|

Getting your Trinity Audio player ready...

|

On Day 3 of CoinGeek New York, Stephen Stonberg, CEO of Bittrex Global, joined to speak about digital currency as a tool for financial inclusion.

Financial inclusion, banking the unbanked, and democratizing finance are hot topics in the digital currency sector. However, far too often, these wholesome and beneficial use cases are overlooked in favor of speculating on the prices of worthless tokens and get-rich-quick schemes.

Stonberg gave a 15-minute presentation highlighting how the digital currency sector, including the BSV blockchain, can help to transform the world in positive ways.

Some facts and statistics on financial inclusion

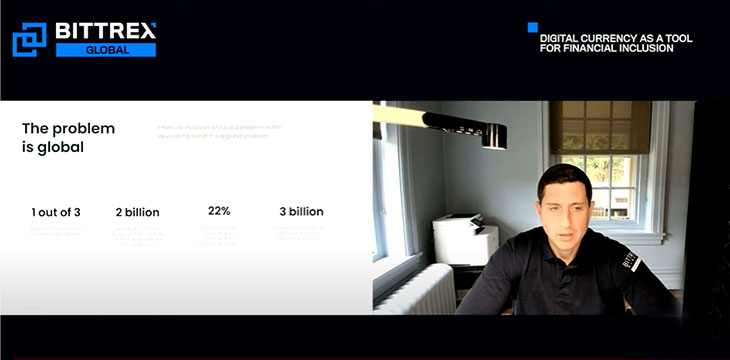

In his opening remarks, Stonberg gave some eye-opening facts on the state of the current financial system as related to inclusion. He informed us that:

- One in three adults is unbanked globally.

- 22% of Americans are either unbanked or underbanked.

- Three billion people had no financial safety net whatsoever during the pandemic.

These facts are from credible economic sources like the World Bank and the Federal Reserve, so they can be taken at face value to some extent. They don’t paint a pretty picture of things as they stand, with almost 2 billion adults globally excluded to varying degrees from the legacy financial system.

Stonberg believes that technology, including digital currencies like Bitcoin, can play a role in closing the gap, bringing these people into a new, easier-to-access, and more inclusive financial system.

What are the answers to the problem of financial inclusion?

During the rest of his presentation, Stonberg went on to outline an optimistic view of the future and how blockchain technology and digital currencies can play a role in transforming the world for the better.

- Technology – He outlined how the M-Pesa system in Kenya had given millions of people with nothing but mobile phones a chance to earn, save, and pay for things with an innovative mobile money system. Essentially, many people in Kenya have leapfrogged straight to mobile money, skipping the traditional banking system almost entirely. This shows how basic technology like mobile phones, which two-thirds of the two billion unbanked adults in the world already have, can play a part in working towards financial inclusion.

- Digital currencies – Blockchain technology and digital currencies can play a role in aiding financial inclusion. Stonberg noted that the adoption of digital currencies is actually greater in countries where this is a more pronounced problem. He gave the example of Nigeria, noting that one in three Nigerian adults regularly use digital currencies in everyday life. He also noted how digital currencies can act as an alternative to national currencies, which are often debased by central banks on a whim, a point made by Satoshi Nakamoto himself in the early days of Bitcoin. He gave the example of Nigeria, where in 2018 alone, the central bank printed so much money that the Bolivar dropped in value by 95%.

- DeFi – At CoinGeek, we’ve made no bones about the fact that we believe DeFi is rife with scams and that most of it aren’t legal or legit. However, it’s important not to throw the baby out with the bathwater, and DeFi can, when regulated correctly, make it easier to access short-term loans and microfinance in developing countries. In time, with proper KYC checks, perhaps linked to digital identities, DeFi can even play a role in helping people build credit ratings and financial reputations. Since the total DeFi market grew from $1 billion to over $85 billion in just over a year, it’s clear there’s a real demand for it.

- Peer-to-Peer Tech – Satoshi Nakamoto called Bitcoin a “peer-to-peer electronic cash system.” At CoinGeek, that’s the fundamental thing we believe in. Like Stonberg, we want to see Bitcoin used by billions of people as a digital currency. In the presentation, he noted how Bitcoin and digital currencies can cut out greedy middlemen who often take huge percentages from the poorest people in the world in the remittance markets. In this way, it can make sending and receiving funds much easier, and it can keep the money where it belongs, in the pockets of the people who earned it.

How BSV can play a role in financial inclusion

BitcoinSV has no serious competitors when it comes to blockchains. As far as scalability and low fees are concerned, the data speaks for itself. BSV processes millions of transactions every day with median fees of $0.001.

Whereas some other blockchains have fees that skyrocket into the hundreds of dollars when demand is high, making them wholly unsuitable to be part of any new system predicated on financial inclusion, BSV is ready to play its part today. It won’t scale in 18 months from now with layer two solutions because it scales to 50,000+ transactions per second now, and its fees actually decrease as demand picks up.

Let’s build tools to aid financial inclusion now

While there are many things that participants in the digital currency space disagree on, one thing we can all agree on is that financial inclusion is a noble goal worth pursuing.

So, let us build, build, and build to serve the people who need these services most. If scalable applications with low fees are your goal, then BSV is well worth a look.

Watch CoinGeek New York 2021 Day 3 here:

03-08-2026

03-08-2026