|

Getting your Trinity Audio player ready...

|

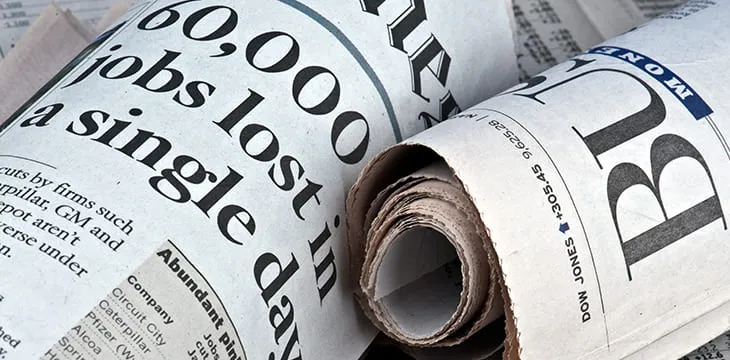

It’s been a month since the FTX exchange and its subsidiaries and affiliates collapsed, but the impact is still being felt across the digital asset world. The latest casualty is Australian exchange Swyftx which has announced that it’s laying off 40% of its workforce and blamed the FTX fallout for its woes.

Swyftx CEO and co-founder Alex Harper announced in a blog post that the exchange was laying off 90 employees this week.

According to the blog, while the exchange didn’t directly lose money in the collapse of Sam Bankman-Fried’s $35 billion empire, it’s still been badly hit, and the founder believes the only way to weather the storm is by laying off some of its staff members.

“As we’ve just announced to the team, Swyftx has no direct exposure to FTX, but we are not immune to the fallout it has caused in the crypto markets. As a result, we have to prepare in advance for a worst-case scenario of further significant drops in global trade volumes during H1 next year and the potential for more black swan-type events,” Harper stated.

This is the second round of layoffs this year for Swyftx. In August, Harper announced at a “townhall” meeting with the employees that the exchange was laying off 74 people, representing 21% of the workforce.

At the time, the exchange blamed the layoffs on “an uncertain business environment, with levels of domestic inflation not seen in over two decades, rising interest rates, highly volatile markets across all asset classes, and the potential for a global recession.”

As with most digital asset companies that have announced layoffs this year, including Coinbase (NASDAQ: COIN), Harper acknowledged that his company had grown too fast and hired too aggressively with an assumption that the prices would keep rising.

Swyftx, which was founded in 2018 and merged with share trading fintech startup Superhero earlier this year, joins an extensive list of digital asset firms that have laid off thousands of workers this year. Just days ago, derivatives exchange Bybit announced its second round of layoffs this year, while Kraken laid off 1,100 workers a week ago.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

07-03-2025

07-03-2025