|

Getting your Trinity Audio player ready...

|

In the first article that reviews the various token solutions out there since my critical piece taunting the space, we take a look at Elas Digital, founded by Brendan Lee. Brendan is one of the top educators in the space from his work with Tokenized, Bitcoin Association, Faia and now Elas Digital.

From their blog posts, we can see that Brendan’s journey through the space led him to create this unique token solution that claims to be “the most simplified approach (they) believe possible in Bitcoin.”

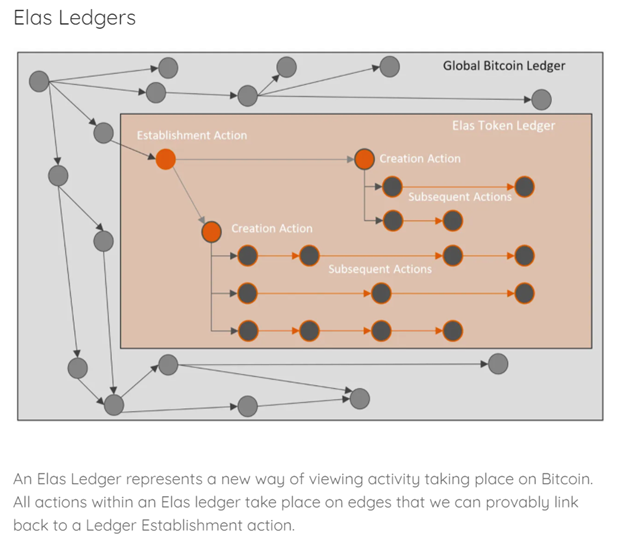

Elas tokens are defined with an ‘establishment action’ that contains all necessary information defining the token. Subsequent spends can be any type of Bitcoin transaction since details about the token are defined immutably on initial transaction.

The definition details of the token are not bound by any protocol, thus fully customizable. The data could even be its hash, where the details are kept privately off-chain.

Wallets that implement these tokens only need to recognize the minting transaction to display details about the token to its owner.

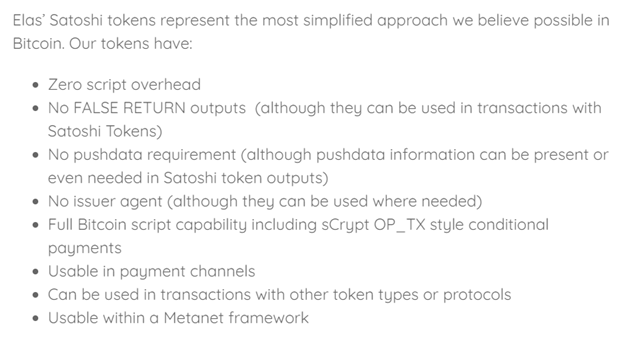

Elas proposes the only token solution so far that does not require embedding of some type of data into each transaction, thus the ‘zero script overhead’ claim. That stated, metadata can be optionally included alongside the transaction if desired.

This solution is indeed simple, yet quite powerful. The implication is that once minted, these tokens out of the box support all Bitcoin script types without any custom development required.

R-puzzles, P2PKH, multi/threshold signature and even proof-of-work (Boost, 21e8) scripts are all possible to use.

Minters have great flexibility as they can “define subsequent sub-ledgers for different purposes,” implying fiat token support as well as any type of non-fungible token (NFT). This flexibility comes with responsibility as the creator (not the platform) assumes culpability for the type of token launched (including ICOs).

The distinction is welcome since it promotes experimentation without stifling innovation for the sake of regulation.

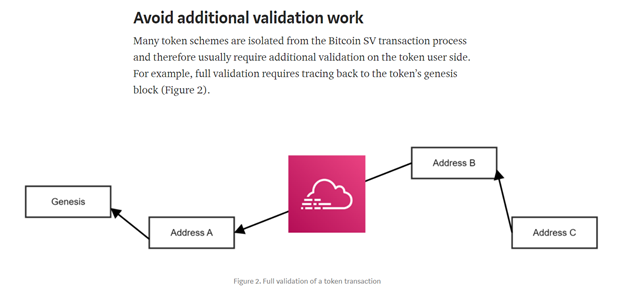

All token solutions have some drawbacks and Elas’ is no exception. What I am labeling the ‘Back to Genesis’ issue that all tokens face is Elas’ primary one.

This ‘Back to Genesis’ issue is how do wallets prevent arbitrary spoofing of tokens since its definitions, i.e. supply cap, balance and denomination are outside the scope of Bitcoin script. All further spends of a token must validate against the original minting transaction, which has scaling challenges.

Another con is the lack of current wallet support. While Elas tokens are not constrained by the protocol, wallets that implement them must allow users to select inputs when spending tokens. This feature is non-existent today; wallets simply choose a sum of UTXOs such that they have sufficient satoshi amounts to spend and broadcast them.

With this ‘dumb’ implementation in place, Elas tokens could be accidentally spent which is a non-starter. The wallet problem is less of a con with Elas’ solution, as it is a dependency on wallets to step their game up.

I believe the first existing, major wallet to support any type of useful token will become immediately used since the space is starving for a solution. If Elas starts to gain traction it could incentivize wallet innovation and push them to start supporting more complex transaction types.

Overall, Elas seems to be a great solution that does utilize the benefits of the Bitcoin ledger and full capability of script. The need to trace back poses an immediate scaling challenge, but with solutions on the horizon like TXDB, this appears to be solvable.

What are your thoughts? Let us know on Twetch and Twitter. Be on the lookout for the next token solution we will review!

03-07-2026

03-07-2026