|

Getting your Trinity Audio player ready...

|

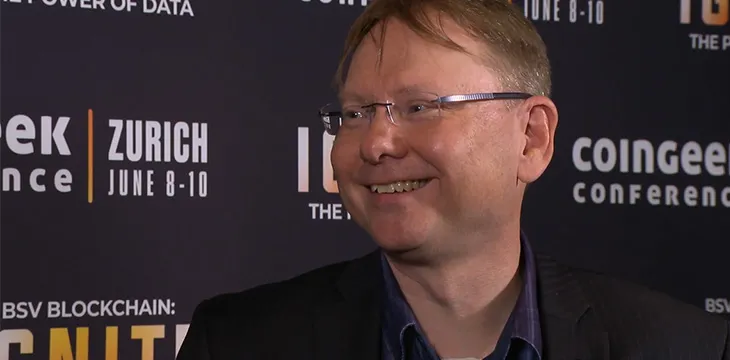

Digital currencies are gradually making their way into the financial services world, with more banking institutions developing services and products suited to the growing Bitcoin-savvy clientele. Dr. Holger Vogel, a financial engineer at Basler Kantonalbank, joined CoinGeek Backstage to talk the rise of digital currencies in the banking world, how regulation is dictating the pace of development and how Bitcoin SV’s stable protocol has made it easier for developers to build on Bitcoin.

Vogel is also an Avaloq developer for Basler Kantonalbank, one of the 24 cantonal banks service Switzerland’s 26 cantons. He joined CoinGeek’s Patrick Thompson on the sidelines of CoinGeek Zurich to talk about how he got into Bitcoin and what he foresees in its future.

Vogel, who has been at the bank for close to 14 years now, first came across Bitcoin in 2011 while he was “trying to find a way of testing my own trading systems that I had developed.” In his quest to find a testing environment with the most similarity to the real world, he stumbled on Bitcoin.

Having been in the industry for over a decade, Vogel has seen it all. In that time, he has watched as Bitcoin evolved to the formidable financial and data system it is today.

He told CoinGeek, “Today, I’m quite happy that we are back in terms of the technology – the protocol is now much better because the focus is on scaling and not on changing the protocol itself.”

Bitcoin SV has focused on providing a stable protocol, giving developers the peace of mind to know that their applications will be running on the network decades to come without having to change some aspects as the protocol changes.

“It’s always a pain in the ass if things are changing,” Vogel summarized it.

Working in the highly-regulated banking industry, Vogel is fully aware of just how critical it is to stay compliant. This has married well with Bitcoin SV’s stable protocol. “You can’t change a product after it’s released to the public or the secondary market,” he stated, underlining the importance of a stable protocol for banks and other financial services providers.

Basler Kantonalbank has dived into digital currencies, offering trading and custodial services through its subsidiary Bank Cler. The bank, which has been around since 1899, was the first government-backed ban to test the waters in digital currencies.

Vogel sees great value in tokenization, he told CoinGeek. “Everything can be tokenized for me,” he stated. Even on Bitcoin SV, tokens will play a big role to increase the granularity of the network.

07-05-2025

07-05-2025