|

Getting your Trinity Audio player ready...

|

The clash between the world’s richest man and his on-again, off-again attempt to buy embattled social media service Twitter (NASDAQ: TWTR), has dominated tech and business headlines alike since April, when Elon Musk made an unsolicited, non-binding offer to purchase the platform for an eye-watering $43 billion and take the microblogging platform private.

The saga has seen several ups and downs, with public derision and childish behavior—predominantly on the behalf of Musk—seen throughout. Despite the deal appearing dead in the water, with the prospect of a lengthy legal battle and gargantuan breakup fee for pulling out, less than 48 hours before Musk was due to be deposed in court as part of a legal maneuver by Twitter to force the deal through, he appears to have once again had a change of heart and is now back on track to acquire the social media behemoth.

But for how long that remains the case is anyone’s guess.

Unsurprisingly, all was not as it appeared from even the fledgling moments of the potential deal, with common sentiment questioning from the outset just how serious the Tesla (NASDAQ: TSLA) and PayPal co-founder was about actually acquiring Twitter. Suggestions of it being little more than yet another publicity stunt from the “overgrown man child” were common fodder prior to the official offer being made, while musings that the entire saga being a convoluted cover story for liquidating a chunk of his personal Tesla holdings without alarming other shareholders and tanking the price (though, if this was the plan, it failed entirely as Tesla stock took a heavy hit the second that Musk’s intentions to buy Twitter became public) were also rife.

But the true schadenfreude may not have actually been on the part of Musk in this entire saga. At least not entirely.

Blockchain technology and the power players in the industry—including those, like Twitter and its founder Jack Dorsey, that strive to become power players—have been a common, if largely unexplored and uncovered, thread throughout the ongoing Musk/Twitter tie-up. But newly released documents reveal just how deep a role they may have played in shaping Musk’s attitudes and thinking towards Twitter and his acquisition of the company—with the billionaire’s musings evidence of a deep interest in leveraging the technology to replace Twitter, before personal texts show an apparent change of heart in response to overtures received from key members, as well as persons purporting to represent them, of the self-installed crypto oligarchy.

On-chain Twitter—a completely new and novel concept…

Wants to build Twetch, buys Twitter instead pic.twitter.com/XNUrBXoc3i

— Rodsirloin @365 (@RodSirloin) October 5, 2022

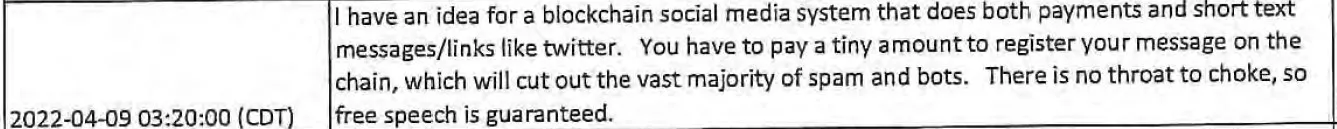

On April 9, the same day that Musk was due to join Twitter’s board—and also the same day that he reportedly acquiesced on this offer—he texted his brother Kimbal Musk, himself a successful entrepreneur, about his idea for a blockchain-based alternative to Twitter.

“I have an idea for a blockchain social media system that does both payments and short messages/links like Twitter,” wrote Musk.

“You have to pay a tiny amount to register your message on the chain, which will cut out the vast majority of spam and bots. There is no throat to choke, so free speech is guaranteed”

Four days later, Musk built on this idea in a message to Steve Davis, President of The Boring Company—a Musk-founded company focused on the development of major infrastructure—primarily tunnel construction—that started life as a subsidiary of another Musk-founded company, SpaceX.

“My Plan B is a blockchain-based version of Twitter, where the ‘tweets’ are embedded in the transaction as comments,” wrote Musk.

“So you’d have to pay maybe 0.1 Doge per comment or repost of that comment.”

As those within the BSV community will be well aware, what Musk is describing here is nothing new—it already exists and is underpinned by the original blockchain technology—not a meme coin that serves no purpose except being a Twitter-fueled speculative instrument. I’m talking, of course, about Twetch.

u should try Twetch @elonmusk

I know @jack has.

— Twetch (@twetchapp) September 30, 2022

For those out of the loop, Twetch is one of—if not the first—examples of a true Web3 social network. Built entirely on the Bitcoin SV blockchain, every action and interaction in an on-chain event—be it posting, sharing, commenting, or liking—with a small fee charged for each action, with the revenue generated split between the user and the platform. All data is saved directly to the blockchain—demonstrating two of the core qualities that have defined Bitcoin since its inception: censorship-resistant information and the ability to carry out microtransactions—as explained by Josh Petty, co-founder and CEO of Twetch.

“When somebody interacts with the information that you post, you’re earning. Using microtransactions, when you post something, it might cost you a penny or two to make that post. But, if somebody likes your post, or they share it or reply to it, they might pay a penny or two to make that interaction, so you’re earning back the pennies you paid to post that initial information,” he said.

“It’s a really simple information market, and the best way that is understood is through a simple interface – like Twitter or like any other social media platform – but it’s built on Bitcoin.”

The fact that Twetch has been live and running now for a number of years, with several million posts and interactions being carried out on its platform—all of which are publicly verifiable on the Bitcoin SV blockchain—makes Musk’s next move, and in particular, the reasoning behind it, all the more confusing.

A confusing about about-face

That’s because just 10 days later, Musk took an entirely different tone from his conversations with his brother and Davis, when responding to a message to Michael Grimes, Head of Global Technology Investment Banking at Morgan Stanley, communicating with Musk as an intermediary representing the founder of “cryptocurrency” exchange (or egregious purveyor of self-enriching Ponzi schemes) FTX, Sam Bankman-Fried, writing:

“Blockchain Twitter isn’t possible. The bandwidth and latency requirements cannot be supported by a peer-to-peer network, unless those ‘peers’ are absolutely gigantic, thus defeating the purpose of a decentralized network.”

Of all the messages from Musk musing about the idea of a blockchain-based Twitter alternative, this one is particularly problematic. Now, with Twetch—which has been live and active on the Bitcoin SV blockchain for several years—we know that the first part is not true. But in and of itself, that may not be the most troubling part of the message, because, at face value, the second part demonstrates a troubling level of misunderstanding around the concept of decentralization, particularly in the context of blockchain technology.

#Watch it here 👇 https://t.co/qY0QJeLrDz

— nChain (@nChainGlobal) September 29, 2022

As Dr. Craig Wright, the creator of Bitcoin and inventor of blockchain technology, recently explained in a TEDx talk, the prevailing message that has been propagandized by BTC bag holders regarding decentralization and the role that nodes play in decentralizing a network are entirely incorrect

“[Decentralization] is not like people say [when referring to] Bitcoin or Ethereum, about a central system running a few nodes, because nodes aren’t what makes Bitcoin decentralized. Nodes aren’t the answer: nodes index. In these systems, they record information. But the exchange [of information] should be decentralized,” Dr. Wright explained.

“Decentralization has been created into something involving technology. It’s not. The term decentralization really refers to bringing things out to the edges. Decentralization isn’t just about having nodes and it isn’t about Silicon Valley controlling everything, it’s about individuals trading and exchanging. It’s about people. Decentralization is about direct exchange – peer-to-peer – between people.”

Had Musk however done his homework, he’d know that this is nothing new—even within the context of Bitcoin and blockchain. Even before Dr. Wright was revealed as the man behind the Satoshi Nakamoto moniker, he explained that the future of Bitcoin would in fact be based around the very “gigantic” nodes Musk sees as incompatible with the concept of blockchain, saying:

“The current system where every user is a network node is not the intended configuration for large scale. That would be like every Usenet user runs their own NNTP server. The design supports letting users just be users. The more burden it is to run a node, the fewer nodes there will be. Those few nodes will be big server farms.”

But for someone with the credentials and technological nous of Elon Musk—not to mention the willingness to explore novel concepts and try things that others say aren’t possible – to not only be dissuaded from his idea so quickly and easily, but be completely unaware of basic technical concepts and the history that accompanies them…. That doesn’t seem quite right.

So, is there more here than meets the eye?

Enter the Crypto Cabal

During the two-week period between Musk first privately sharing his ideas about a blockchain-based Twitter replacement and then hastily declaring it a non-starter, he was in contact with several well-funded individuals and institutions—many of whom would end up committing substantial sums towards funding his takeover bid for the social media platform. But what is most interesting about these conversations, as we can piece together using newly-public documents revealed in court, filings made with the SEC, as well as comments made by those both directly involved and others with knowledge of the happenings, is that a substantial proportion of these talks involved power players from the “cryptocurrency” industry.

Among this group of the “cryptocurrency” oligarchy who had contact with Musk as part of these funding discussions was Changpeng Zhao. Better known to most simply as CZ—the Binance chief executive reached out directly to the Tesla CEO through DMs, unironically on Twitter, following the news of Musk’s accepted offer to purchase the platform, signaling his support and interest in getting involved in the deal.

“We, from our friends, heard that [Musk] was looking for third-party investors, and are we interested? We immediately said that we are,” Zhao told the Financial Times in early May.

“He didn’t have a plan for Twitter. There isn’t, like, a business plan. So it wasn’t that type of discussion.”

But instead of discussing the details of the deal or what Musk’s intentions for the platform entailed—something which Zhao said was time prohibitive—he instead claimed that he gave what he described as “more of a blank cheque” to the tune of a cool $500 million.

Completely rational and normal behavior, even considering the individuals involved.

But is it true?

Subsequent statements made by Binance executives suggest that it may not be.

Speaking with Yahoo Finance, Patrick Hillman, Chief Communications Officer at Binance, revealed that contrary to Zhao’s public statements, talks between Musk and the “cryptocurrency” exchange extended far beyond simple DMs and a blank check, with a focus on the influence that crypto oligarchy would be able to exert over Twitter as part of any acquisition.

“We asked a lot of questions about the vision and what he’s prepared to do, and about the problems that we’re looking to solve,” Hillman said.

“The opportunity to potentially be able to work with [the new Twitter] leadership team as they think through how they’re going to address these challenges was something that was too big to pass up. Not only for Binance, but for the entire industry as a whole.”

The meaning of Hillman’s statements couldn’t be more clear: not only did Binance see themselves as the flag carrier representing the entire “cryptocurrency” industry in holding these talks with Musk (though evidently, they were unaware of the conversations with other major players happening in parallel), but the chance—no matter how remote—to install the Binance-approved version of blockchain technology onto the platform was worth taking a half-billion-dollar flyer on.

“We believe that Web3 may have an equally important role in the future of social media platforms, including Twitter. Web3’s focus on decentralization could help facilitate greater transparency, accountability and freedom of expression for all users,” an unnamed Binance spokesperson told Blockworks in an interview.

“For example, what role can BNB Chain play in the future of Twitter?”

Now, it would be easy enough to write off the BNB Chain comment—even the entire bid for inclusion in the deal—as yet another case of purely self-interested behavior from Binance. The “cryptocurrency” casino is obsessed with controlling its image, having bought out DappReview in 2019, CoinMarketCap in 2020, in addition to making a $200 million investment in media conglomerate Forbes. Having a major stake in Twitter as part of that growing portfolio and the opportunity to influence the content that is purveyed on its platform is right in line with its previous moves.

But my own hunch is that this is much more than a throwaway comment and instead, is one that undoubtedly influenced Musk’s pursuit of a blockchain-based alternative to Twitter and may have even pushed him towards his October renewal of the deal.

Through Musk’s correspondence, we can see that him scrapping his ideas for a blockchain social media platform were killed because of a perceived lack of scalability for blockchain networks—and if he had been conversing with Zhao (as we know he had been), it’s not difficult to see how he reached that conclusion.

The BNB Chain that Binance executives have been hawking to the media is one of the jewels in the crown of the “cryptocurrency exchange.” A rebranding of the previously under-fire Binance Smart Chain (BSC), the entirely centralized BNB network was re-envisioned in large part as a move towards increasing its scalability to facilitate a far larger application ecosystem built atop it (along with the unbelievably high number of unregistered scam securities it hosts). But despite the enormous investment made by Binance and the PR push which accompanied it, the network has to date topped out at processing a deeply unimpressive 16.26 million transactions in a day according to data from YCharts (a resource not controlled by Binance), equating to approximately 188 transactions per second.

Compared to the 6,000 posts that are made every second on Twitter, or around 500 million each day, it’s not hard to see why after a conversation with Binance representatives, Musk soured completely on the prospect of a blockchain-based alternative—particularly given the high degree of centralization apparent—when its peak throughput could only handle a fraction over 3% of the necessary volume.

But to equate the potential of blockchain with the abilities of the BNB Chain not only does Musk a significant disservice, but it also discounts what is truly possible—and has been possible—since the very first example of the technology, Bitcoin.

Now operating under the BSV ticker symbol, the original Bitcoin has already demonstrated on its main net the ability to handle a per-second transaction throughput to support each individual Tweet (much like on Twetch) being boiled down to a single transaction, with the network to date showing a peak throughput of 5,124 transactions per second—which, in Twitter terms, equates to 85% of the required volume. But we haven’t yet even seen what the original Bitcoin network is truly capable of. With the release of Teranode—the next evolution of the node client software used to power the Bitcoin network—just around the corner, transaction throughput capacity is expected to hit more than 50,000 transactions per second—that’s enough to power Twitter 8 times over and still have the requisite capacity to handle the average number of transactions processed by the Visa network each second left in reserve!

So how was this information kept from Musk?

It couldn’t possibly be due to the underhanded behavior of Zhao, who has for years waged a public campaign against Dr. Wright—including the delisting of Bitcoin from the exchange he runs (an action for which he is currently staring down the barrel of a nearly £10 billion class action lawsuit for), could it?

Craig Wright is not Satoshi.

Anymore of this sh!t, we delist! https://t.co/hrnt3fDACq

— CZ 🔶 BNB (@cz_binance) April 12, 2019

Not the same Zhao, that has overtly echoed the words and voiced his support for criminals and defamers, such as Peter McCormack—whose libelous behavior towards Dr. Wright was affirmed with a guilty verdict to his name in an English court of law?

https://twitter.com/cz_binance/status/1117606851351179264

Not the same Zhao who had no problem backing the prolonged campaign of abuse against Dr. Wright by proven cyberbully Hodlnoaut?

Lastly, anyone who supports BSV from a tech perspective should be attacking the fraudulent Craig Wright, who is poisoning YOUR community, and not attack the rest of the world.

Anyone thinking CW is Satoshi should read about how a private key works, ie, learn about crypto.

— CZ 🔶 BNB (@cz_binance) April 15, 2019

And certainly not the same Zhao, who admitted putting financial self-interest above the progress and future of what helped make him his fortune in the first place?

I normally don't like get involved in debates, pick sides, etc. But this is going too far.

I also didn't like the fact that the fork caused BTC to drop below $6k, which caused pain to many in the industry.

— CZ 🔶 BNB (@cz_binance) April 12, 2019

It really makes you think, doesn’t it?

FTX not BSV—said far less succinctly

But to Musk’s detriment—and inarguably, to the public at large—Zhao was not alone in representing the crypto industry during the course of his Twitter courtship. As revealed in the course of the Musk vs Twitter litigation pre=trial discovery, Sam Bankman-Fried, founder of FTX—perhaps the most egregious of the “cryptocurrency” casinos, both directly and through intermediaries, was also in contact with Musk throughout the process of courting financiers.

“Hey – I saw your poll on Twitter about Twitter and free speech. I’m not sure if this is what’s on your mind, but my collaborator Sam Bankman-Fried has for a while been potentially interested in purchasing it and then making it better for the world,” William MacAskill, an Associate Profession in Philosophy at Oxford University and personal adviser to Bankman-Fried, sent to Musk in an unsolicited message.

“If you want to talk with him about a possible joint effort in that direction, his number is [redacted] and he’s on signal.”

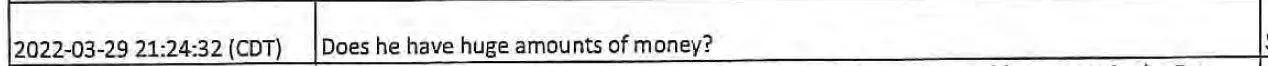

To which Elon, who appeared at this stage to be blissfully unaware of Bankman-Fried and his role in perpetuating the “cryptocurrency” Ponzi – not to mention the fixing and corruption of markets that Alameda Research in conjunction with Tether is regularly accused of, asked, “Does he have huge amounts of money?”

Of course, Bankman-Fried is sitting on a trove of personal treasure, “earned” off the back of the unassuming everyday man, who FTX and its associated-but-not-associated Alameda Research, regularly use as exit liquidity in their rigged gambling games—a fact confirmed by Macaskill in subsequent messages.

“Depends on how you define ‘huge’! He’s worth $24B, and his early employees (with shared values) bump that up to $30B,” MacAskill replied.

“I asked about how much he could in principle contribute and he said: “~$1-3b would be easy ~3-8b I could do ~$8-15b is maybe possible but would require financing.”

The response clearly piqued Musk’s interest, who, after confirming whether MacAskill personally vouched for Bankman-Fried (he did) agreed to speak with the FTX founder later that day, with the provisor that he didn’t have to have “a laborious blockchain debate.”

Exactly how that conversation went remains unclear, as unfortunately, there is no written transcript of their oral conversation available. However, for the future of blockchain and Twitter, we can be certain that it certainly didn’t help Musk in pursuing such a path. Because in this world—much like with the rest of the crypto cabal – ulterior motives are as common as unregistered securities, even for those with public images as carefully crafted as that of Bankman-Fried—the self-anointed leader of the effective-altruism movement.

Much like Binance’s Zhao, Bankman-Fried has also been quick to turn his back on and disparage the very technology to which he can attribute his fortune. Earlier this year, in an interview with the Financial Times, Bankman-Fried couldn’t even pretend to hide his disdain for Bitcoin and its role in any future blockchain landscape.

“The Bitcoin network is not a payments network and not a scaling network,” he boldly told the business newspaper.

“Things that you’re doing millions of transactions a second with have to be extremely efficient and lightweight and lower energy cost. Proof-of-Stake networks are.”

He offered something of a clarification later in the interview, saying that “I don’t think that means Bitcoin has to go”, instead advocating for the typical “crypto-maxi” viewpoint that it had a future as “an asset, a commodity and a store of value”—in other words, digital gold.

Of course, all of these statements are wildly incorrect, as CoinGeek’s Gavin Lucas expertly explained in the immediate aftermath of the interview.

Ultimately, Bankman-Fried did not end up directly committing funds to Musk’s bid for Twitter (perhaps because he didn’t get the answer that he was hoping for on the blockchain element of the deal?), though Sequoia Capital, which has invested hundreds of millions of dollars in FTX and undoubtedly wields significant influence over its activities, pledged the second highest amount of any of the prospective investors. But the damage may have already been done.

Instead, the final publicized message between Musk and Bankman-Fried came courtesy of Musk, who responded to a message from the crypto billionaire, saying “Sorry, who is sending this message?”

Ouch.

In a final twist of irony, some months later, Bankman-Fried himself advocated for a blockchain-based social media platform that bears a striking resemblance to that proposed by Musk – or more accurately, exactly what Twetch is already running on the original Bitcoin network—before deciding that it currently wasn’t possible because of the technical limitations of presently available blockchain platforms, in yet another example of egregious mistruth emanating from the mouth of our billionaire altruist.

28) So how about social media?

Right now, if you tweet something, and your friend pulls out Facebook, they can’t see your tweet.

Social media networks are isolated, not interoperable.

— SBF (@SBF_FTX) July 16, 2022

31) Let’s say that, instead, we put messages on a blockchain.

So if you used Blockchain-Twitter (BT):

–You type the message in BT’s interface

–BT posts the message on a public blockchain

–Your friend pulls out Blockchain-Facebook (BF)

–BF reads your message and displays it— SBF (@SBF_FTX) July 16, 2022

32) By using an underlying public chain for messages, we’ve made different networks compatible.

You can use any platform, and still talk to all your friends on every platform.

Your messages, and network, are yours: you can move platforms and keep them.

— SBF (@SBF_FTX) July 16, 2022

32) By using an underlying public chain for messages, we’ve made different networks compatible.

You can use any platform, and still talk to all your friends on every platform.

Your messages, and network, are yours: you can move platforms and keep them.

— SBF (@SBF_FTX) July 16, 2022

So was this the result of a disagreement between Musk and Bankman-Fried—a lover scorned, if you will? Perhaps a case of yet another stolen idea being claimed as Bankman-Fried’s own? Or maybe, just a veiled shot at the original blockchain technology?

Only you can be the judge of that.

A better future for Twitter is still possible

But as is a common theme with this publication—and in the broader blockchain space, if you know where to look—hope is far from lost. With yesterday’s news that Musk’s acquisition of Twitter is once again back on the cards and the prospect of the company becoming a private entity looking likely, allow me to lay out a three-point plan that could transform the social media giant, while at the same time realizing Musk’s ambition for a blockchain-based social media platform that makes for a better world:

- Cut through the propaganda and take the time to understand the true power of Bitcoin—the original blockchain technology—which, contrary to the musings of “crypto” oligarchs, is a network that has always been predicated on censorship-resistant information, microtransactions, and scalability.

- Study the applications that are already leveraging the superpowers of the massively scaling, energy-efficient, Bitcoin network, that can be seen across the Bitcoin SV ecosystem. In the context of this discussion, Twetch is an obvious example, but the likes of my2cents, CryptoFights, and HandCash all provide excellent examples of different use cases that embody the ethos of what Bitcoin is all about.

- Accept the kind offer of Dr. Craig Wright—the visionary and creator of the technology—to meet and hatch a plan on how best to work together. That doesn’t have to be limited to Twitter either—two men with the credentials and intellect of Musk and Wright would no doubt be able to solve the issues that ail the social media service—but the potential there goes far beyond what is at its core, little more than a rudimentary microblogging platform.

https://twitter.com/RealCoinGeek/status/1430908231258279950

It really is that simple.

In the messages released as part of the pre-trial discovery process, Riot Games co-founder Marc Merrill tells Musk, “You are the hero Gotham needs.” If it were me conversing with Musk, I’d come bearing a slightly different message: “Bitcoin is the hero the world needs.”

And Elon, you have the power to make it happen.

Watch: The BSV Global Blockchain Convention presentation, Making it easy for creators to earn – using BSV blockchain

04-19-2025

04-19-2025