|

Getting your Trinity Audio player ready...

|

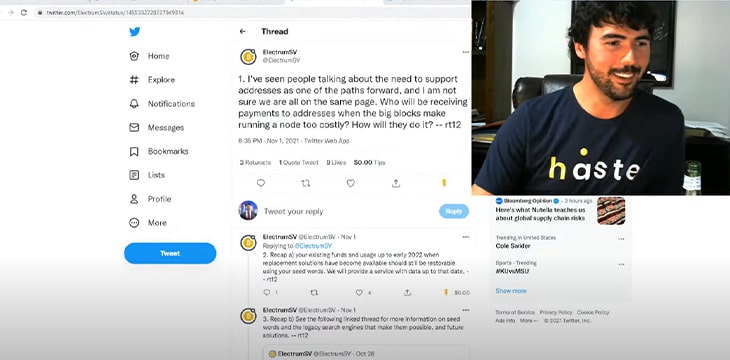

Ever since ElectrumSV’s Roger Taylor shared his views on seed phrases and UTXO management for wallet providers, the Bitcoin SV community has been debating what the future holds as we enter an era of exponentially bigger blocks. Britevue founder Connor Murray gave his views in a recent video, delving into what Satoshi Nakamoto says on the Bitcoin white paper about how miners will reclaim disk space once the blocks get bigger and how the Mandala Network applies to the UTXO management debate.

Seed Phrases and the Mandala Networkhttps://t.co/t5EeONSgrc

— Connor Murray (@Bitcoin_Beyond) November 10, 2021

Murray went into the history of seed phrases, which emanated from Satoshi’s directive that Bitcoin users shouldn’t reuse private keys (which he further breaks down in this blog post). With the need to have a new key for every transaction arose the need for “12 words that could deterministically generate all the private keys for a derived master key,” Connor explained.

As ElectrumSV’s Taylor pointed out, seed-based restoration will become way too expensive as blocks get bigger, at least for platforms that currently offer the service for free. Murray agrees, noting that we’ve already witnessed this when HandCash went out of beta and its users attempted to import their 12-word seed phrases but weren’t finding some of their coins. This was resolved later, but it should have rung an alarm bell on the feasibility of seed phrase restoration when the blocks are much bigger.

Bitcoin employs two transactions types, Connor went on. The first, which is the standard one, is the pay-to-public-key-hash (P2PKH) transaction type wherein a user sends funds to a Bitcoin wallet. In the second, which is not as popular, a user uses a locking script to lock coins which has an unlocking script that gives any other user access to these coins. This second transaction type further complicates access to the coins, meaning that just providing a Bitcoin address doesn’t unlock them.

“I’d be surprised if pay-to-public-key-hash is the dominant transaction type in the future. While it is right now, there are better ways of doing that.”

As CoinGeek reported, Joshua Henslee recently delved into seed restoration and UTXO management. In his video, he acknowledged as well that it’s unlikely that wallet providers will continue scanning the blockchain for their users for free.

For Henslee, the solution lies in users having to store their own UTXOs whenever they back up their seed phrases. This allows them to spend their UTXOs without having to scan the blockchain. Henslee also acknowledged that this is something Dr. Craig Wright has been trying to emphasize for years now, but many have ignored him.

The best way forward may lie in yet another solution that Dr. Wright has been calling for—the Mandala Network. This is a family of networks that are fast and cost-effective, built up in layers. In essence, a Mandala Network is “as a mathematical graph with certain rules for the distribution of nodes and edges in each shell, and how they connect to nodes in the shell below.”

With Bitcoin functioning as a Mandala Network, the miners will increasingly prune everything in the blockchain aside from the UTXO set and the hashes of all blocks. Satoshi even covered this in Section 7 of the white paper under “Reclaiming Disk Space,” Murray noted.

In his op-ed on Bitcoin being a Mandala Network, blockchain expert Jerry Chan stated that the solution to these emerging seed phrase restoration issues is to let capitalism take its course. This can be done through archive nodes whose sole job will be running a full copy of the Bitcoin blockchain and giving you access to the entire history of your coins, but at a cost.

Murray concurs, pointing out that users won’t mind paying for such a service if it allows them access to a wallet address with a significant number of coins. It’s kind of like spending $10 to access $1,000, he added.

Watch: CoinGeek New York panel, A Better Internet Experience using Blockchain

02-20-2026

02-20-2026