|

Getting your Trinity Audio player ready...

|

Nigeria and South Africa are the global leaders in digital asset ownership, a new report has revealed.

The Web3 Perception report by blockchain incubator Consensys found that 99% of Nigerians have heard about digital assets and that 77% fully understand what they are. This is far higher than leading economies like the United States and the United Kingdom, where only 54% and 45%, respectively, understand digital assets.

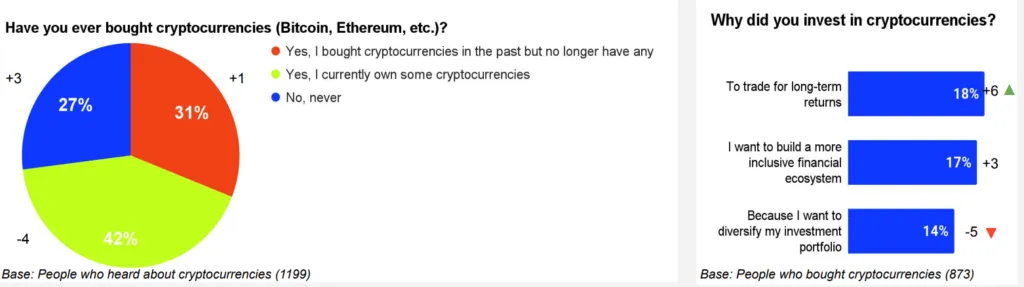

Ownership in Nigeria is also world-leading, with 74% of respondents who have heard about digital assets owning them at some point; 42% still own these assets today.

Nigerians were also among the highest globally in familiarity with Web3 and non-fungible tokens (NFTs), with 58% of the respondents saying they were either very familiar or fairly familiar with the latter.

South Africans also ranked highly. Sixty-eight percent of respondents said they had owned digital assets at some point, although only 22% still owned them. Around one in two South Africans is familiar with Web3 and NFTs.

The high ownership of digital assets in Africa’s two largest economies aligns with the survey’s findings that most people distrust the banking system. In South Africa, 65% of the respondents believe the financial system should be improved or completely rebuilt. Nigerians are even more distrusting, with only 10% saying that the banking system works well.

However, beyond payments, Nigerians have been exploring digital assets and blockchain technology to gain more control of their digital identity, Consensys CEO Joseph Lubin revealed in a statement to media outlets.

“In terms of data privacy, 92 percent of Nigerians and 87 percent would like to have more control over their identity on the internet, while over half of respondents think that decentralization could improve traditional banking and social media platforms,” Lubin stated.

Nigerians also “expect a share of the profits generated from their data compared to other countries,” which they believe is best achieved through blockchain.

Nigeria has consistently led the continent in adopting blockchain and digital assets. According to Chainalysis, the West African nation ranked second globally for adoption this year—only bettered by India—a position it has held for two consecutive years.

Despite the high adoption, Nigerians have concerns. Over half the respondents cited volatility as a significant barrier. A significant portion of the respondents also cited scams, privacy, and security.

Watch: Blockchain is changing Nigeria’s tech city ecosystem

09-09-2025

09-09-2025