|

Getting your Trinity Audio player ready...

|

A staunch critic of Silicon Valley, writer and journalist David Gerard offers a stinging critique of Facebook’s cryptocurrency project: “Libra is not a story about cryptocurrency; it’s a story about Silicon Valley hubris and people who think they can start their own money and take over the world that way.”

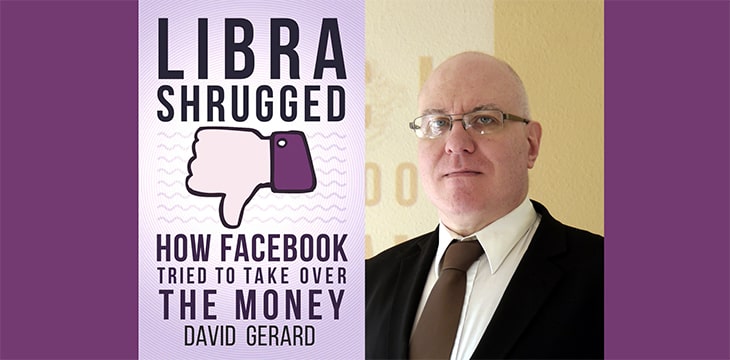

Known in the digital currency world as a BTC, Tether and blockchain critic, Gerard offers a comprehensive analysis of Facebook’s Libra project in his new book Libra Shrugged. Speaking to CoinGeek’s Charles Miller, he characterizes the Libra team as “a group of people who think they can take advantage of the system without getting called out on it.”

When Facebook announced Libra back in June 2019, “Its original plan was to run a currency basket-based token on blockchain,” Gerard explains. The project, however, was met with fierce criticism from regulators around the world.

Regulators’ biggest concern, Gerard says, is to avoid a repeat of the 2008 financial crisis which was brought about by the kind of structure Facebook’s Libra was proposing. Regulators fear that a monopoly could threaten global financial stability—similar to what happened in 2008 when a few companies were purported to be ‘too big to fail’:

“Regulators around the world are frightened of one thing and that’s another 2008 happening. And Facebook came along and presented them with a plan for ‘here’s how we could do a 2008 all by ourselves’.”

Following opposition and backlash, the social media platform floated a new plan for a series of currency substitute tokens such as a dollar token, pound token, and Euro token. But as Gerard explains, this plan didn’t go down well with regulators either. “The real objection the regulators have is the scale of it.” The currency reserve needed to fulfill Facebook’s plan would have been worth over a trillion dollars—posing a major problem for global financial stability in itself.

In October 2020, Facebook’s Mark Zuckerberg was summoned by members of the U.S. Congress to a hearing to explain the company’s plans. Gerard observes Zuckerberg to be a good talker, serving up well thought-out statements, however lacking substance. Zuckerberg has since made it clear that Libra would not move forward without proper regulatory compliance. But one by one, large companies dropped their support for Libra, leaving a select few onboard.

In December, Libra was renamed Diem. In an attempt to win over regulators, Diem presented a simpler and revamped structure. Its launch date was initially set for January 2021. As Gerard explains, it’s the same Libra group proposing different technologies to solve problems, except that now it’s the Diem Association instead of the Libra Association.

You can buy David Gerard’s Libra Shrugged here.

Hear the whole of David Gerard’s interview in this week’s CoinGeek Conversations podcast or catch up with other recent episodes:

You can also watch the podcast video on YouTube.

Please subscribe to CoinGeek Conversations – this is part of the podcast’s fourth season. If you’re new to it, there are plenty of previous episodes to catch up with.

Here’s how to find them:

– Search for “CoinGeek Conversations” wherever you get your podcasts

– Subscribe on iTunes

– Listen on Spotify

– Visit the CoinGeek Conversations website

– Watch on the CoinGeek Conversations YouTube playlist

02-22-2026

02-22-2026