|

Getting your Trinity Audio player ready...

|

Australia’s financial crimes watchdog is taking a keen interest in digital asset crime and has launched a new task force to monitor ‘crypto’ ATMs.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) recently stated that its study revealed that digital assets were being increasingly used for money laundering and scams.

ATMs are at the heart of it; their enhanced anonymity limits legal action against the perpetrators, and they are easily accessible to Australians, including those without any prior digital asset experience. With 1,323 ATMs, only the United States and Canada, respectively, have more outlets globally than Australia.

The new internal task force will ensure that all ATM operators meet the minimum AUSTRAC standards and have sufficient checks to ensure their machines are not used to move money associated with fraud, scams, or any other proceeds of crime. Australia’s anti-money laundering (AML) law demands that virtual asset service providers (VASPs), including those with ATMs, monitor transactions, complete Know Your Customer (KYC) on all clients, report suspicious transactions and submit reports for any transactions worth more than AUD10,000 ($6500).

“Cryptocurrency and crypto ATMs are attractive avenues for criminals looking to launder money, as they are widely accessible and make near-instant and irreversible transfers,” commented AUSTRAC CEO Brendan Thomas.

“As the use of cryptocurrency increases, so too will criminal exploitation, which is why this taskforce will work to eliminate non-compliant high-risk operations,” he added.

Thomas further reiterated AUSTRAC’s commitment to stamping out ‘crypto’ crime in Australia, which he said would be the agency’s focus over the next year.

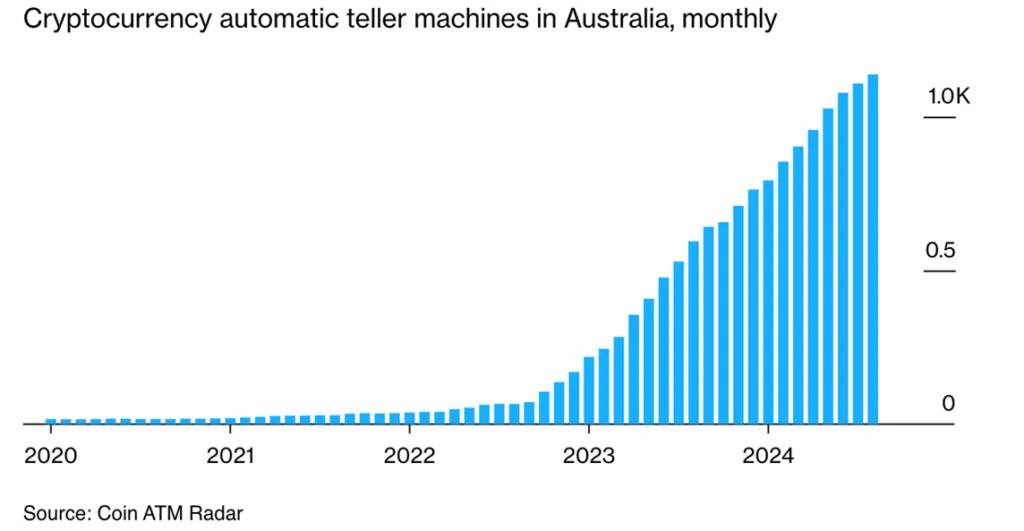

Digital asset ATMs in Australia have recorded explosive growth in the past two years, shooting from around 100 in 2022 to over 1,300. In April 2023, the country surpassed the entire Asian region—which includes powerhouses like Japan, India, and China—and the number is expected to keep rising. Bitcoin Depot, a leading ATM provider, revealed in August that it has over 200 ATMs awaiting the regulatory green light to be installed in the country.

AUSTRAC isn’t the only one that targets criminals using these ATMs. The Australian Federal Police (AFP) identified them last year as a key channel for scammers and other criminals, noting their high availability across the country and anonymity as the biggest draws.

But the growth isn’t just down to criminal use. In fact, according to Chainalysis, only 0.34% of all on-chain transaction volume was linked to crime.

In Australia, one of the drivers of ATM growth is the ensuing lack of access to digital assets on- and off-ramps for retail clients. The country’s largest banks, including the Commonwealth Bank, Westpac, NAB and ANZ, have all imposed restrictions on the transfer of funds to and from digital asset exchanges. These four banks combined control over 70% of the Aussie market.

US FSOC concerned about stablecoins’ risk to financial stability

In the United States, the Financial Stability Oversight Council (FSOC) has identified stablecoins as a “potential risk to financial stability because they are acutely vulnerable to runs absent appropriate risk management standards.”

The FSOC recently published its annual report, which it submits to Congress each year on emerging and potential threats to financial stability. It noted that digital assets continue to intertwine with traditional finance following the launch of exchange-traded products in the U.S. this year.

However, the Council is most concerned about stablecoins. It believes that market opacity and concentration amplify the risk of runs on stablecoins.

On the latter, it noted that one operator controls 70% of the stablecoin market. While it didn’t explicitly mention Tether, the company controls 66% of the $208 billion market with USDT.

“Given that firm’s market dominance, if it continues to grow, its failure could disrupt the crypto-asset market and create knock-on effects for the traditional financial system,” the Council opined.

It’s not the first agency to decry Tether’s dominance in the stablecoin market. For any company, controlling three-quarters of the market is undesirable, especially in finance. But when this company is Tether, the risk is significantly heightened. The company was kicked out of New York for “recklessly and unlawfully [covering up] massive financial losses” with its sister company Bitfinex and found to have lied about the backing of USDT.

The Council further noted that stablecoin issuers also tend to operate in opacity, shunning any opportunity to reveal their inner workings. These issuers, led by Tether, are notorious for providing “limited verifiable information about their holdings and reserve management practices.”

As the head of the FSOC, Janet Yellen, the outgoing Treasury Secretary, implored Congress to formulate laws for stablecoin issuers to protect investors.

“The council continues to call for legislation to create a comprehensive federal prudential framework for stablecoin issuers and for legislation on cryptoassets that addresses the risks we have identified,” she stated.

Watch: Breaking down solutions to blockchain regulation hurdles

09-12-2025

09-12-2025