|

Getting your Trinity Audio player ready...

|

1/ Today we launch the first exclusive book NFT on Bitcoin. https://t.co/r6lPpqNBgC

— Canonic (@canonicxyz) March 17, 2021

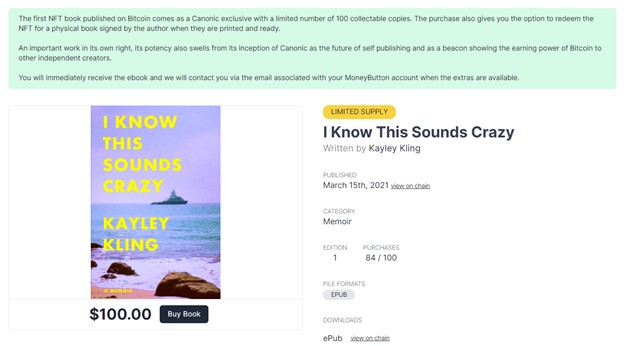

After a countdown from last week, stating ‘the world begins with attention’ Canonic emerged as a marketplace where authors can ‘self publish on Bitcoin’. The market starts with one exclusive book available for purchase, titled ‘I Know This Sounds Crazy’ by Kayley Kling.

Purchase of the book provides immediate access to a digital copy on-chain. In addition, purchasing one of the first 100 exclusive copies gives the customer an NFT, which can be redeemed for a physical book signed by the author. Given the NFT hype and blatant scamming lately an honest use-case that leverages the accountability features of the ledger is quite welcomed.

In this case, the NFT actually represents some type of unique value rather than a simple receipt, transaction hash and some image file ‘everyone and their mama’ can distribute on social media. Given that the customer owns the token, they also have the option to purchase to speculate instead of simply consume. Consumers can gamble on future value of the physical, signed book and author’s potential fame by holding and potentially selling for a higher value in the future.

2/ Canonic begins as a marketplace that lets you self publish on Bitcoin. The digital work is immutably stored on Bitcoin $bsv, creators earn in Bitcoin, and build on top of an interoperable and decentralized layer where distributors will soon compete to sell their work.

— Canonic (@canonicxyz) March 17, 2021

The exclusives are sold initially for $100; Canonic takes a 20% cut on each sale. Some may see this as steep but Canonic is the first to market in this area and invites others to “build on top of an interoperable and decentralized layer where distributors will soon compete to sell their work.” Expect many more competitors to emerge driving the revenue share towards zero.

One can inspect the encrypted book on-chain before purchasing as well as a publishing transaction that contains details about the book such as title, description, author’s paymail from their wallet, proving ownership. Additionally, a ‘Bitcoin Standard Book Number’ which is an on-chain unique identifier of the book, establishing authenticity.

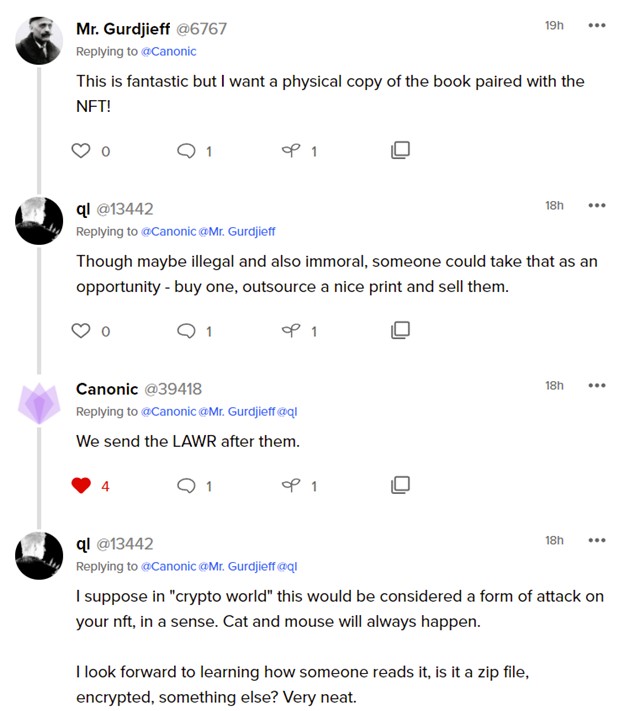

Piracy is the paramount issue with limited edition items. The Bitcoin technology does help in this regard, but the incentives are more aligned. If one pays a hefty price for a book upfront when the link that they own to the true original is immutable and recorded publicly, the incentive to scam becomes lower. Especially when considering the option to speculate on the future value of the book, a customer would not want to flood the market with copies, inflating the limited supply just as a miner has a disincentive to increase Bitcoin’s 21 million fixed supply cap.

Canonic only allows reviews from those who purchased the book. This is an immediate advantage over a service like Amazon who only can place ‘Verified Purchase’ labels on reviews who actually bought the item. This is possible since the receipt is linked to the original author’s work.

One could attempt to spoof reviews, but other potential customers could check the review for themselves if the reviewer bought the book rather than trusting the service provider and a meaningless label.

Lastly, Canonic’s service attempts to eliminate book burning, similar to how service providers de-platform content creators based on their political views. Canonic is simply an interface to the blockchain; if they decide to engage in censorship, other interfaces could emerge leveraging the same authenticity techniques and data format protocols on Bitcoin that allow authors to continue to trade. The author’s work is recorded immutably (for the time being) so cannot be taken down arbitrarily.

Canonic is not an open market yet but does plan to open up for other authors to publish soon™.

Check out the new self-publishing platform on Bitcoin SV at canonic.xyz.

02-20-2026

02-20-2026