|

Getting your Trinity Audio player ready...

|

Digital payments have surged in the past decade, accounting for over 80% of all e-commerce transactions in the Asia-Pacific (APAC) region, a new report says.

The Global Payments Report 2025 revealed that since 2014, digital payments have surged from 34% of e-commerce payments to 66% in 2024. Authored by London-based Worldpay, the report included digital assets, digital wallets, and buy now pay later platforms under digital payments.

The ubiquitous usage of smartphones and rapid developments in the fintech space are among the factors that have boosted digital payments in the last decade. Additionally, national payment systems have changed the game, dominating payments in some of the largest economies.

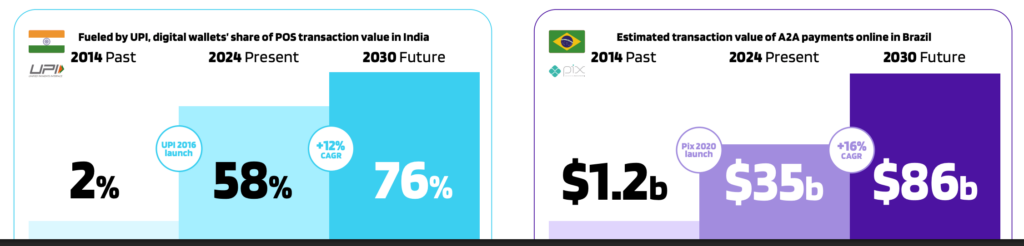

In India, the Unified Payments Interface (UPI) now accounts for nearly 60% of all point of sale (POS) transactions, up from 2% in 2014, and is projected to hit 76% by 2030. Thailand’s PromptPay has a 41% market share, while Brazil’s Pix processed $35 billion in account-to-account payments last year, a massive increase from $1.2 billion in 2014.

But while digital payments’ dominance rises, the report notes that there has been resistance to the demise of cash payments.

“Cash’s share of payments value plummeted in the past decade, yet demand for cash persists. Unlike many of its analog contemporaries, cash may prove timeless,” it says.

Worldpay projects that while demand for cash will continue dipping, it’s likely to find its floor. Cash accounted for $5.6 trillion of payments last year, and it’s expected to stay above $5 trillion by 2030, with demand highest in some major economies like the Philippines, Nigeria, Japan, Indonesia, Mexico, and Vietnam.

Asia’s cashless revolution

The APAC region has been one of the fastest-growing cashless societies over the past decade, the report revealed. In 2014, China had an uneven lead over the other nations, but the picture is more balanced now, with digital payments now the most popular channel for a majority of the countries.

In e-commerce, digital payments accounted for the lion’s share in most of the APAC nations, with Taiwan, South Korea, and Japan the notable exceptions, where credit cards dominated.In Thailand and Malaysia, the national payment services PromptPay and DuitNow, respectively, dominated. Thailand’s government has also been pushing a digital wallet initiative through which it distributes its 10,000 baht ($300) handouts. Prime Minister Paetongtarn Shinawatra recently reiterated that the government is still committed to the initiative despite local reports that it would be shut down.

China remains the beacon of digital payments in APAC, with digital wallets accounting for 84% of all e-commerce payments and 70% of POS transaction value. Leading digital wallets, including Alipay and WeChat Pay, have incorporated local cards into their platforms, with the government pushing them to accept foreign cards this year.

On the other extreme, Japan remains the most cash-loving nation. Worldpay predicts that cash usage will only dip 2% annually through 2030 in a country where 10% of the population is aged above 80 and holds cash in high regard.

For the first time, digital currencies were included as payment methods in the report in the APAC region. However, they accounted for less than 1% in all countries, except in the Philippines, Singapore, and India, where their share was 1%.

SMEs driving digital wallet adoption across Asia

While peer-to-peer digital payments are at an all-time high across Asia, Deloitte says that small and medium enterprises (SMEs) have been key drivers in adopting digital wallets across the region.

“The barriers to entry have been lower for the SMBs. Digital penetration and the number of consumer apps and super apps across the region have supported the SMB sector,” says Tony Wood, the banking lead for Asia-Pacific at Deloitte.

Wood noted that formal banking channels continue to rely on legacy infrastructure and technology, which tends to be costly and tedious to integrate for smaller businesses. This has pushed them to digital solutions, which aligns with the region’s drive toward digital payments.

Professor Sumit Agarwal concurs, noting that the low setup cost, low fees, and no requirement for POS machines have attracted SMEs to digital payments. He added that consumer behavior has also played a role.

“Customers are increasingly relying on mobile and QR code-based technology. SMEs are essentially required to provide the services for their customers,” stated Agarwal, a professor of economics and finance at the National University of Singapore (NUS).

Watch: New age of payment solutions

03-10-2026

03-10-2026