|

Getting your Trinity Audio player ready...

|

We’ve talked about using nLocktime in Bitcoin payment channels, but how do we start ordering all these things? “We have to think a little bit differently than the typical cypherpunk stuff,” Dr. Craig Wright answered.

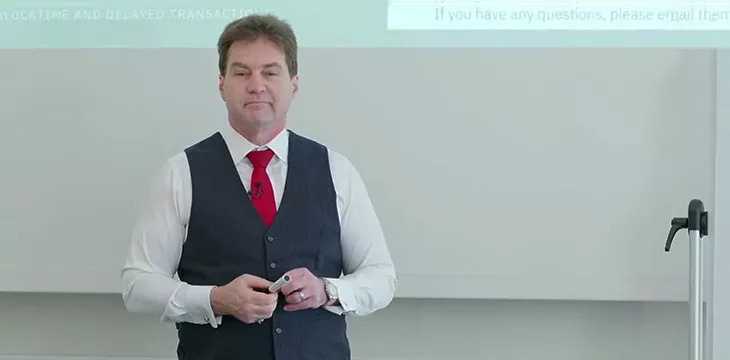

Dr. Wright gave a “path-based sessions” tutorial to kick off Day 2 of the latest The Bitcoin Masterclasses series in London last week.

“We don’t want to start thinking all intermediaries are bad,” Dr. Wright says. His Bitcoin white paper discusses eliminating the need for trusted third parties in small everyday payments, but other intermediaries still have points and purposes. That’s especially true when constructing complex payments with locked times, fees, and automation to consider.

We could have one such intermediary that “functions as a miner” but manages locked and timed transactions, ensuring ordered transactions get to the network at the right times. Dr. Wright draws a diagram of a “very simple perceptron,” where different addresses are effectively inputs in a state machine.

“An address is not what people think. It’s a template.” Bitcoin public keys are just one use for them, and Dr. Wright expected others to explore more. (Trivia: the “1” at the start of many Bitcoin public keys is a reference to “template type one.”)

Do whatever you want before the transaction is finalized

We can have multiple potential inputs and multiple potential outputs, and any of these can be changed before nLocktime expires and a finalized transaction goes to the blockchain. A series of linked payment channels can communicate with each other in ways that determine the final (recorded) outcome. We can outsource many of these functions to the market, i.e., third-party providers who develop optimized solutions.

“Other than chatbots, this is a real use for A.I. This is something that has real-world value,” Dr. Wright pointed out.

So, we have these third-party intermediaries figuring out which transactions to send to miners. How do you ensure they (and the miners) are all being honest with each other and processing the right payments? Dr. Wright also makes a short trip to the world of incentives, saying the rules of competition tend to favor honesty, as everyone in an industry is incentivized to identify wrongdoing amongst their competitors—in the hope of knocking them out of competition.

One example he gives is a hypothetical world where all tickets—concert or airline seats—could be tokenized. Tickets unsold just before an event or flight could be offered in a fire-sale auction. Discounted tickets could come with special conditions or restrictions. Bought tickets could even be “scalped” (ahem, legally re-sold) in a way that still pays a percentage royalty to the original seller. As long as transactions are finally settled, transacting parties are happy, and a profit can still be made, everything’s good.

Once all the steps in a process are in a definite order/sequence, and there’s a means to ensure a transaction is settled, once all the variables in a sequence are sorted out; we can apply them to any area of commerce. Even a global settlement system like SWIFT could be better if banks could account for every payment and the exact order in which it was made.

“You could say ‘this is complex’ – and yes, it is. That’s why we have computers,” Dr. Wright said.

Like Bitcoin, the Masterclasses series is Dr. Wright throwing ideas out there and allowing smart people to devise innovative ways to make money from them. These classes are worth watching for inspiration alone, and there are plenty of next big thing suggestions in every session.

02-27-2026

02-27-2026