|

Getting your Trinity Audio player ready...

|

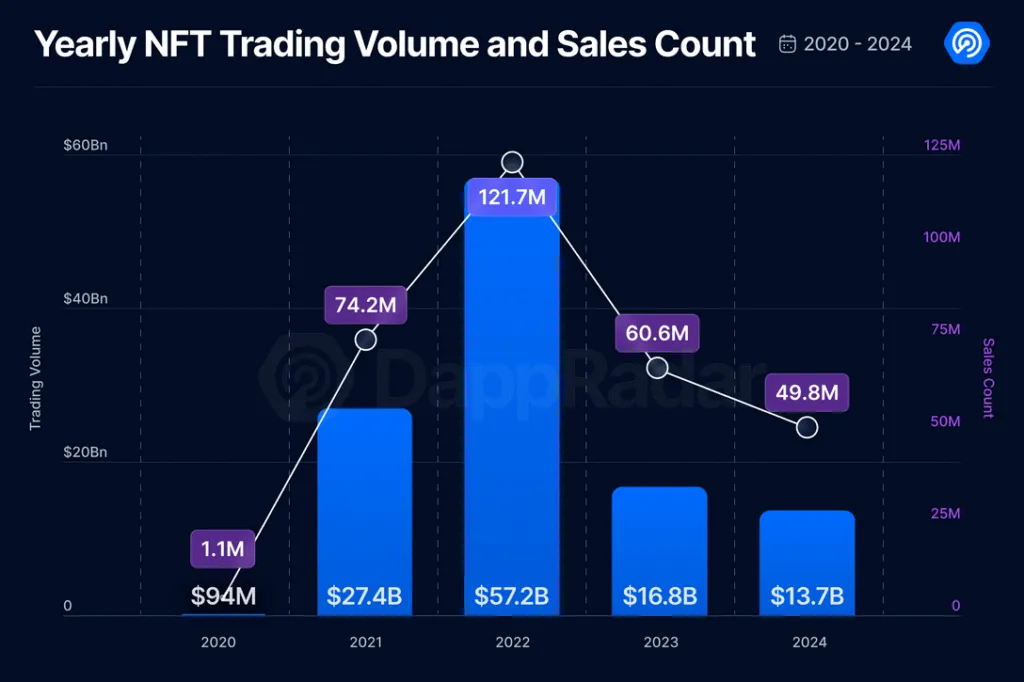

Non-fungible tokens (NFTs) had yet another unimpressive year in 2024, with trading volume and sales hitting their lowest numbers in four years, a new report by DappRadar has revealed.

NFTs started the year on a high, boosted by the Q1 bull rally that was sparked by the approval of BTC spot ETFs in the U.S., hitting $5.3 billion in trading volume. However, the momentum was short-lived; by Q3, it had dropped to $1.6 billion, as the DappRadar 2024 Industry Report shows. A Q4 rebound, triggered by the election of Donald Trump in the U.S., was not enough to turn the sector’s fortunes, which finished the year at $13.7 billion in trading volume, a 19% dip from 2023.

Token sales also slumped 18% to end the year at 49.8 million, the lowest since 2020.

The dip is unsurprising. When they first broke out, NFTs were nothing more than speculative JPEGs whose value was shooting up tenfold every other day. American graphic designer Mike “Beeple” Winkleman selling an NFT for $69 million in 2021 was a testament to the hype the sector was attracting. As with other facets of the digital asset sector that purely relied on hype, like the ICO mania of 2017, NFTs were bound to lose steam.

However, as the speculators waned off, NFTs that deliver real value continued to grow. From gaming NFTs that enable real in-game asset ownership to tokens that offer access to features and services, such as entry into an event, the sector is now focused on utility. It has gone beyond private enterprises, with some local and national governments now issuing NFTs; recently, Jeju Island in South Korea unveiled an NFT-based tourist card to attract more visitors.

Away from NFTs, decentralized finance (DeFi) made a comeback in 2024, the DappRadar report revealed. The sector doubled its total value locked (TVL) to hit $214 billion at its peak in early December. The report attributed the rise to the memecoin hype, which acted as a gateway for new users into DeFi.

Decentralized apps (dApps) also had their best year yet, with the unique active wallets surging 485% to 24.6 million UAWs daily in 2024. AI dApps, which integrate artificial intelligence into dApps to make decisions and analyze data, catalyzed the growth, surging 2,270% in activity last year.

On the security side, the dApp sector lost $1.3 billion, with the first three quarters reporting at least $400 million in losses. However, this was 30% lower than the 2023 losses and the lowest since 2020.

Access control vulnerabilities were the biggest threat to dApps; in such attacks, criminals target weaknesses in the control mechanisms of a dApp, gain unauthorized access and wipe the wallets clean. Rug pulls and flash loan attacks were the other major vulnerabilities.

Watch: AI boom is a boost for NFTs

08-21-2025

08-21-2025