|

Getting your Trinity Audio player ready...

|

JPMorgan analysts have drawn the wrong conclusion in a recent report issued to their clients stating that BTC is likely to survive in the future even as a speculative asset. Unfortunately, the analysts do not realize they are not talking about the original Bitcoin. While it might “exist” in the future, no one will be using it and its token will be practically worthless.

The report stated that whilst surviving in tough economic conditions that 2020 has brought so far with the coronavirus pandemic, the BTC token “price action points to their continued use more as a vehicle for speculation than medium of exchange or store of value.”

Whilst BTC diverged away from the design outlined in the original whitepaper it has been reduced to a single use case being a speculative asset only. The original version of Bitcoin that has survived through the ticker symbol BSV was built to be scalable enough to handle the entire economy and internet of things being stored on one single globally distributed blockchain.

Bitcoin either functions as electronic cash, or it is useless

You don’t need to go as far as to read the entire whitepaper to determine what Satoshi Nakamoto envisioned Bitcoin to be. All you need to do is take a look at the introduction e-mail he wrote on the cryptography mailing list that explains in laymen terms that it is an electronic cash system primarily. This means the value of the system as a whole is derived from being a means of exchange, which will also make it a store of value.

Nearly 12 years on Wall Street is touting labels like ‘speculative’ because of the total lack of utility for BTC. Also, BTC has lacked significant adoption since it was created due to the protocol’s limited block sizes. The harm the BTC protocol developers did to Satoshi’s creation will be clear for all to see in massive ways as we head into the 2024 halving event. Ironically, the very feature that is championed by misinformed Core developers and their followers (small block sizes) has guaranteed it will not have a future. The BTC protocol developers have purposely acted as central planners to limit the growth of Bitcoin as a payments system.

The speculative narrative looks even more ridiculous as the world becomes more connected, BTC is more like a digital Dow Jones tracking the performance of stocks currently. But once Bitcoin SV starts really ramping up adoption, the days will be numbered for BTC speculators. There is no greater micropayments network ever invented other than the Bitcoin SV (BSV) protocol, which has proven already to be able to successfully scale on-chain. The block size capacity on BSV is unbounded and the transactions on the protocol cost a fraction of the price vs traditional payment systems like Visa and PayPal. Educated investors prefer to speculate on something that is real, not smoke and mirrors.

I remember when bitcoin was going to replace PayPal and Western Union.

Now small blockers are begging PayPal to pump their bags and Western Union is a cheaper, faster way to send money around the world than BTC.

🔥😂🔥😂🔥😂🔥 https://t.co/BuRbxGgCZE

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) June 23, 2020

BTC has not aspired for the same accolades as Bitcoin SV, you can barely spend BTC anywhere. Entrepreneurs cannot build a business that harnesses the power that a distributed blockchain provide on the BTC protocol due to its complete lack of scalability with a maximum throughput capacity of 7 transactions per second. It’s too slow to move money around with the removal of instant confirmation transactions and much more expensive than traditional payment methods for use in commerce.

Bitcoin has been co-opted by the same entities who are threatened by it

Looking at the ‘what’ without the ‘how’ leads to the assertation that the report by JPMorgan analysts is misleading to the public.

The report is correct in saying that so far BTC has managed to survive holding its price in terms of fiat valuation during uncertain economic periods in 2020 under no real basis other than speculation.

However, not looking at how this happened and stating that it is likely to continue in the future is deceptive as it sends the wrong message to their investor clients. Building nothing of value cannot generate value in the future except in fantasy land, but we all live in the real world.

The speculation thesis that Wall Street is pushing is conveniently timed rhetoric at best. It is also an attempt to neutralize the development and activity in the space, something those in the traditional banking space currently fear for some reason. The ‘speculative’ narrative allows these threatened entities to buy some more time, to develop in house solutions like JPM Coin or to simply allow more time to tightly claw onto existing legacy models if it means keeping control for a little bit longer. They also need retail muppets to dump their BTC stash too and reports like this garner that sort of interest.

There has been trouble for those trying to find a way to stop the original Bitcoin technology from succeeding. Attempts have been occurring through various means like social engineering attacks, 51% mining attacks, delisting attacks, even forking and hijacking the ‘BTC’ network and ticker. This has proven to be unsuccessful as the original Bitcoin protocol has managed to be preserved and continue to thrive under the ticker BSV.

It appears the most successful attempt to stop Bitcoin has been to co-opt the Bitcoin brand, network and industry as a whole by crippling development, discouraging use of it and at the same time artificially pumping the price of BTC. Keeping all the current BTC participants pacified for now only buys these actors a little more time.

The inventor, Dr. Craig Wright owns copyright and other Bitcoin related IP. He has signaled that he is about to start enforcing his rights in court and this will be the start of a death spiral for BTC as it will educate the world that the token is illegally using the Bitcoin name and possibly other things such as its historical database. Unlike in previous years, this is a real issue now for those pretending their token is Bitcoin.

A hedge against hyperinflation does not benefit the ‘miners’ long-term

Block reward mining will continue to be slightly profitable in the short term for the biggest companies still in the space whilst insiders continue to artificially pump the price via Tether (USDT). Collusion is happening between criminal exchanges (bucket shops) that keep the BTC price artificially higher than it should be to fuel the fallacy that the token will be priced much more higher in the future. The rest of the crypto media help pump the price with daily columns from so called experts calling for the BTC token to be worth 50k, 100k, 1m per token in a year or two. It might be profitable enough to continue this trick to keep BTC in the speculative asset game, but it cannot survive much longer.

This only serves to kick the can down the road a little further.

If we are truly serious about Bitcoin becoming the global ledger of everything, it will exist in a world where everything is either priced in or pegged to satoshis (smallest unit of Bitcoin) which is what the miners and transaction processors earn to secure the network.

The price valuation that we see today in fiat terms is merely a temporary representation of the value of Bitcoin in this co-existence period. A hedge against hyperinflation in the short term still does not sustain processors’ long term as it doesn’t represent what a world of Bitcoin looks like when the true value will be represented in satoshis.

The economic model that both BSV and BTC share is what incentives the transaction processors to keep the network secure. It has a brutal depreciation schedule of the block reward revenue, but designed in a way that if on-chain transaction fees can replace the fixed diminishing subsidy then Bitcoin will realize its potential. It will also mean that Bitcoin as BSV will be able to sustain itself for centuries to come.

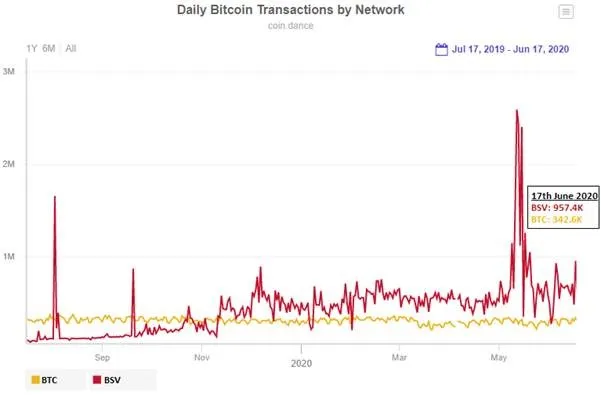

Looking at the trajectory of transactions over the past 12 months, Bitcoin SV is thinking about survival through utilization of the ledger. The BSV Node Team’s approach to unbound scaling Bitcoin in the last several months as insured increase adoption on-chain. Removing the block size limit and restoring the Bitcoin script language has opened the blockchain up for anyone to use it without permission so we will all see the true potential of what Bitcoin can really become by following this chart.

Source: CoinDance

The BTC network has reached full capacity with the block size limited capped at 1 megabyte (max 7 transactions per second) and off chain solutions like Lightning Network will only accelerate a chain death scenario.

When the manipulation of the fiat price can no longer be sustained, there will not be enough volume on the network for BTC to subsidise the lost revenue from the fixed subsidy.

When the focus moves to utility over speculation, the value will be actualized in reality

There won’t be enough doorways available for those stuck in BTC to accommodate all the people trying to head to the exits at once as is the case with all Ponzi schemes that have no utility.

Manipulation will always exist across all investment classes, however there will always come a boiling point where all value seekers will have to retreat towards utility.

Whether this happens sooner or later is irrelevant, all roads lead to BSV. Regardless of what you think of Bitcoin SV, one thing is certain. BTC has eliminated itself from the future a few years ago when they introduced Segregated Witness to its protocol.

The minority will continue to focus on building and creating value on Bitcoin SV (BSV) to entice the majority.

When successful, the majority will have no other choice but to flock over. This includes miners, entrepreneurs looking to build utilizing the power of a distributed blockchain that infinitely scales, users looking to earn and spend in the new digital economy, and yes even the very same entities that are threatened by Bitcoin today.

07-04-2025

07-04-2025