|

Getting your Trinity Audio player ready...

|

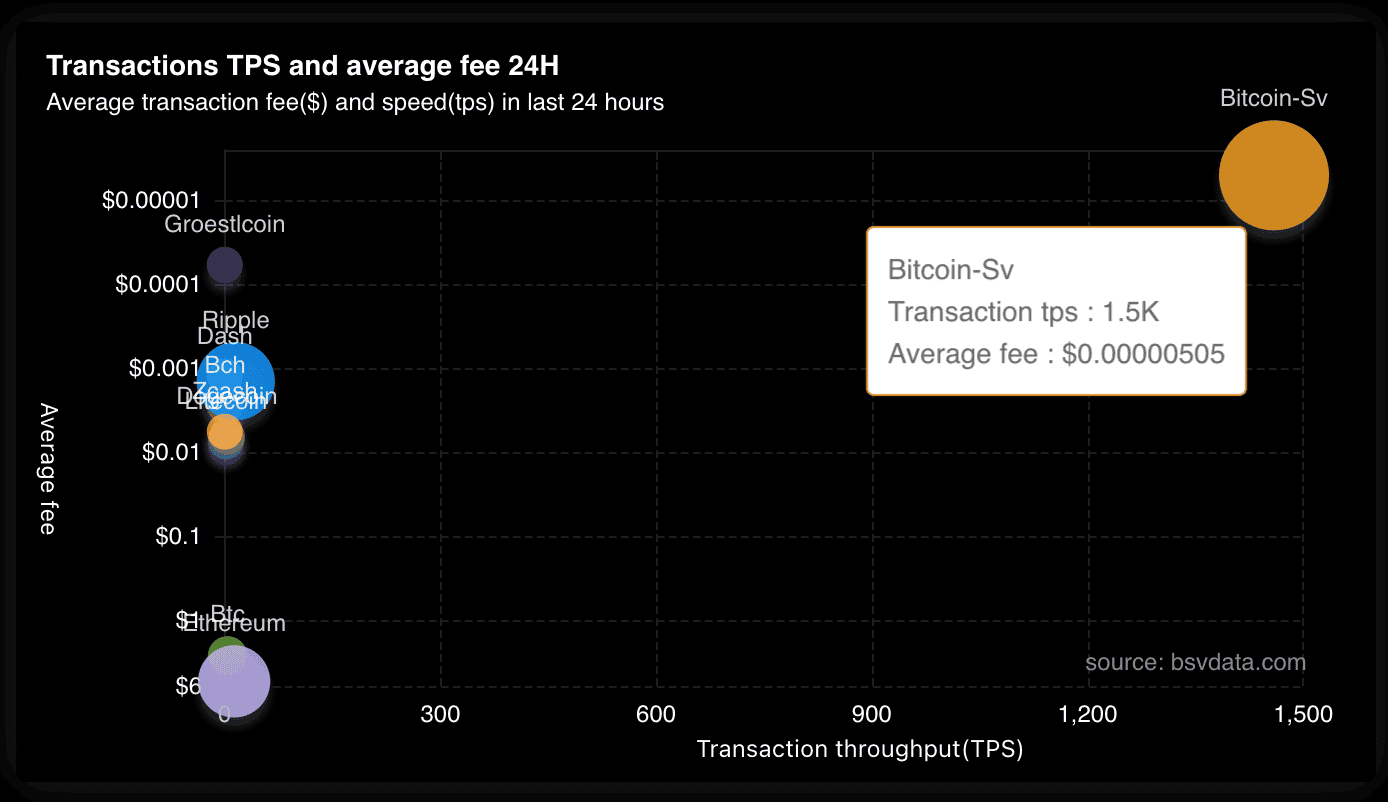

Everybody in the BSV blockchain industry should bookmark the BSVdata.com site. Created by Fueng Lee, it’s been an invaluable source of insights into who’s using the BSV blockchain and for what purposes for several years now. The site recently added metrics comparing not only the BSV blockchain, but other blockchains as well. According to Lee, this is to give a simplified overview of several chains’ capacity and performance with easy-to-understand charts, which, by their nature, highlight BSV blockchain’s advantages in these areas.

Launching a live monitoring tool for blockchains performance, a one-stop site comparing Bitcoin-sv with other blockchains and payment networks. https://t.co/46bSc6Y8AU pic.twitter.com/ZqVua3k7aR

— BSVData (@bsvdata) July 27, 2023

BSVdata has also highlighted some little-known and fairly interesting trends in the BSV blockchain industry’s evolution over the past 4+ years. Speaking to CoinGeek in the interview below, Fueng Lee gave us an update and a summary of some of the essential knowledge he gained during that time.

According to Lee, there have been distinct “waves” in BSV blockchain development and investment, influenced by factors like basic services users required, investment inflows, and more recent attention on micropayment transactions and enterprise-scale applications.

Speaking of investment, Lee expressed that graphic blockchain statistics sites are an invaluable resource for users, investors, and developers, but making and maintaining these isn’t exactly a lucrative business itself. Read on to learn more about Lee’s future plans and how his two-person dev team keeps the site up-to-date and available to all.

Why did you decide to have comparative blockchain metrics on BSVData?

At the outset, I had contemplated incorporating comparative metrics spanning various blockchain types. However, I eventually ignored this idea due to our primary focus on the BSV blockchain. Instead, we intended to compare Bitcoin against established payment networks and data processing giants like PayPal (NASDAQ: PYPL), Visa (NASDAQ: V), and Amazon Web Services (AWS) (NASDAQ: AMZN). Despite the backdrop of market fluctuations and manipulation, the proliferation of blockchain and web3 technologies has been undeniable. It strikes me that these diverse competitive solutions—be it proof-of-work, proof-of-stake, or other mechanisms—will coexist in a similar vein to the coexistence of socialism and capitalism, driven by distinct ideologies. Given this perspective, it seemed imperative to integrate a comparative feature that would offer users a simplified overview of blockchain performance and capacities through charts while acknowledging the potential of the BSV blockchain.

Recently, the CEO of BlockDojo, James Marchant, suggested we add a transaction comparison chart, which BSV blockchain has been excluded from bitinfocharts.com (note: BSV transaction data appears to have been since restored on the site). This move could portray BSV alongside other blockchains, attracting more traffic in the process. By providing users with the means to conveniently juxtapose volumes, fees, and other pertinent statistics, we aimed to save users from scouring information from different sources.

What major trends have you noticed in the BSV blockchain usage since you started the site?

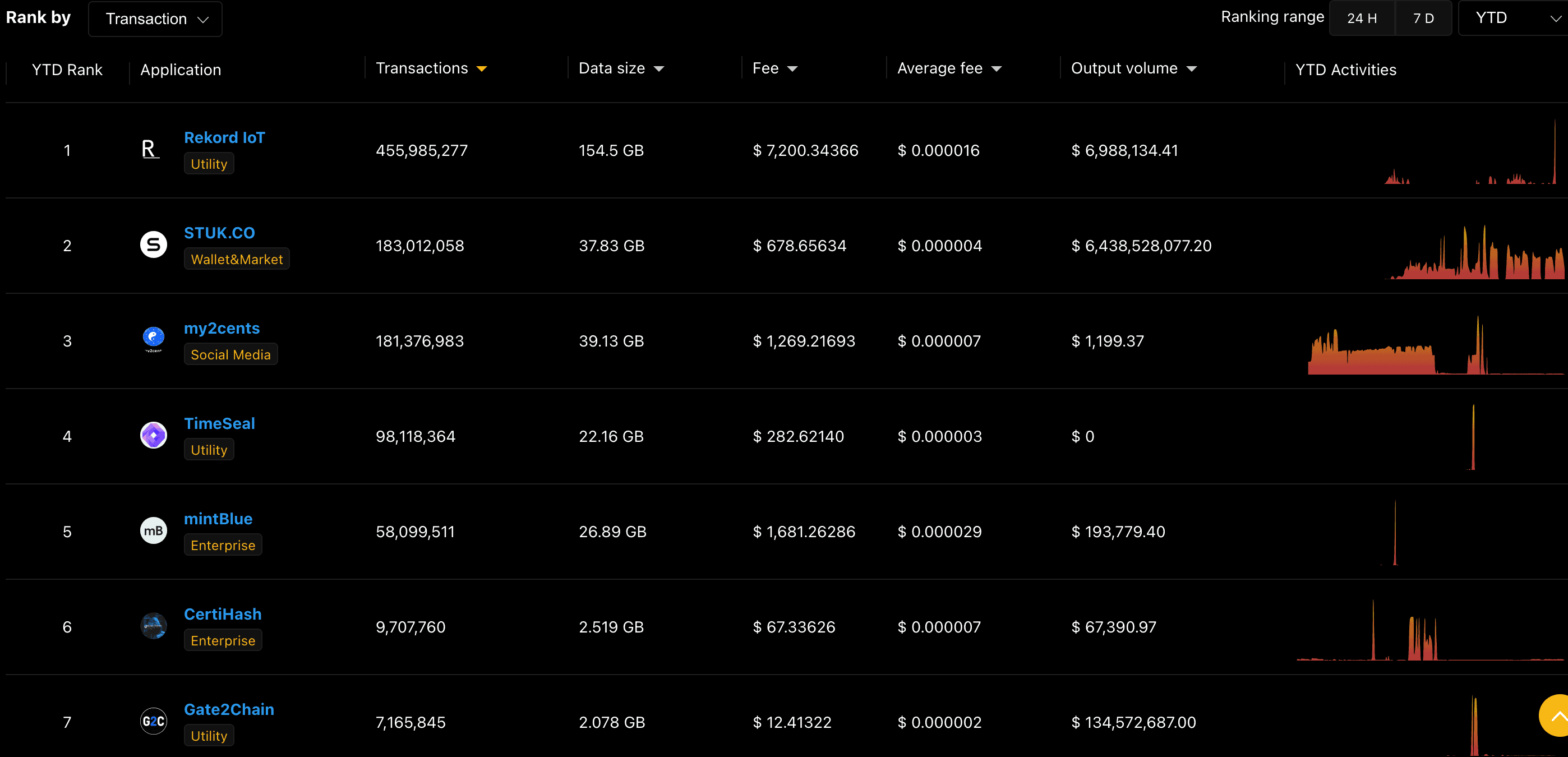

Looking into BSV transaction volumes across various sectors, I found distinct phenomena between two waves of projects and innovations—pre and post-COVID-19 pandemic. The initial wave, characterized by innovations and experiments, primarily originated from steadfast BSV blockchain supporters who hail from developer or entrepreneurial backgrounds. Their focus centered on consumer-oriented businesses, spanning gaming and social media. Subsequently, the second wave, witnessed in the past year, unfolded due to venture capitalists and investors taking the lead. This latter wave demonstrated an inclination toward enterprise solutions, incorporating blockchain for endeavors such as data management, IoT, and tokenization. This transition is promising as it suggests the industry is progressively shifting towards addressing genuine problems. Essentially, this entails services that harness Bitcoin as both a computational commodity and data ledger, enabling users or clients to engage without necessitating direct acquisition of the coins.

Have certain sectors exhibited more growth compared to others?

While we remain entrenched in the early stages of development, positive momentum is evident across the board. Some sectors have experienced more activity, yet no significant variance exists in growth rates. Many projects have embraced Bitcoin’s potential as a micropayment system, leveraging it for data integrity management and real-world asset tokenization. This year has seen growth in enterprise blockchain services and solutions, showcasing the emergence of mature products from entities like TimeSeal, Gate2Chain, Rekord IoT, CertiHash, MintBlue, Tokenized, and more. These solutions are poised for industry-wide adoption.

We’ve seen some other sites remove BSV-related metrics from their charts. Why do you think they did that?

Indeed, there have been instances where platforms like bitinfocharts intermittently excluded BSV-related data, mainly when BSV’s transaction volume was substantial. While the exact motivations behind these actions remain unclear, it could be speculated that they either seek to avoid promoting the BSV blockchain or face technical limitations. It’s not just bitinfocharts. Some other major explorers, such as blockchair, have withdrawn support for the BSV blockchain. Regrettably, some platforms might view the BSV blockchain, the original Bitcoin protocol, as an unwelcome outsider or competitor.

Could you highlight the most popular sections of your website?

Well, it’s hard to say which part is the most popular. But when you examine user interactions on Twitter, The macro statistics and charts of the BSV blockchain garner substantial sharing and engagement. Moreover, a distinct subset of users are frequently monitoring on-chain volumes of applications and protocols. They are app developers, investors, and blockchain consultants who maintain a keen interest in these real-time metrics.

How many people do you have working on the BSVData project?

We currently have merely two developers. Notwithstanding the team size, we dedicate our energy and skills to crafting the most sophisticated data analytics product in the blockchain space.

What would you like to add to the site, and what resources do you need?

Our current website represents just the tip of the iceberg. Many metrics and features require further development, including in-depth token and business analysis. Token analysis holds particular importance in a future characterized by tokenized economies. It’s essential to differentiate our focus from mere speculative trading of images and metaverse trends; instead, we’re deeply intrigued by real-world assets and trading. Our vision entails furnishing users with tools to track and analyze various types of tokens, such as IoT processes and financial instruments. As all token flows are intrinsically linked to businesses that utilize blockchain, businesses stand at the epicenter of value discovery.

Realizing this ambitious vision needs financial support for our team. Additionally, the costs associated with running a Bitcoin node are substantial. As we need servers and bandwidth resources, collaborating with a miner to access and share node data might be an optimal solution. To this end, we extend an open invitation to anyone captivated by our project to reach out and connect.

CoinGeek Conversations with Kirsty Barany-Gibson: The only blockchain able to handle speed and volume is BSV

02-18-2026

02-18-2026