|

Getting your Trinity Audio player ready...

|

The BTC network is becoming congested as activity continues to increase to limits beyond its capacity. There has been a lot of hype recently when the price appreciation surged towards US$10,000, which paints a correlation that users are largely using BTC as a speculative tool for trading.

The congestion would therefore account predominately from people shuffling funds between wallets and exchanges for trading purposes rather than for more primary use cases such as peer to peer electronic cash in commerce.

However, as Bitcoin is inclusive all use cases are deemed to be acceptable. This goes to show that BTC has failed to remain useful even in its lowest use case as a speculative trading instrument by failing to scale to handle any sort of increase in the load of the network and making changes to the protocol so that it no longer behaves as Bitcoin is described in the whitepaper.

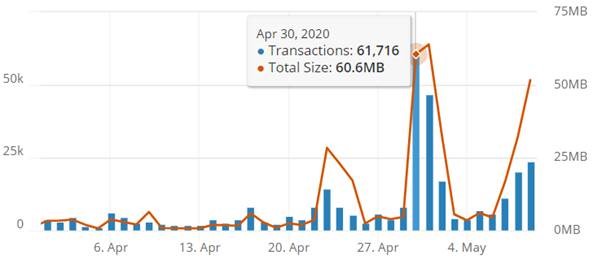

On April 30, 2020, the mempool (pool of unconfirmed transactions yet to be written onto the next block) exploded to a yearly high of 61,716 for the day, with a total block size of 60.6 MB. Congestion is on an upward trajectory again and is heading towards setting a new record for the year.

To put it in perspective, at any given time BTC can only handle a maximum of 2,000 of transactions per block of 1 megabyte that is generated every ten minutes, so it could take up to several hours for transactions to be confirmed for users on the BTC network.

There is no other alternative for BTC to have instant confirmation transactions (0-conf) due to Replace By Fee (RBF) which was introduced into the BTC protocol by Bitcoin Core developers in 2016 to enable the congestion and create a fee market with limited block size space to deter people from using it for “spam”, or making them pay a premium.

RBF would also allow a user to double spend their own transaction with a higher fee to raise the chances of moving it into the next block. The problem is that this completely broke the security of safely using zero confirmation transactions.

Zero confirmations (0-conf) are safe to use on BSV, which means that any transaction that has been broadcasted onto the network can be safely accepted without the need of waiting at least 10 minutes before it is included into a block. The first transaction that has been broadcasted onto the network would be timestamped as the valid transaction and any subsequent attempt to double spend would be rejected.

This has created the bidding war to get transactions approved quicker as congestion of the network continues to steadily rise for BTC users evident with average transaction fees hitting a yearly high at an average of US$3.175 this month.

Satoshi Nakamoto said it best when he described the potential of the Bitcoin as a payment system in 2009:

Bitcoin can already scale much larger than that (Visa) with existing hardware for a fraction of the cost.

With the luxury of both foresight and hindsight, we can see that this is true in both lenses.

For a peer to peer digital currency without any intermediaries, the cost and wait time for BTC transactions is beyond what anyone would consider acceptable compared to today’s traditional payment methods like VISA and PayPal.

It’s always good to keep a close eye on the metrics of the competing Bitcoin networks, so let’s take at the stats for May 2020 so far before the halving for BTC halving event takes place in a few hours.

|

|

BTC |

BSV |

|

Market Cap* |

162 Billion |

3.5 Billion |

|

Price* |

$8,849 |

$187 |

|

Hashing function |

SHA-256 |

SHA-256 |

|

Total Supply |

21 million cap |

21 million cap |

|

Block size limit |

1 megabyte |

Unlimited |

|

Block size capacity |

2000 tx per block |

Unlimited tx |

|

Max Tx/second |

7 |

10000+ |

|

Instant transactions |

No, due to RBF |

Yes |

|

Total transactions – May* |

3,160,949 |

6,684,745 |

|

Average daily transactions – May* |

316,094 |

668,474 |

|

Average daily transaction fee* |

2.27 USD |

0.0004 USD |

*Data is for the period of May 1 – May 10, 2020 at the time this article was published. (Source: Blockchair)

Both are staking claims to the Bitcoin name as they share the history of the blockchain right to the very first block, but it is clear that there is only room and a need for one. It is also clear that only one, BSV, follows the original design of Bitcoin.

We will keep monitoring these metrics closely as the year progresses as the landscape of the industry should see a dramatic change following the BTC halving event.

03-09-2026

03-09-2026