|

Getting your Trinity Audio player ready...

|

The EU General Court has slapped down the latest attempt by Coinbase (NASDAQ: COIN) to have a Japanese exchange’s trademark over the word ‘coinbase’ revoked.

Coinbase was appealing an earlier decision that found that the U.S.-based exchange had failed to prove that bitFly, the Japanese exchange, had secured a trademark over the word in bad faith. This week, the court agreed that Coinbase had failed to prove its claims.

It’s the most recent decision in a long-standing legal fight between Coinbase and bitFlyer. bitFlyer, a Japanese digital asset exchange, obtained a trademark over the word in 2015. The trademark was granted in relation to five specific classes of goods and services only.

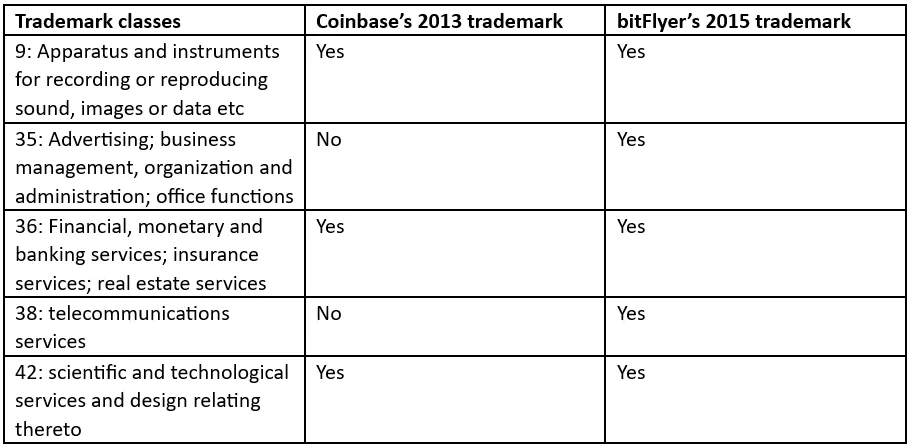

Coinbase filed with the European Intellectual Property Office, asking to have the trademark ruled invalid. It asked for this on two bases: first, the trademark risked confusion with an earlier trademark already granted to Coinbase in 2013 because that trademark related to three of the five classes of goods and services contained in bitFlyer’s 2015 trademark.

More substantially, Coinbase also argued that bitFlyer’s trademark of the word ‘coinbase’ had been filed in bad faith on the basis that it was relevant to goods and services not directly tied to its business and that it was aware of the overlap with Coinbase’s previously granted trademark.

Coinbase primarily relied on Article 52(1)(b) of the EU’s community trademark regulation no 207/2009, establishing grounds for revoking trademarks in cases where the applicant filed in bad faith. In particular, it argued that bitFlyer was aware of the pre-existing trademark as well as the overlap between three of the five categories referenced in bitFlyer’s trademark application and, therefore, was made in bad faith.

Coinbase initially secured a partial victory before the European Intellectual Property Office’s Cancellation Division, which agreed that there was a risk of confusion concerning three categories of goods and services that were common between the two trademarks. However, it refused revocation in relation to the non-overlapping categories, rejecting Coinbase’s argument that they had been sought in bad faith for lack of evidence.

In other words, Coinbase had succeeded in revoking the trademark with respect to those goods and services that overlap with those provided by bitFlyer; the remaining two categories survived.

Coinbase appealed this to the Office’s Fourth Board of Appeal. The appeal was rejected. The Board decided that the appeal must be limited to examining whether there was bad faith behind the two remaining categories of goods and services in the trademark because the lower court had already ruled in Coinbase’s favor with respect to the three overlapping categories.

Coinbase then successfully appealed this ruling to the EU General Court. It argued that the lower court was incorrect to consider that it should only examine the non-overlapping categories in determining whether bitFlyer had acted in bad faith. Instead, Coinbase argued that the court was required to look at the totality of bitFlyer’s behavior. The EU General Court agreed.

The practical result of Coinbase’s successful appeal was that the decision was sent back to the Board of Appeal for reassessment, this time with the mandate that the court should look at the totality of the events surrounding the trademark application in determining whether bad faith exists.

The Board did so but ruled the same way: it found that Coinbase had not presented sufficient evidence that bitFlyer had acted in bad faith. Coinbase again appealed to the EU General Court.

This month, the court ruled substantially against Coinbase. Though it again agreed that there was a risk of confusion with Coinbase’s earlier patent about the overlapping categories of goods and services, it found that the U.S. exchange had still failed to prove that bitFlyer had registered the trademark in bad faith, noting that even if a trademark application is made in respect of goods and services not then being provided by the applicant, there still may not be sufficient grounds for finding bad faith.“In any event, in light of all the foregoing assessments, the applicant [Coinbase] has not submitted relevant and consistent evidence to show that the holder of the contested international registration had filed the application for registration, not with the aim of engaging fairly in competition, but with the intention of undermining, in a manner inconsistent with honest practices, the interests of third parties,” reads the judgment.

No doubt the court’s commentary on the case will be examined carefully by IP lawyers worldwide. The question of precisely what amounts to a bad-faith trademark application under the regulation has received much attention, with more clarity being provided each time it comes before courts. However, there is no hard-and-fast threshold for what conduct will amount to bad faith.

Perhaps the best illustration of this is the fact that Coinbase has already successfully challenged the trademark’s validity in Singapore, where it was originally granted. There, the Singapore court took a dim view of bitFlyer’s registration of a mark identical to that of a competitor without providing a clear explanation of why. It was also more skeptical of bitFlyer’s attempt to trademark the word ‘coinbase’ with respect to goods and services it wasn’t actually providing at the time than the EU court would turn out to be.

Timeline:

- December 6, 2013: Coinbase trademarks the word ‘coinbase’ in classes 9, 36 and 42

- December 18, 2015: bitFlyer trademarks the word ‘coinbase’ in classes 9, 35, 36, 38 and 42

- June 29, 2018: Coinbase files with the European Intellectual Property Office, seeking revocation of bitFlyer’s patent on the basis of confusion and bad faith

- June 26, 2020: EUIPO’s Cancellation Division rules in favor of Coinbase on confusion with respect to the overlapping classes, but rejects the argument of bad faith with the non-overlapping classes

- August 26, 2020: Coinbase files appeal of June 2020 decision

- April 29, 2021: The Board of Appeal dismisses the appeal, finding there is insufficient evidence of bad faith

- June 29, 2021: Coinbase appeals to the General Court, arguing that the Board of Appeal did not take into account all necessary circumstances

- March 22, 2023: The EU General Court agrees with Coinbase, sending the case back to the lower court for reassessment on the bad faith point

- November 29, 2023: After reassessing the decision, the Board of Appeal comes to the same conclusion

- January 16, 2025: Coinbase appeals the reassessed decision

- June 11, 2025: EU General Court dismisses Coinbase’s appeal, agreeing that there is still not enough evidence for bad faith

Watch: Teranode is the digital backbone of Bitcoin

08-23-2025

08-23-2025