|

Getting your Trinity Audio player ready...

|

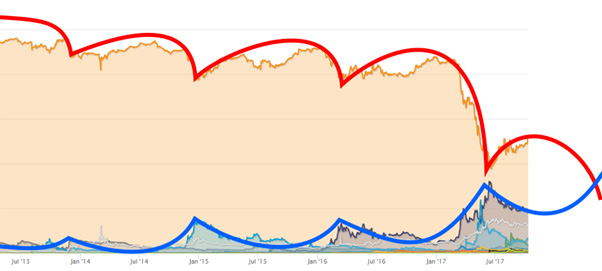

Over time, Bitcoin has been losing significant market share of the global crypto-currency market cap. We’ve noted now, many times that Bitcoin experiences seasonal hype cycles, and reflectingly, altcoins experience the opposite phenomenon.

Every time Bitcoin experiences a dip, a large portion of funds cascade into altcoins. The last dip however, was abnormally painful to swallow. In fact, Distributed server processing system Ethereum had come in within striking distance of taking the mantle, and the crypto-world had almost experienced its first ‘flippening’ – that is, the moment an alt-coin becomes the dominant by market-cap.

While markets go through cycles, the drop Bitcoin experienced in March onwards was peculiar. In fact, it correlates strongly, with a time where Bitcoin fees sky-rocketed, congestion slowed transactions right down, businesses shut down BTC commerce, and the Bitcoin network became highly unreliable to do business with. Bitcoin received bad press – and rightfully so. In fact, Stephen Pair, Co-Founder of BitPay – a dominant merchant service in the Bitcoin world actually tweeted “8MB hard fork on #bitcoin now, test SegWit on litecoin”, in May. Many businesses that wished to remain with Bitcoin, were forced to change their business models, and were compelled to pass fees onto their customers, rather than absorb them as in the past.

To place the disaster into perspective, transacting with Bitcoin 2 years ago, cost no more than 5 cents. Today it costs 3 dollars. And that’s with SegWit activated. Early adopters of Bitcoin are indeed the ones most frustrated, – as they are more than anyone, aware of how well the system can actually work, if it is allowed to grow.

However, Stephen Pair of BitPay, did get his much wanted 8MB hard fork, and it came in the name of Bitcoin Cash. Today Segwit1x represents Bitcoin Core, and will fight for the mantle in what can only be described as the biggest battle for Bitcoin to date. Segwit2x comes with the backing of over 90% of the eco-system’s mining hashpower, and will not be implementing replay protection. If Segwit2x is intended to be an upgrade to Segwit1x, then by all means, replay protection should not be on the cards.

The existence of two SegWit coins can spell trouble. With both fighting over the ‘Bitcoin’ brand name, and both camps having different back-room deals with various exchanges, we can potentially face a very messy outcome. One thing is certain, this is not going to be the clean split that Bitcoin Cash was… Not even close. I certainly don’t see Core backing down from this, not even in the face of impending doom. But by avoiding replay protection, the intention is to keep the Bitcoin eco-system on one chain.

There are many culminating points interest all coming to a head, come November. Ironically, the November hard fork is timing itself to be in line with Bitcoin’s seasonal dips, and if we are consistent on Bitcoin’s declining market share, then a flippening may very well be imminent.

Distributed server processing system Ethereum has threatened before, and may very well do so again. Bitcoin Cash is a dark horse for the time being. It has tremendous potential, technologically, and economically. Its infrastructure may be young, but should the Segwit1x/2x war drag out, we may very well see Bitcoiners move to Satoshi’s envisioned coin. Whatever the outcome, it’s going to make for some prime time viewing.

Eli Afram

@justicemate

02-25-2026

02-25-2026