|

Getting your Trinity Audio player ready...

|

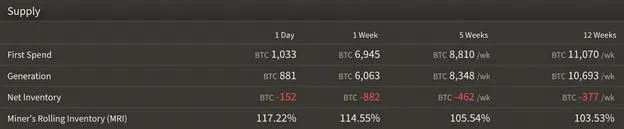

Over the May 26-June 2 period, BTC block reward miners generated 6063 new tokens but sold 6,945 BTC. This indicates that BTC block reward miners believe the fiat they receive from the sale of their BTC is more valuable than holding the coin. It also shows us what BTC block reward miners believe about the short-term future of the BTC network and BTC’s future value.

BTC block reward mining is not profitable

After the BTC halving took place on May 12, a lot of BTC block reward miners, especially the individuals who operated smaller-scale operations, found that they could no longer profit from processing BTC. The block reward decreased from 12.5 BTC per block to 6.25 BTC per block, which made it impossible for a lot of them to stay cash-flow positive.

For most block reward miners to stay cash-flow positive, they would need better equipment, cheaper electricity, or increased BTC prices. However, the equipment they desire has not been released in the market yet, it is hard to come by cheap electricity unless you are willing to relocate to desolate areas around the world, and BTC prices have remained relatively stagnant since the halving took place.

Why BSV is attracting BTC block reward miners

BTC block reward miners are increasingly becoming interested in processing transactions on Bitcoin SV. The fact that BTC miners rely on the block reward—and not the actual use and utility taking place within BTC to fill blocks with transaction fees—is a fault of the BTC network. The block reward will continue to half, and with each halving, more and more BTC block reward miners are going to have to stop supporting the BTC network because they can no longer stay cash-flow positive.

However, those block reward miners that stay afloat are more likely to start processing transactions on the BSV blockchain because there is no block size limit, which means there is no limit to the number of transaction fees that can accompany a BSV block. Publicly traded blockchain company TAAL recently mined a world record-sized block containing 369MB of data made up of 1,324,314 transactions.

“The industry is about to undergo significant change, and we expect to see a transition away from a block rewards subsidy model to a transaction fee-based model, which will be a major issue for any miner who hasn’t already modified their business strategy,” TAAL CEO Jerry Chan said.

Value must now be delivered on utility, not speculation, because in four years we will encounter yet another scheduled Halving Event, where the block subsidy reduces even lower to 3.125 coins per block.

As the block reward continues to halve, collecting block rewards will no longer be profitable for many miners. To stay cash-flow positive, miners will need to support a chain that is rich with transaction fees resulting from individuals actually using the chain, like BSV.

BTC has no utility, instead, BTC owners speculate that the price of BTC will continually rise without them adding value to the chain. Fortunately, BSV does not have that problem. BSV has many apps and services that consumers spend their BSV on each and every day and has strategically positioned itself to survive as chains like BTC die out.

07-03-2025

07-03-2025