|

Getting your Trinity Audio player ready...

|

Benjamin Celermajer, the index manager of crypto analytics firm Coin Metrics, revealed that over half of the BTC active supply has not moved in over one year.

#Bitcoin's 1 year HODL Factor surpassed 50% for the first time, indicating that half of BTC's active supply hasn't moved in over a year

This fundamental indicator of Bitcoin health demonstrates an increasing long term holder base, supporting the SoV narrative

Data: @coinmetrics pic.twitter.com/F62Wxcfa9u

— Benjamin Celermajer (@CelermajerB) May 25, 2020

In other words, even individuals who have owned BTC for over a year are not using their BTC, which indicates that BTC has little to no real-world utility.

Why BTC has no utility

BTC has no utility because software developers cannot build platforms and services with the BTC protocol. Therefore, it is not possible to create goods and services with BTC that bring real value to people’s lives and improve the world. Instead, BTC is primarily used as an investment vehicle that individuals speculate on. BTC investors hope that someone who is not them would be willing to pay more for BTC than they paid themselves—which is why Goldman Sachs recommends that its clients do not invest in BTC.

However, even though BTC has no real utility, and its supporters do nothing to make the BTC protocol more valuable, most BTC owners continually hope that BTC will appreciate in value without doing anything that will actually bring more value to the BTC network. This is why many people who support other blockchains call BTC supporters communists.

All things considered, it makes sense that over half of the active supply of BTC has remained dormant for over one year. Considering BTC’s features, or lack of features, individuals who hold BTC have no reason to move their BTC from their cryptocurrency wallets.

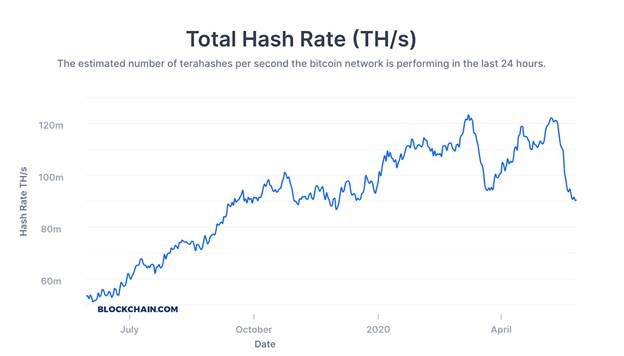

BTC hash rate is at its lowest level in 2020

The BTC hash rate is at the lowest level it has ever been at in 2020, and this downtrend shows no signs of reversal. Since the BTC halving, BTCs hash rate is down more than 25%.

As a result of the recent BTC halving, many miners can no longer profitability mine BTC, have stopped pointing their hash power at the BTC network, and have switched to a more profitable chain like Bitcoin SV.

As time goes on, and more BTC miners consume the predetermined amount of electricity they are contractually bound to consume, you can expect even more BTC miners to stop supporting the BTC network and point their hash power at a more profitable chain like the original Bitcoin (BSV).

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-09-2026

03-09-2026