entire first day of the latest Masterclass series here, and watch any previous Bitcoin Masterclass sessions on the CoinGeek YouTube channel.

Dr. Wright begins by asking how much everyone understands about EDI (Electronic Data Interchange), a set of business/logistics-focused electronic communications standards that first developed in the late 1940s for the military. However, it didn’t really see commercial implementation until the 1970s.

I thought we were already digital

In today’s world it’s easy to assume the entire global economy is digitized—along with most other important records. However, this often isn’t the case. Dr. Wright gives the examples of shipping documents, including Bills of Lading, which are still mostly paper-based. They are also traded as physical goods on localized exchanges like the CME.

Even examples that were ahead of the digitization curve (for their time), such as the U.S. Army, use archaic forms of digital documentation. An estimated US$6 trillion in global trade happens through that institution per year, in a clunky combination of fax-to-TCP, converted Excel spreadsheets, and streaming TIFFs. These are very error-prone and insecure, with their “digital signatures” based on CRCs (cyclic redundancy checks) and a code.

What we need is some form of attestation to verify that certain processes and transfers have actually taken place, even if the transaction itself involves physical items. Even this is often done in improvised ways, like regular email or phone calls. We need a better form of evidence, and although courts have accepted un-secure emails as evidence, there have certainly been cases where attackers have intercepted communications to send false approval emails (one early blockchain industry example was a fraudulent email attack on BitPay and former CEO Tony Gallippi in December 2014).

We have bar codes, QR codes, RFID tags, various systems to exchange electronic data within a business or government process. A scalable blockchain can standardize these processes and make them far more efficient, as well as easier to learn. Its single source-ledger of truth can avoid duplication or incompatible standards.

Defining what we’re sending

Dr. Wright notes that any EDI document can form a (legally recognized) contract if there’s a “master contract,” where all parties agree to a set of rules and definitions, and methods of dispute resolution, before starting the rest of the process.

We have purchase orders, invoices, and other commercial documents. How can we make these better using a blockchain? How can you have that data in a format that can also be accessed by external parties (with approval), local tax authorities, accountants and auditors.

He whiteboards a simple template structure for such things, which can take information from different sources and gather them in one place, giving Bitcoin Script examples. These include methods for attestation and authentication, including signed fields and methods to verify them. The Bitcoin network handles the verification and the blockchain provides a permanent, auditable record.

These contracts can be made complex and more flexible, taking into account variables like world events and political shifts, natural disasters, weather, changes in price and availability of goods over long periods of time. Markets can emerge to trade on the differences in these variables, losses and risks can be minimized, and valuable marketing lessons can be learned (e.g., why do some supermarkets put beer next to the baby goods section?)

Putting all this information in a central (yet decentralized!) place creates efficiency advantages and new commercial opportunities, by creating the ability to access and cross-reference data. There are efficiency improvements to be found in both physical goods and prices, and blockchain development opportunities in building these systems.

Technically, all it takes is know-how and creativity. Perhaps getting that first “master contract” agreement with the commercial world will be the most difficult part—though increased awareness of blockchain and its potential real-life applications (other than coin trading), and more appreciation of its data-verifying capabilities, will advance the cause a lot.

“Wouldn’t that be better than Boring Apes?” Dr. Wright asks.

Watch The Bitcoin Masterclasses #4 in London highlights: nLocktime & delayed transactions

02-25-2026

02-25-2026