|

Getting your Trinity Audio player ready...

|

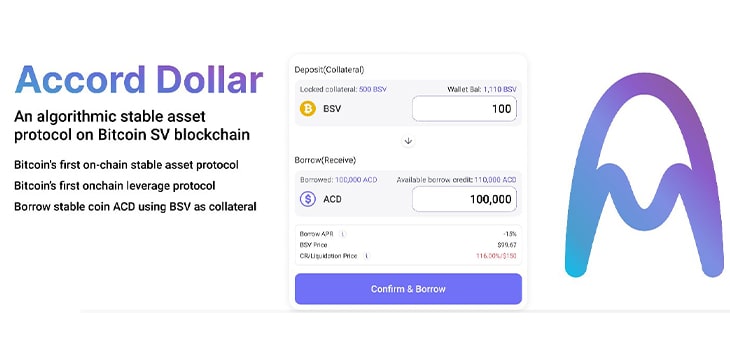

The Accord Dollar (ACD) is Bitcoin SV’s first decentralized stablecoin to launch on the network. On the Accord Money platform, users can take out BSV collateralized Accord Dollar loans, earn AMT, the utility token that powers the Accord Money platform, liquidate undercollateralized positions to earn revenue, as well as repay and redeem personal loans.

Accord Money is launching on mainnet today. AMT release will follow in a few days

— Accord Money (@AccordMoney) April 19, 2022

Unlike a majority of the stablecoins that exist across blockchain networks, the Accord Dollar is a digital currency-collateralized vehicle backed by BSV.

“It is an onchain collateral based stablecoin protocol running on BSV blockchain using BSV as collateral. It is the MakerDAO of BSV, except it is built on Bitcoin with sCrypt smart contract technology,” said the Accord Money team.

“We decided to launch a decentralized stablecoin for two major reasons: efficiency and legal concerns. We don’t have the resources to build another USDT, it wouldn’t work even if we had the financial and legal resources to build another USDT. But by using sCrypt, we’ve empowered end-users and have made it possible for the Accord Dollar to take off without significant amounts of initial capital input from our team,” the team added.

Because Accord Money is decentralized, its success relies on the project being bootstrapped by its users and integrated into apps and services rather than it being backed by a venture capital firm or investor with a big bankroll.

As of press time, 702,867.51 ACD are in circulation via Accord Money, and the platform has a Total Value Locked of 18,809.88 BSV ($1,512,238.80)

How Does Accord Money work?

Accord Money allows users to take out BSV-based collateralized debt positions, a type of loan that gets its value from the underlying asset(s) it is backed by, in this case, BSV.

The Accord Dollar keeps its $1 peg by algorithmically buying back ACD and exchanging it for BSV when its price drops below $1 dollar. When the price of the Accord Dollar is above $1, users are incentivized to borrow more, which increases the supply of the Accord Dollar and lowers its price.

A user can take out an Accord Dollar stablecoin loan in any size as long as they post a minimum of 120% collateral to back their position. This means that if you are looking to take out a $100 loan (100 ACD), then you need to post $120 worth of BSV as collateral.

Interest is fixed at 15% annually, and it accrues over time, which means that when you go to pay back your loan 365 days after you take it out, you will have to pay an interest amount of $15 in addition to the principal $100 loan you took out for a total of $115.

Where does the interest go?

The interest and fees that the platform captures when users take out loans, redeem loans, and get liquidated by others fuels the AMT utility token.

“All value captured will be distributed to AMT holders through a staking program we are building. AMT currently incentivizes early borrowers to create liquidity for ACD and it serves as a value capture token for Accord Money stakeholders,” revealed the Accord Money team.

As of press time, 139 AMT is proportionally distributed to ACD owners in relation to the amount of ACD they hold. These AMT rewards incentivize the growth of Accord Money by giving early Accord Dollar adopters the chance to earn passive income in return for providing liquidity.

Redeem, Repay, and Liquidation

There are two ways that your loan can be closed on Accord Money:

- you can repay your loan + interest, and

- if your collateralization amount dips below 120%, another user on the platform can liquidate you to earn profit. Liquidated losses are capped at 115% for the borrower.

If you repay your loan, you get your BSV collateral back. If your collateral dips below 120% and you are liquidated, the liquidated borrower can receive a fraction of their collateral back (the amount of collateral left between the percentage the loan was liquidated at and the 115% cap).

The Accord Money platform also has a feature that allows you to Redeem your ACD for BSV and has plans to add a “bond” feature in the future that will enable users to buy a limited amount of AMT at a discount price.

What are stablecoins good for?

Stablecoins are crucial tools that offer digital asset owners shelter from volatile markets. A stablecoin can lead to the creation of apps, services, and opportunities that were not possible in the past. Through Accord Money and Tswap.io, a digital asset owner can ultimately convert their BSV into ACD and Tether (USDT) to access the broader bitcoin economy and financial markets.

Although the focus is very finance-centric at the moment, the Accord Money team believes there will be more use cases for both the Accord Dollar and Accord Money as more apps are being built on BSV.

Watch: CoinGeek New York panel, Investing in Blockchain Ventures

https://www.youtube.com/watch?v=SdWurEo58ok

02-17-2026

02-17-2026