|

Getting your Trinity Audio player ready...

|

https://www.youtube.com/watch?v=QCI1f2b2SI0

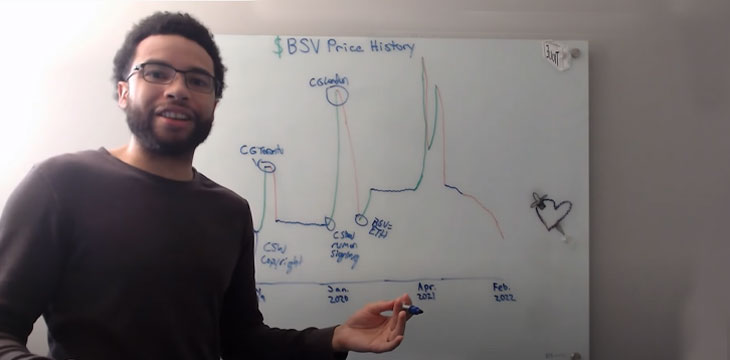

Joshua Henslee has recently released lots of great content related to the BSV ecosystem. He recently put out a video discussing the entire price history of BSV, going all the way back to November 2018. We’ve provided a written summary of Henslee’s new video below, but you can watch it directly on Henslee’s Youtube account if you prefer.

Henslee covered:

- The BCH/BSV fork

- The price movement since then and what drove them

- What we can expect moving forward for the rest of this decade

A timeline of BSV’s price history

Henslee remembered that BSV has pre-fork trading on Poloniex. This drove the BSV token price up to around $200. However, after the split, the price dropped back down to around $50.

The next major price move for BSV was when Dr. Craig Wright filed his Bitcoin white paper copyright claim in the United States. The BSV token pumped more than 100% in a single day due to this. Henslee credits this event with changing the momentum of BSV and the morale of many people involved in it.

Shortly after that, CoinGeek Toronto happened, and the BSV pump continued to around $235. Henslee recalled that he and his fellow BSVers were ecstatic at this point. This entire pump was decoupled from the rest of the digital assets in the space.

However, the price soon dropped again. Such is the rollercoaster of digital assets. Henslee dismissed this as market noise. Eventually, the price bottomed out at around $80 or so before January 2020.

In January 2020, right before CoinGeek London, BSV pumped to $415. This was an all-time high. This price pump took BSV to number four on CoinMarketCap and caused a huge wave of excitement for BSVers. It also passed BCH, the only time BSV has done that so far. Henslee recalled that even legacy financial funds investing in the space sat up and paid attention during this pump.

This huge pump was caused by a rumor on Chinese social media that Dr. Craig Wright had signed the Genesis block. Henslee remembered massive optimism in BSV during the CoinGeek London Conference. There was a real sense of optimism as the ‘Return to Genesis’ happened.

However, in March 2020, the world entered a panic, and everything dumped hard. Stocks crashed, digital currencies tanked, and BSV did not escape unscathed. It ended up roughly back where it had started before the huge pump surrounding the false rumor that Dr. Craig Wright had signed the Genesis block. At the bottom, BSV and ETH were roughly equal in terms of price.

For the rest of 2020, BSV recovered slightly then hovered around $170. However, in April 2021, it took off like a rocket as digital currency FOMO gripped the world. BSV hit an all-time high at $500 along with many other digital currencies. It drew back, pumped back to $400 or so, and then another huge price dump occurred along with the rest of the market. At the peak of this pump, Henslee noticed that BSV experienced the second-highest volume ever recorded.

After this huge market dump, Henslee noted that many people closed their BSV short positions. However, we’ve been on a market down-trend even with that, and BSV has been edging lower. This has been demoralizing for many in the BSV ecosystem as BTC, ETH, and some other coins hit new all-time highs as BSV kept sinking lower.

A question about why BSV hasn’t moved with the rest of the market recently

These observations lead Henslee to a question. Why did BSV hit an all-time high of $500 when BTC hit around $50,000 back in April 2021, but why didn’t BSV move much after the most recent dump and the closure of many BSV short positions?

Henslee believes there’s an apparent reason for this. In the summer of 2020, we saw various attacks on BSV. Double spend attacks, illegal reorg attacks, and all of the negative reporting across the ecosystem’s various media outlets happened in quick succession.

Henslee said he believes these attacks were much more damaging even than the delisting of BSV on exchanges like Binance. He noted a severe lack of volume since these attacks. Even when Dr. Craig Wright won his court case against Ira Kleiman, BSV only pumped 30%, and it was short-lived.

Some key takeaways

Stopping to review all of this, Henslee spoke of some key takeaways.

- BSV has never traded on its fundamentals. This is despite having the biggest blocks, highest transaction count, and fees making up an ever-greater percentage of block rewards. Henslee said that BSV’s fundamentals are the strongest they have ever been right now.

- Dr. Wright is a major factor in BSV’s price pumps. Looking back over the history of BSV price action, Henslee noticed that the major price pumps were linked to Dr. Wright’s copyright filing, the false rumors of his signing the genesis block, and his recent court victory.

- Henslee thinks the digital currency market is wrong. He noted that it looks as if the market has written BSV off. While the market largely sees BSV as “a scam coin made to fulfill the desires of a madman,” Henslee strongly disagrees with this analysis. Knowing what’s being built on BSV, he believes the market has got this one wrong.

Watch: CoinGeek New York panel, Blockchain: The Future of Technology Building on Achievements of the Past

https://www.youtube.com/watch?v=lK8-86QLmIs

02-26-2026

02-26-2026