|

Getting your Trinity Audio player ready...

|

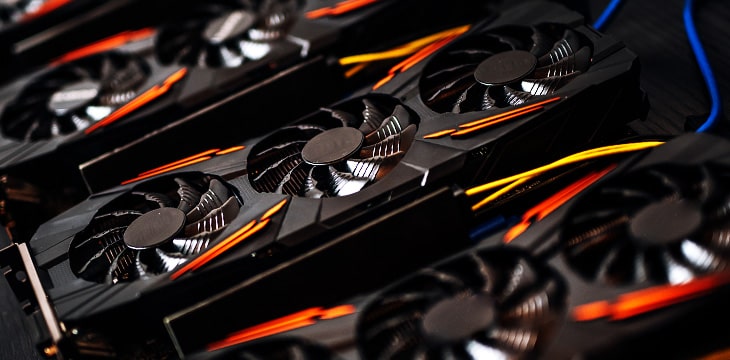

NASDAQ-listed Canaan Creative has released two new ASIC mining rigs, which offer lower hash power compared to its competitors.

The Avalon 1146Pro has a maximum hash rate of 65 TH/s and an energy-efficiency ratio of 52 J/TH, according to Canaan’s website. The Avalon 1166, meanwhile, has a maximum hash rate of 70 TH/s, with an energy-efficiency ratio of 47 J/TH.

The power consumption of the new Avalon rigs is 40% higher than MicroBT’s Whatsminer M30S++ but only has one-third of the M30’s hash power. The M30S series has the lowest power consumption in the market, according to reports.

Canaan continues to struggle

It hasn’t been a good year for Canaan so far. The China-based company has been performing poorly in the United States stock market ever since it went public on Nasdaq in November 2019.

Canaan is currently down more than 75% from its IPO price of $8.99 per share and approached its all-time low of 2.00 per share shortly after it announced its inferior mining machines. $CAN’s downtrend has no signs of letting up anytime soon. Shortly after Canaan’s 180-day lock-up period concluded on May 19, company insiders began to offload their $CAN shares and the stock price declined over 40% in ten days. All around, Canaan looks like a company that is struggling to advance in its industry.

Not even Canaan wants Canaan stock

On May 27, Canaan filed an S-8, a form the U.S. Securities and Exchange Commission (SEC) requires companies to file if they are looking to issue equity to their employees. This shows that Canaan believes their stock is better off in the hands of their employees than in their own hands. It also indicates what Canaan Creative believes is the true value or potential future value of their stock.

If Canaan thought shares of $CAN were going to be worth anything in the future or that the company was making advancements in their mining hardware and technology, they would not be so quick to offer their employees the option to opt into a benefits package that gives them equity in Canaan. But since Canaan has performed so poorly ever since going public, it is not a surprise they are trying to offload shares of company stock on to others.

02-27-2026

02-27-2026