The European Securities and Markets Authority (ESMA) has released its second consultation paper on the implementation of the EU’s Markets in Crypto-Assets (MiCA) law passed back in June. The release kicks off phase 2 of the ESMA’s MiCA consultation.

MiCA creates a new EU-wide regulatory framework for digital assets, addressing everything from licensing to stablecoin backing. As is typical with so-called ‘level 1’ EU legislation, it leaves the more granular implementations to the European Commission and other EU supervisory authorities (such as ESMA) to work out.

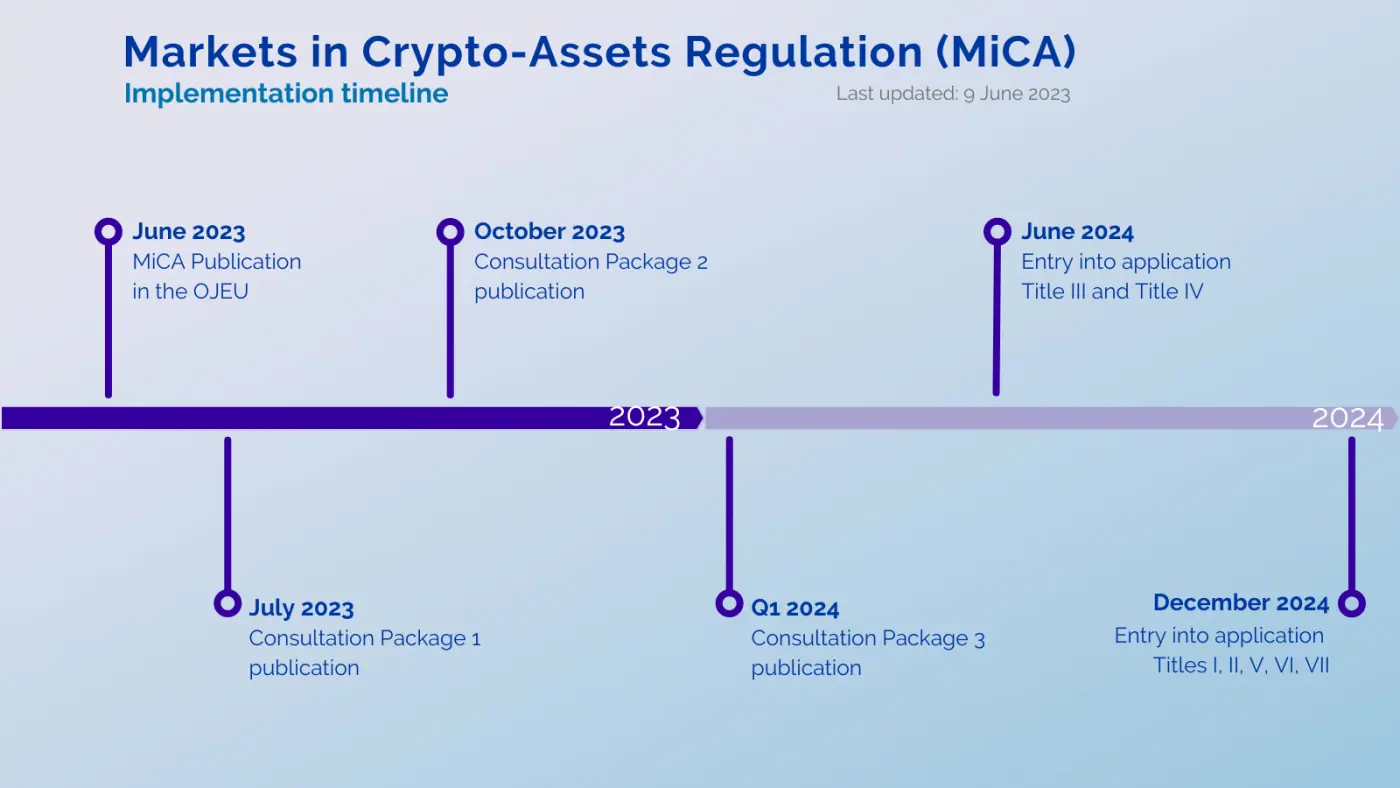

To that end, ESMA kicked off a three-phase consultation period back in June in conjunction with the European Banking Authority, the European Central Bank (ECB) and the European Insurance and Occupational Pensions Authority. The first phase covered implementations such as which information financial entities must report to national regulators regarding companies providing digital asset services.

This staggered approach is consistent with the MiCA framework and its directives, which set out the dates by which specified portions of the MiCA rules will come into force. The entire framework—including the delegated rules designed and implemented by ESMA—is expected to be in force by December 30, 2024.

For the latest consultation phase, launched Thursday, the ESMA is proposing and seeking input on potential rules in five key areas:

Sustainability indicators for distributed ledgers: Under MiCA, ESMA is charged with developing technical standards on the content, methodologies and presentation of environmental and climate information as it relates to digital asset projects. ESMA presents preliminary analysis on this issue, concluding that the sustainability impact of consensus mechanisms can be ‘anchored’ in three main features of DLT network nodes: the energy consumption of each node, their location, and the devices that each node uses to participate in the network.

Disclosures of inside information: ESMA refers to MiCA’s directions as to the disclosure of inside information as one of the ‘pillars’ of the framework’s market integrity provisions. MiCA obliges issuers, offerors and traders to inform the public as soon as possible of inside information that directly concerns them unless such disclosure would prejudice a legitimate interest of the relevant party. Against that background, ESMA compares the new MiCA requirements with the existing obligations under the Market Abuse Regulation (MAR) and proposes a number of disclosure standards that aligns the two regulations, leveraging the experience gained from the MAR.

Technical requirements for white papers: The consultation paper has many references to the standardization of white papers and white papers are considered throughout the document. Specific proposals include making white papers machine-readable and creating a white paper register. This is to give effect to MiCA’s mandate that white papers are “regulated information whose content is prescribed by legislation,” a significant departure from the standard practice of treating white papers as mere marketing documents.

Trade transparency measures: The MiCA framework makes a priority of ensuring that information about trading interests is made available in real time and on a continuous basis. The consultation paper considers both pre-trade and post-trade transparency. For instance, ESMA proposes a requirement that digital asset trading platforms report the following information regarding executed transactions: the date and time, the asset involved, pricing information, the quantity and the venue of execution.

Record-keeping and business continuity requirements for digital asset service providers: MiCA obliges digital asset platforms to keep records of all of their digital asset related services, including all orders and transactions, and be able to present those records to national regulators. The specific records that must be kept are largely left up to ESMA to decide. ESMA’s proposed approach is to provide digital asset providers the flexibility to maintain transaction data in the form they consider most appropriate provided that such information can be converted into a specific format when requested by authorities. ESMA also proposes the use of the Digital Token Identifier, provided by the DTI Foundation, which would ‘unambiguously’ link a digital asset with the ledger it is issued from.

The full paper, including ESMA’s recommendations and points of feedback, can be found here. Feedback on the proposals will be accepted until December 14.

The third and final consultation phase is not expected until Q1 2024. According to the ESMA website, this phase will cover the qualification of digital assets as financial instruments, the monitoring and detection of market abuse, investor protections against reverse solicitation, and system resilience.

From the consultation period, it is expected that a final implementation of MiCA will emerge. ESMA has said that it plans to submit a final paper with the draft technical standards and implementations by June 30, 2024.

Watch: Regulatory frameworks for digital currency in Europe with Yves Mersch

07-08-2025

07-08-2025