|

Getting your Trinity Audio player ready...

|

Digital asset payments will surge over 80% over the next two years as friendlier regulations boost user confidence, a new report projects.

Meanwhile, tokenization is impacting the payments industry, with Mastercard (NASDAQ: MA) revealing that it tokenized 30% of its transactions from 2024.

Digital asset payments to explode: report

The surge in digital asset prices in recent years, which has pushed the sector’s overall market cap above $3 trillion, has sparked the growth of almost every other digital asset use case, from NFTs to DeFi. However, payments, Bitcoin’s original use case, have taken the backseat.

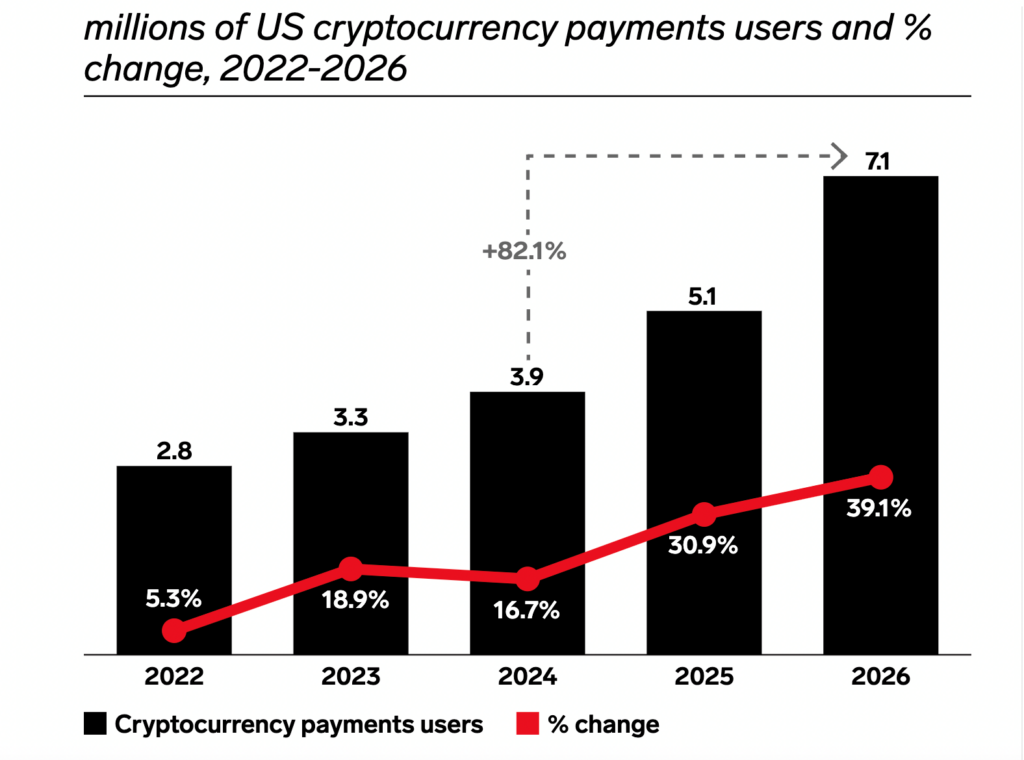

This is expected to change, with a new report predicting that digital asset payments will surge 82% by 2026 in the United States. The report by U.S.-based market research firm eMarketer projects that over seven million Americans will be paying in digital assets in two years.

The report estimates that at least 36.6 million Americans will own digital assets by 2026, translating into one in five digital currency holders using it for payments. This will be a notable increase from the 14% of owners who paid in digital assets last year.

However, the new report’s estimated digital asset ownership figures are way below other reports. In a separate report two weeks ago, Security.org estimated that 65 million Americans own digital assets, equating to 28% of the U.S. adult population, a slight dip from the 33% who owned digital assets in 2022. Another 14% reportedly plan to purchase digital assets this year.

However, eMarketer’s estimates align with a Federal Reserve report from in May 2024 that put the number of American digital asset owners at 18 million, or 7% of the population.

The new report says that friendlier regulations will be the main tailwind for digital asset payments over the next two years. In his second term, President Donald Trump has pledged to make the U.S. a digital asset hub, and while some of his proposals have been extreme, experts expect more enabling regulations and regulators.

But while Trump may be ‘pro-crypto,’ his allegiance lies squarely with speculative tokens, not utility projects. The Republican leader has already launched his memecoin on Solana, which peaked around his inauguration at over $20 billion in market cap. The memecoin has since shed 80% of its value. His wife’s memecoin has lost 90% of its value from its $2 billion peak.

Still, digital asset payment could have a golden era under Trump. In a recent interview, Bank of America CEO Brian Moynihan said U.S. banks are ready to “go hard on the transactional side” of digital asset payments once regulators give the green light.

The latest financial giant to back digital asset payments is the Swiss buy now, pay later firm, Klarna. CEO Sebastian Siemiatkowski revealed last week that the firm is exploring digital asset offerings, which he has previously written off as a “decentralized Ponzi scheme.”

“Sometimes you’re wrong,” he told Bloomberg.

Mastercard tokenized 30% of transactions in 2024

Elsewhere, payments giant Mastercard’s recent SEC filing revealed that the firm tokenized 30% of its transactions in 2024. The company didn’t provide any details on the tokenization, but it says it’s part of its peer-to-peer architecture, which “enables the network to adapt to the needs of each transaction.”

The New York-based firm also noted that it has been developing solutions to unlock new blockchain-based business models. This includes applying risk management practices and continuously monitoring its digital asset partners. Programmable payments via its Mastercard Multi-Token Network “helps make transactions within blockchain ecosystems more secure, scalable and interoperable,” it added.

Additionally, the company has partnered with various VASPs to allow users to purchase digital assets directly via its cards.

Mastercard also acknowledged stablecoins and digital assets as competitors on the payments front. It pointed to their “immediacy, 24/7 accessibility, immutability and efficiency” as some of the factors behind their rise in recent years.

“Digital currencies and emerging players (such as crypto natives) have the ability to disrupt traditional financial markets. The increased prominence of digital currencies creates an opportunity for us, but could equally compete with our products and services.”

While it’s now warming up to digital assets, Mastercard spent fortunes over a decade ago to suppress Bitcoin and impede its progress toward becoming global electronic cash.

Watch: New age of payment solutions

02-23-2026

02-23-2026