|

Getting your Trinity Audio player ready...

|

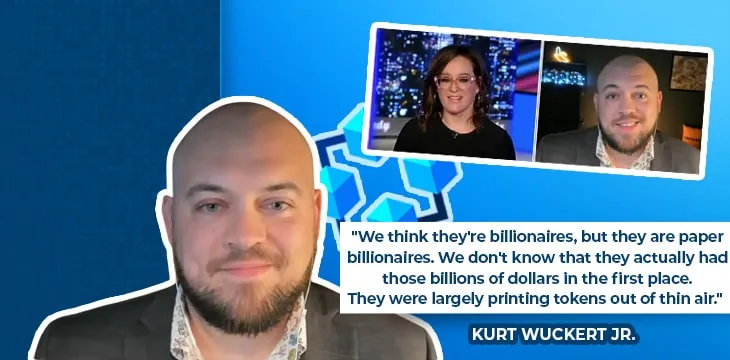

Bitcoin Historian Kurt Wuckert Jr. joined Lisa Kennedy on FOX Business to talk about the recent FTX collapse, Sam Bankman-Fried, and what it means for the industry at large.

Bigger than Enron

Kennedy begins by summarizing the situation: FTX has collapsed, and as liquidators and bankruptcy lawyers dig through the rubble, it’s being called ‘bigger than Enron.’

FTX bankruptcy shows the company had 134 affiliates spread across the globe and may have liabilities of up to $50 billion.

Enron had liabilities of $23 billion.

FTX may be worse than Enron.

— Brian Sullivan (@SullyCNBC) November 11, 2022

She refers to Sam Bankman-Fried as an “asshat super-douche,” outlining how he will soon be dragged in front of U.S. Congress to explain himself. Kennedy mentions how ‘SBF’ was donating to the party in power to influence regulations in a sinister plot to make things go his way in the industry.

Kurt Wuckert Jr. gives the lowdown on what happened

Kennedy asks Wuckert what happened, and he says it’s a symptom of many things that accumulated over time. It started when Three Arrows Capital (3AC) collapsed, and Celsius Network went bankrupt and cascaded from there.

“FTX is the biggest domino to fall,” he says.

Part of the problem is that exchanges are keeping money on each other’s exchanges, offering users unsustainable yields on holding stablecoins, and playing other crazy games. The worst of the news hasn’t come out yet, Wuckert says, hinting at bigger dominos to fall.

What could these bigger dominos be? Wuckert refers to Deltec Bank, Tether Corporation, and Binance as potential danger points. Gemini’s earn program and Genesis have also had problems in the past few days, indicating systemic contagion.

How much wealth is at stake here? Wuckert points out that most of the big players are only billionaires on paper. That all of this is worth nothing shouldn’t come as a shock to anybody.

What is the fate of those who have been burned by all of this? Wuckert thinks they might be luckier than those who have been wrecked in previous crashes. Because some of the biggest VC firms and investors in the world were involved in this, there’ll likely be a class-action lawsuit coming up.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

07-15-2025

07-15-2025