|

Getting your Trinity Audio player ready...

|

Binance continues to fight to keep the assets of its U.S.-facing digital assets exchange out of the hands of the federal government.

On Thursday, attorneys representing both Binance and the Securities and Exchange Commission (SEC) filed a joint status report on their efforts to reach a mutually acceptable resolution to the SEC’s bid to freeze the assets of Binance’s U.S.-facing exchange Binance.US.

The SEC seeks the freeze due to fears that Binance boss Changpeng ‘CZ’ Zhao could otherwise send the assets overseas. That’s definitely a concern, as the 13 civil charges the SEC filed against Binance/CZ earlier this month show a pattern by which Binance.US customer funds were routinely funneled to CZ-controlled entities as part of a wider “calculated evasion” of U.S. law.

Thursday’s joint status report is barebones, stating only that all parties have been “diligently working towards an agreement … including many hours spent with Magistrate Judge Faruqui, yesterday and today. Progress has been made, and the parties are continuing to negotiate.”

U.S. District Judge Amy Berman Jackson, who is handling the proceedings, herded the parties in Faruqui’s direction earlier this week after hearing arguments from both sides. She gave them a 5 p.m. EST Thursday deadline to make a deal, but it appears they might have won an extension.

The hopeful signs came too late for some. On Thursday, Binance.US confirmed a Reuters report that the exchange has sacked around 10% of its nearly 500 workers. The day before, Binance.US informed staff that its board of directors had directed the company to “shrink the size of our teams across the company and reduce our burn rate.”

The announcement didn’t mince words when citing the need to cut payroll, saying the exchange had been targeted by a “politically motivated regulator” and the company was bracing for “a multi-year and very costly litigation process.”

While no one enjoys seeing anyone lose their livelihood, the blame for these layoffs can’t be laid at the SEC’s door. The rampant nature of the illegality contained in the internal communications of Binance’s senior management—including CZ—not only proved that the SEC had to act, but it also detailed Binance’s absolute control over its U.S.-facing offshoot, with detailed plans to “re-arrange its leadership when it has served its purposes.”

Abra cadabra: funds sent to Binance!

Meanwhile, Binance got a shout-out in the Texas State Securities Board (TSSB) emergency cease and desist order filed Thursday against the Abra/Plutus Financial digital asset custody/lending business and its founder William John ‘Bill’ Barhydt.

Among the TSSB’s allegations are that various Abra entities—Abra Earn, Abra Boost, Plutus Lending, etc.—have been “insolvent or nearly insolvent” since at least March 31, when TSSB agents interviewed Barhydt.

Abra’s insolvency was partly triggered by the bankruptcies of other digital asset entities to which Abra had sent customer funds. These include hedge fund Three Arrows Capital (3AC) (at least $10 million), lender Genesis ($30 million), and lender Babel Finance ($29.7 million).

Barhydt and his entities are accused of fraud, offering unregistered securities to state residents and making materially misleading statements designed to deceive the public. This included comments via official social media platforms that there was “no truth that Abra is bankrupt or about to be.”

The TSSB added that Abra Trade and Plutus Lending “have been secretly transferring assets” to Binance.com without disclosing these transfers to U.S. customers. The value of these assets was estimated at nearly $118.6 million as of February 2023, whereas Abra held only $43.8 million worth of assets at Fireblocks, the U.S.-based custodian at which Abra claimed its customers’ assets were stored.

The TSSB also said Abra/Plutus failed to inform customers of the SEC suit (or the suit filed by the Commodity Futures Trading Commission) against Binance/CZ and the possible consequences of Abra/Plutus customer assets having been sent to Binance.

The TSSB notes that their California counterparts hit Abra/Plutus with a $1 million penalty this April for, among other things, not having “sufficient liquid assets to satisfy all investors in the United States.” In 2020, Abra/Plutus reached a $300,000 joint settlement with the SEC and CFTC, both of which accused the firms of offering illegal swaps.

‘Binance should have been taken out years ago’

Tuesday saw a U.S. House of Representatives’ Financial Services Committee hearing titled The Future of Digital Assets: Providing Clarity for the Digital Asset Ecosystem. Like a different House committee hearing earlier this month, the focus was on the proposed Digital Asset Market Structure Bill but also offered up the usual repertoire of bashing the SEC and its chairman Gary Gensler.

However, if CZ was expecting Binance to benefit from the mantra of ‘the enemy of my enemy is my friend,’ he was sorely disappointed. Except for the nagging question of which digital assets are securities and which are commodities, the SEC’s actions against Binance were largely endorsed on a bipartisan basis.

Speaking to DL News on the sidelines of Tuesday’s hearing, Committee chair Patrick McHenry (R-NC) said, “I think [Binance is] an illegal actor—transacting in illicit finance. They don’t adhere to the rule of law, but frankly, we don’t actually have a set of rules for the United States. So we’ve got to do our work so we can chase bad actors much more efficiently. And frankly, Binance should have been taken out years ago.”

‘The gateway of the Binance treasury’

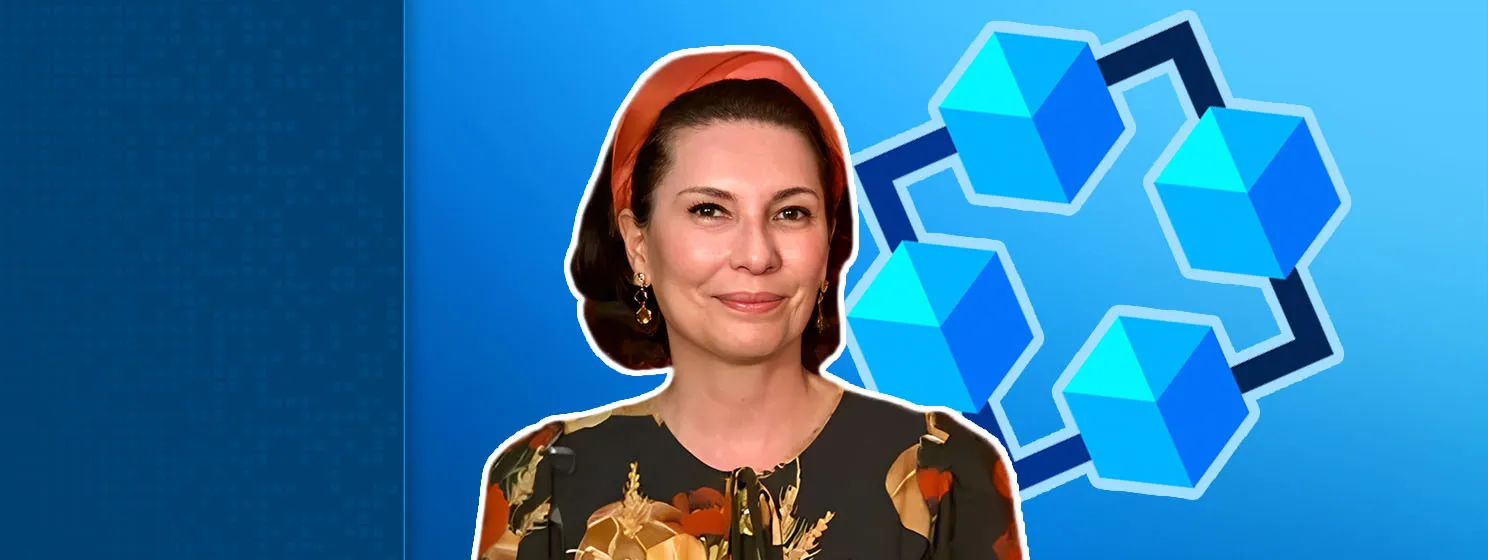

On Wednesday, Forbes dropped a major profile of Guangying ‘Heina’ Chen, the Binance insider listed as the director of eight Binance entities and signatory for the bank accounts of 27 entities across 13 countries—including the only signatory for all nine Binance.US accounts. As one unidentified former Binance exec told Forbes, Chen is “the gateway of the Binance treasury.”

Binance has named a few individuals as chief financial officers over the years, but a former Binance advisor told Forbes that Chen “was the real CFO” because CZ “trusted very few people with access to money.” (Or with orchestrating chicanery. The SEC’s suit cites Chen as executing the rampant wash trading on Binance that occasionally accounted for as much as 99% of certain tokens’ volume.)

While former CFO Wei Zhou may have conducted negotiations with banking regulators in Lithuania, Forbes revealed that it was Chen’s signature on financial attestation forms and it was Chen who wired millions into an escrow account from a Binance account at a Lithuanian bank. (In internal communications, Zhou once referred to Chen as CZ’s “personal finance manager.”)

Binance’s chief strategy officer, aka PR flack Patrick Hillmann rubbished the Forbes article via Twitter, claiming that “the amount of pearl-clutching here is laughable.” Hillmann didn’t reply to queries regarding his previous comments that Chen was simply “an employee that worked on our admin team.”

It was that comment that prompted CZ to write a blog post last September in which he felt the need to clarify that Chen “currently oversees the admin and clearing team for the organization” but Chen “does not own Binance.”

Okay, but Chinese corporate records show that Chen held 93% of the shares in Binance’s predecessor Bijie Network Technology Co Ltd—which provided software to digital exchanges—and was listed as the company’s founder and sole legal representative. Chen was also listed as a legal representative in Binance’s 2017 registration documents and was identified as holding 80% of its shares.

CZ’s blog post also claimed that Chen was a “passport holder in a European country,” but the registration documents of Binance’s Malta-based offshoot show Chen updating her info with a new Chinese passport. (China doesn’t allow dual citizenship.)

BNBeware

Meanwhile, Binance’s frantic efforts to prop up the price of its in-house-backed-only-by-CZ’s-winning-personality BNB token has taken on a new air of desperation. In the past 24 hours, Binance has minted $2 billion in new stablecoins, split evenly between Tether’s USDT and Justin Sun’s TUSD.

BNB’s fiat value dropped by around one-quarter in the wake of the SEC’s civil charges, falling dangerously close to the $220 mark that would see around $200 million in liquidations on Binance’s ‘decentralized finance’ (DeFi) platform Venus.

Hence CZ’s newfound determination to spend billions buying up all the BNB he doesn’t already own, lest that liquidation event sparks an even greater ‘investor’ rush to dump BNB. Remember that it was Binance’s former chief compliance officer who warned that “anyone who takes BNB now if fking brave.” True then, true now. BNB: ‘Buy? No! Beware.’

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

05-10-2025

05-10-2025